Wills, Trusts, & Estates - Robert H. McKinney School of Law

advertisement

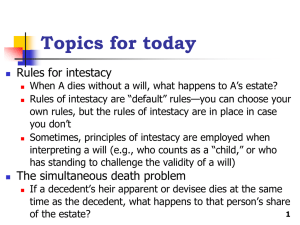

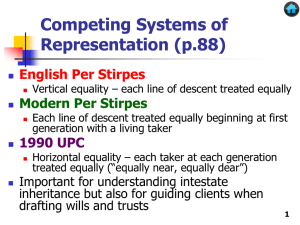

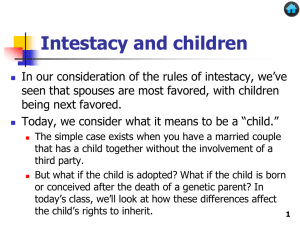

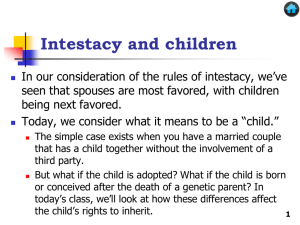

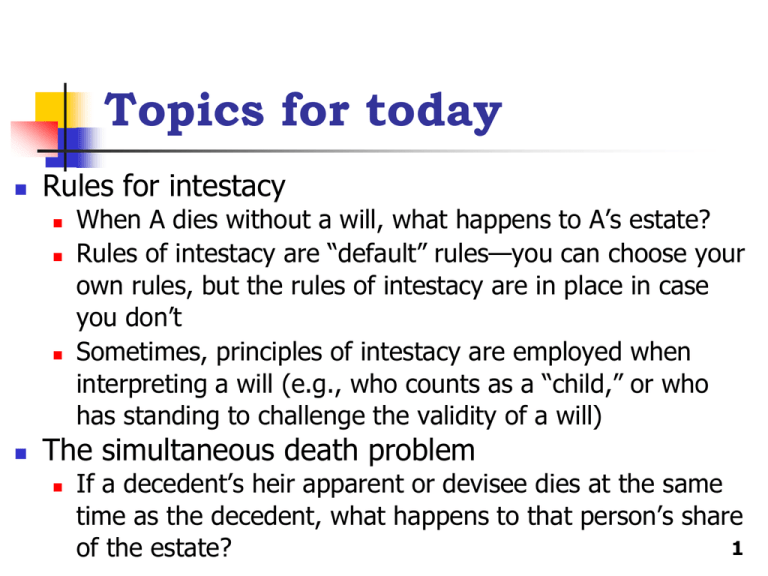

Topics for today Rules for intestacy When A dies without a will, what happens to A’s estate? Rules of intestacy are “default” rules—you can choose your own rules, but the rules of intestacy are in place in case you don’t Sometimes, principles of intestacy are employed when interpreting a will (e.g., who counts as a “child,” or who has standing to challenge the validity of a will) The simultaneous death problem If a decedent’s heir apparent or devisee dies at the same time as the decedent, what happens to that person’s share 1 of the estate? Intestacy as default rules (pp.71-72) Testacy Intestacy Decedent leaves a will that provides for the disposition of property at death (also allows testator to select guardians for minor children and an executor for the estate) Decedent leaves no will. The probate estate passes by intestacy. Partial Intestacy Decedent leaves a will that disposes of only part of the probate estate; the part of the estate not disposed of by the will passes by intestacy. 2 UPC intestacy rules (p.73) Facts 1990 UPC § § 2-101 to 2-106 (rev. 2008) S; no D; no P §2-102(1)(A) all S S; D §2-102(1)(B) all S only if all D are also S’s and S’s only kids §2-102(3) $225K + 1/2 S if D are also S’s but S has others; rest D §2-102(4) $150K + 1/2 S if one or more D is not S’s; rest D S; no D; P §2-102(2) $300K + 3/4 S; rest P no S; D §2-103(a)(1) all D (per capita at each generation) no S; no D; P §2-103(a)(2) all P no S; no D; no P; B or S §2-103(a)(3) B or S (per capita at each generation) no S; no D; no P; no B or S; G or GD §§2-103(a)(4) and (5) 1/2 paternal G; 1/2 maternal G or all to maternal or paternal if no survivors on other side – per capita at each generation no S; no D; no P; no B or S; no G or GD §2-103(b) stepchildren §2-105 escheat to state; therefore no “laughing heirs”; note: no great grandparents 3 UPC-Indiana comparison If no living parents or descendants, spouse receives entire estate under UPC and in IN If the decedent has living descendants only through the spouse, spouse still receives entire estate under UPC but first $25,000 plus half of the remaining estate in IN (with rest to descendants) If no living descendants but a living parent, spouse receives first $300,000 plus ¾ of the remainder under UPC or first $25,000 plus ¾ of the remainder under IN (with rest to parents) Ind. Code §§ 29-1-2-1 and 29-1-4-1 4 UPC-Indiana comparison UPC and IN include grandparents and descendants of grandparents in their list of potential heirs (i.e., aunts and uncles and their descendants), but neither includes more distant relatives. UPC turns to step-children if the list of blood relatives is exhausted and the spouse is deceased (2-103(b)), but IN does not. 5 UPC §2-102: Share of spouse Facts 1990 UPC § § 2-101 to 2-106 (rev. 2008) S; no D; no P §2-102(1)(A) all S S; D §2-102(1)(B) all S only if all D are also S’s and S’s only kids §2-102(3) $225K + 1/2 S if D are also S’s but S has others; rest D §2-102(4) $150K + 1/2 S if one or more D is not S’s; rest D S; no D; P §2-102(2) $300K + 3/4 S; rest P no S; D §2-103(a)(1) all D (per capita at each generation) no S; no D; P §2-103(a)(2) all P no S; no D; no P; B or S §2-103(a)(3) B or S (per capita at each generation) no S; no D; no P; no B or S; G or GD §§2-103(a)(4) and (5) 1/2 paternal G; 1/2 maternal G or all to maternal or paternal if no survivors on other side – per capita at each generation no S; no D; no P; no B or S; no G or GD §2-103(b) stepchildren §2-105 escheat to state; therefore no “laughing heirs”; note: no great grandparents 6 UPC-Indiana comparison UPC reduces spouse’s share if either decedent or spouse has a child from a previous marriage (2-102(3)-(4)) IN reduces spouse’s share if decedent had a child from a previous marriage, but only when the spouse and decedent had no children together (29-1-2-1(c)) 7 Howard and Wendy Brown problem 1, page 77 Howard Sarah Brown First Husband Wendy Steph. Brown Michael Walker 8 Problem 1, page 77 9 Problem 1, page 77 What about the possibility of the surviving spouse remarrying and having more children? Let’s say the only children are the two children that Wendy and Howard had together If Howard dies, Wendy takes the entire estate even though she might have children later with a new husband Thus, Howard’s genetic children are protected if Wendy had another child with a previous husband, but not if she has another child with a later husband Trying to anticipate later children would make for a much more complicated statute—this is an example where the law sacrifices some accuracy to avoid complexity 10 Problem 2, page 77 Brother H W After one year of marriage, H dies. What is W’s share? 11 Legal Recognition of Same-Sex Couples (August 2013) WA MT ME ND VT MN OR NH ID WI SD NY WY RI CT MI PA IA NE NV OH IL UT MD WV KS MO VA KY NC TN AZ OK NM NJ DE IN CO CA MA AR SC MS AL GA Same-Sex Marriage TX Civil Union/Domestic Partnership LA FL AK HI (p. 78) 12 The simultaneous death problem A is the heir apparent of spouse B, and A and B die at the same time (e.g., in an automobile accident) Does A inherit B’s estate (and then A’s heirs take), or is A presumed to predecease B (and then B’s heirs take)? Not an issue just for intestacy, but it tends to come up much more in the setting of intestacy because a welldrafted will deals with the problem The issue comes up especially in the context of spouses 13 What were the facts in Janus (p.80)? 14 Janus v. v. Tarasewicz Tarasewicz, Janus 482 N.E.2d 418 (Ill. App. 1985) Jan Alojza Stanley Theresa 15 Disposition of Stanley’s life insurance proceeds If the proceeds went to Theresa’s estate, who would actually receive them under the UPC? Under Indiana’s intestacy statute, Theresa’s estate would be divided among her parents and siblings (Ind. Code § 29-1-2-1(d)(3) ) 16 Simultaneous death (p.80) Uniform Simultaneous Death Act (1940, rev. 1953): If “there is no sufficient evidence” of survivorship, the beneficiary is deemed to have predeceased the donor. Applicable in Janus and also in IN (Ind. Code § 29-2-141) UPC §§ 2-104, 2-702 (1990, rev. 2008); Uniform Simultaneous Death Act (1991): Claimant must establish survivorship by 120 hours (5 days) by clear and convincing evidence. 17 When did Stanley and Theresa die? 18 Did Theresa really die later than Stanley? We’ll never know for sure—this case illustrates the indirectness of methods for determining the timing of death But in the view of the court of appeals, there was sufficient evidence for the trial court to conclude that Theresa did die after Stanley Unlike some other courts, this court properly deferred to the findings of the trial court Did the intestacy statute carry out Stanley’s likely intent by distributing his property to Theresa’s family? Hence, we have the 120-hour rule. 19 Problems, page 86 20 Shares of descendants Facts 1990 UPC § § 2-101 to 2-106 (rev. 2008) S; no D; no P §2-102(1)(A) all S S; D §2-102(1)(B) all S only if all D are also S’s and S’s only kids §2-102(3) $225K + 1/2 S if D are also S’s but S has others; rest D §2-102(4) $150K + 1/2 S if one or more D is not S’s; rest D S; no D; P §2-102(2) $300K + 3/4 S; rest P no S; D §2-103(a)(1) all D (per capita at each generation) no S; no D; P §2-103(a)(2) all P no S; no D; no P; B or S §2-103(a)(3) B or S (per capita at each generation) no S; no D; no P; no B or S; G or GD §§2-103(a)(4) and (5) 1/2 paternal G; 1/2 maternal G or all to maternal or paternal if no survivors on other side – per capita at each generation no S; no D; no P; no B or S; no G or GD §2-103(b) stepchildren §2-105 escheat to state; therefore no “laughing heirs”; note: no great grandparents 21 Shares of descendants (1) (p. 87) Hall 1/3 1/3 1/6 1/6 22 Competing systems of representation (p.88) English Per Stirpes Modern Per Stirpes Vertical equality – each line of descent treated equally Each line of descent treated equally beginning at first generation with a living taker 1990 UPC Horizontal equality – each taker at each generation treated equally (“equally near, equally dear”) 23 Indiana’s distribution: Modern per stirpes IC 29-1-2-1 Estate distribution Sec. 1. (a) The estate of a person dying intestate shall descend and be distributed as provided in this section. .... (d) The share of the net estate not distributable to the surviving spouse, or the entire net estate if there is no surviving spouse, shall descend and be distributed as follows: (1) To the issue of the intestate, if they are all of the same degree of kinship to the intestate, they shall take equally, or if of unequal degree, then those of more remote degrees shall take by representation. 24 Shares of descendants (2) (p.87) English per stirpes Modern per stirpes Per capita at each generation (1990 UPC) 25 Shares of descendants (3) (p.89) English per stirpes Modern per stirpes Per capita at each generation (1990 UPC) 26 Shares of descendants (4) (p.90) English per stirpes Modern per stirpes Per capita at each generation (1990 UPC) 27 Shares of descendants (5) (p.90) English per stirpes Modern per stirpes Per capita at each generation (1990 UPC) 28 Disinheriting a relative, (p. 92) T A 1/2 1/2 B “I hereby disinherit my brother, B” 1/2 Common Law UPC § 2-101(b) 1/4 1/4 29 Shares of ancestors and collaterals (p.92) English per stirpes Modern per stirpes UPC §2106(c) 30 Table of consanguinity (p.93) 31 Problem 1, page 96 32 Problem 2, page 96 33 Problem 3, page 96 34 Problem 1 at Page 97: Half-Bloods First Wife Second Wife F A B C D In almost all states and under the UPC, spouse (D) would take the entire share (under UPC and in many states like IN, spouse would share with living parents). In a few states, spouse (D) would share with siblings (A & B), and in the 35 majority of those states, A and B would divide equally the sibling share.