Make An Extra $5000 per month!

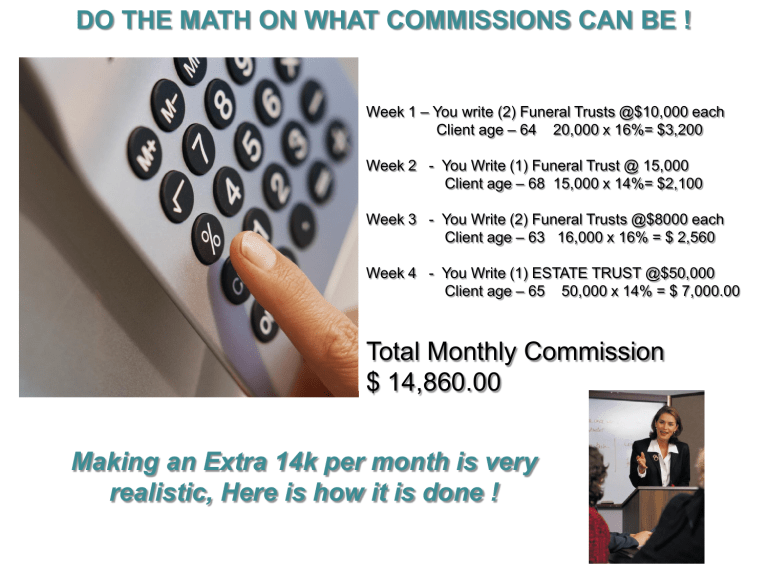

DO THE MATH ON WHAT COMMISSIONS CAN BE !

Week 1 – You write (2) Funeral Trusts @$10,000 each

Client age – 64 20,000 x 16%= $3,200

Week 2 - You Write (1) Funeral Trust @ 15,000

Client age – 68 15,000 x 14%= $2,100

Week 3 - You Write (2) Funeral Trusts @$8000 each

Client age – 63 16,000 x 16% = $ 2,560

Week 4 - You Write (1) ESTATE TRUST @$50,000

Client age – 65 50,000 x 14% = $ 7,000.00

Total Monthly Commission

$ 14,860.00

Making an Extra 14k per month is very realistic, Here is how it is done !

Karl Dovnik, Jr. – Elder Law Attorney

These Products…the funeral and estate trusts are perfect to help your clients protect funeral funds and an inheritance for their family by planning in advance.

This is great planning for all of your senior clients. After 28 years in practice, these products help seniors to protect assets if they were to go into a nursing home.

You are missing the boat if you are not selling these products.

Karl Dovnik, Jr.

Elder Law Attorney

Let’s take a Look at the Funeral Trust

And How to Sell It.

Medicaid Eligibility Rules

Some states may vary on these Medicaid eligibility rules

Single person Spousal Impoverishment

Rules for married couples

Assets - $ 2000.00 –

May vary from state to state. Next page has all states.

Life Policy - $1500.00

Car - $ 4500.00

Personal possessions

Wedding rings

Funeral trust

Assets - $50,000 – 109,560.00

Life Policy - $ 1,500.00

Car – Unlimited Value

Home - $ 500,000 Equity

Personal Possessions

Funeral Trust for both spouses

Income - $2739.00 Monthly

Most Seniors who have Paid Up Life Insurance intend to use it to pay the funeral home when they die.

• Medicaid says only a $1500.00 life insurance policy is exempt.

•

Any policy over that amount in cash values is a countable asset and would have to be spent down for Medicaid Eligibility.

•

Example: $10,000.00 Policy

– (Paid Up)

9,850.00 Cash Value

•

SOLUTION: 1035 Exchange to Funeral Trust. (Tax Free)

– Now it is Protected.

SINCE ONLY $1500.00 IS EXEMPT

FOR LIFE INSURANCE…THIS IS AN ISSUE

Some states may vary on Medicaid Rules, please consult an Elder Law Attorney in your state.

Look for your state

Many states are facing financial budget deficits and you could find all states going down to the $1500 limit. Therefore, the funeral trust makes common sense in all states. This chart subject to change.

What is a Funeral Trust ?

Single Premium

Life policy

Irrevocable funeral trust

Life Insurance Policy is assigned to Irrevocable funeral trust

•Single Premium Life

•Issue ages 0-99

•Guaranteed Issue

•No underwriting

•Commissions up to 16%

•Medicaid exempt once assigned to trust

•Premiums $1000-

$15,000

•Provided by insurance Company

•Medicaid exempt

•Not subject to five year look-back

•Strictly to pay for funeral expenses

The Trust which is managed by the insurance company will pay benefits directly to funeral home that actually provides the service within 48 hours of receiving claim. Excess funds to estate or family.

Unity Financial Life

1. SINGLE PREMIUM LIFE PRODUCT

2. Premiums from $1000 - $15,000

3. ISSUE AGES 0-99

4. NO UNDERWRITING – GUARANTEED ISSUED

5. GREAT COMMISSIONS

6. FUNERAL TRUST PROVIDED BY INS. CO.

1. MEDICAID EXEMPT IN MOST STATES

2. 1035 EXCHANGES ACCEPTED

GREAT FOR PRE-PLANNING AND CRISIS PLANNING

The Irrevocable Funeral Trust

• Irrevocable Funeral Trust (IFT) - Funded by a single premium life policy.

• Trust strictly specifies money is to be used for funeral expenses.

• Life Policy grows @2.00% - ages 0-80, 1.00% -ages 81-90 * Not

Guaranteed

• At Death, the trust pays the funeral home directly with excess funds being returned to the estate or family.

• Death claim - Agent gathers death certificate/bill from funeral home and fills out claim form for family.

The Easiest Sale You’ll ever make

First way to fund a funeral trust.

• 1035 Exchange from Old Life

Insurance

Policies that have a Face

Value of over

$1500.00

Big Money doing 1035 Exchanges

$5,000 commission

The 10% Free Withdrawal To Fund Trust

Second way to fund the funeral trust

We are just going to move money from your old annuity to the funeral trust.

Instant Medicaid Protection

CASH

Third way to fund the funeral trust

Fourth way to fund the funeral trust

Savings Bonds / Stocks

Your Biggest Competition

THE FUNERAL HOME

REASONS WHY YOUR CLIENT IS BETTER OFF DOING BUSINESS

WITH YOU.

The Funeral Home might go out of business

You might move closer to your children in your old age

The Funeral Home may merge with new owners

You might retire down in Florida

Our Funeral Trust doesn’t specify any particular funeral home. This trust can be used with any funeral home at time of death .

WE

OFFER FLEXIBILITY!

Case Study

Medicaid Spend-down – Burial Spaces

YOU CAN USE A

POWER OF ATTORNEY

IF CLIENT IS UNABLE

TO SIGN.

• Crisis Case – Client is already in an institution.

Example: Age 85 – Female

$75,000 remaining in bank acct.

Two Choices –

Choice #1 Do Nothing…Spend $ 70,000 on Nursing Home

Choice #2 -Fund Funeral Trust for Mom - $ 15,000

Fund Funeral Trusts for (6) children @ $10,000 each

Qualify for Medicaid immediately

***Most states allow the institutionalized parent to fund BURIAL SPACES for their children, adopted children or spouses of their children. A burial space is the merchandise….Casket and Vault . ***you must have to have a “Goods and Service

Contract from a funeral home that matches the amount in funeral trust to be Medicaid

Exempt.

***Medicaid laws can vary from state to state and you should consult an elder law attorney in your particular state.

FUNERAL COSTS CAN VARY FROM $7000- $12,000

NATIONAL AVERAGE IS $8495.00

Unity Financial Life

One page Application

• Issue ages 0-99

• Guaranteed issue

• Trust provided

• Medicaid exempt

• $1000 - $ 15,000

• Simple to Explain

• Up to 16.50% commissions

Growth rate is 2% from ages 0-80, 1% growth from ages 81-90, and 0% after 90.

NO Health Questions and no reduction in commissions for poor health as other companies do.

PACKAGE YOUR PRODUCTS

FUNERAL TRUST

FOR

IRENE SMITH

ABC FINANCIAL SERVICES, INC.

123 MAIN STREET

ANYTOWN, USA 00000

800-000-0000

PLANNER – TOM JONES

Existing Clients

You already have relationship

Do an Annual Review with Each of your customers. The best target age is from 60-90.

•

Help Your clients up date their accounts at bank with P.O.D.

•

Review their estate planning and financial documents

• CD holders that have CD’s coming due.

• Passbook Savings customers

• SELL THE FUNERAL TRUST CONCEPT TO THEM.

Annual Review Letter

The Funeral Trust Business is a natural with my existing senior clients.

The Trust Business has added an extra 10K or more to my income monthly!

I Sent the Annual Review letter to my 1100 clients which created more activity in my office than I have had for years.

93% of my clients did not have long term care insurance and they needed these products.