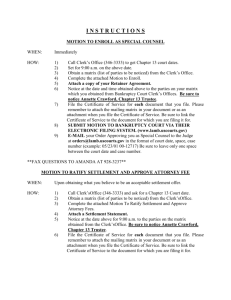

Trust Mills

advertisement

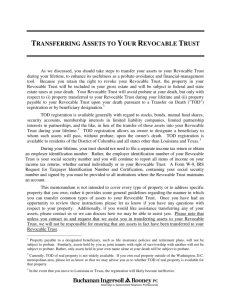

REVOCABLE LIVING TRUSTS, LIFE INSURANCE & ANNUITIES “Financial Exploitation” ? Donald Akers, Jr. Assistant District Attorney 16th Judicial District of Louisiana WORLD ELDER ABUSE AWARENESS DAY 2012 June 11, Slidell, LA June 13, Acadiana * * Except for Louisiana Citizens ?? Will Advanced directive and durable power of attorney for healthcare Financial power of attorney Revocable living trust www.suzeorman.com/igsbase/igstemplate.cfm?SRC=MD012&SRCN=aoedetails&GnavID=84&SnavI D=30&TnavID=&AreasofExpertiseID=113 The trust is the owner of the property transferred to the trust and is managed by a trustee for the benefit of a beneficiary Trusts can be created during life (living trust) or in a will (testamentary trust) Trusts can be “revocable” or “irrevocable” Trusts are used for many legitimate & lawful purposes THE “FREE” LUNCH SEMINAR Lure Leisurely Senior Citizens who have Time & Assets such as Retirement Funds & Real Estate Provide for Higher returns in low return conventional markets (increased risks!) “Free” evaluation of your portfolio, accounts & insurance “Trust Mills” selling living trusts THE LOCATION & THE SPONSOR “EFFECT” Assisted Living Complexes AARP and Senior Group Meetings Nursing Homes Retirement Communities Churches University Leisure Classes Revocable Living Trusts: FACT or MYTH Saves Inheritance & other Taxes Avoids Probate Costs & Attorney Fees are less than Wills /Probate Prevents Freezing of Assets on Death Protects All Assets Cannot be Contested Avoids Public Records Disclosure Avoids Louisiana Forced Heirship Law… Independent Insurance AGENT SENTENCED TO 90 DAYS IN JAIL FOR FELONY THEFT conviction, sold complex “indexed” annuity to an 83 year old woman alleged to have shown signs of dementia… Case Prosecuted under California Elder Protection statute. Agent alleged the woman “appeared fine and wasn’t confused at the time of the transaction” and that he acted appropriately. One agent said “There is nothing in insurance –licensing that prepares you as a nonmedical person to diagnose dementia.” The company returned principal with interest and no penalties Bank Manager notified adult protection agency when customer appeared confused and influenced by her boyfriend to withdraw $175,000 to purchase the annuity AND IN THE ACADIANA AREA … An area financial services company received an alert and caution from their corporate headquarters about the conviction reported in the Wall Street Journal A financial consultant was contacted by his former customer an 83 year old man whose 81 year old wife suffered from Alzheimer's disease. The gentleman had unexpectedly closed his accounts of more than 20 years, withdrawing about $500,000 dollars. • 83 year old elderly man (with an 81 year old wife with Alzheimer’s Disease) reports he started receiving calls from a non-local insurance sales agent many months before he was visited at home • He reports the agent claimed his company’s interest rates were higher than his financial services company investment in short term bonds with a 2.5%-3% annual return • He reports that the agent had him close his financial services account and sold him the following: $ 100,000 Life Insurance (whole life) - 14 year surrender $ 315,000 Index Linked S&P 500 Annuity - 16 year surrender $ 160,000 Variable Universal Life Insurance Total: $575,000 • He reports that he contacted his former financial advisor asking for help because he didn’t understand what he bought and needed $10,000 to pay taxes due to transactions and has no liquidity. • He reports he was referred to elderly protective services and was advised to file a complaint with Louisiana Department of Insurance. • He reports he receives a call and visit from the insurance broker who had received the complaint and was advised that if he dropped the complaint, he could receive funds sufficient to cover taxes due from cashing out bonds. • He reports that he signs documents provided to him by the insurance agent dropping the complaint (reports he learned the document dropped all and not just one with cash available). • He reports he paid his taxes, has no further liquidity and continues to look for help ISSUES A “Crime” or A “Civil Matter” Legal/Compliance Department says: “don’t participate”! • Indexed annuities are attractive to agents because of high commissions, often 12% or more of the invested amount. • Historically low interest rates and a volatile stock market draw buyers, especially fixed income investors. FILE COMPLAINTS Louisiana Department of Insurance Investigates your complaints against companies, agents, or adjusters http://www.ldi.state.la.us/ConsumerComplaintForm/Complaints/Welcome. aspx Web Site: http://www.ldi.state.la.us/ Phone: (800) 259-5300 -or- (225) 342-5900 Fax: (225) 342-3078 • Class Action Lawsuits by Victims in many states are being brought for this ripe area of Consumer Fraud • State Elderly Protective Agencies are focusing on these issues • State Bar Associations are taking action • Take Time to Decide, Is it Too Good To Be True? • Consult with YOUR attorney, accountant, banker or financial Advisor BEFORE YOU BUY A PRODUCT • If you need a Trust or other Estate Planning, seek the advice of a reputable, licensed professional who deals directly with you LOUISIANA OFFICE OF FINANCIAL INSTITUTIONS http://www.ofi.state.la.us/ Investment Adviser Public Disclosure Check professional background and conduct, current registrations , employment history, and disciplinary events 8660 United Plaza Blvd. Second Floor Baton Rouge, LA 70809-7024 Mailing Address: Post Office Box 94095 Baton Rouge, LA 70804-9095 Main Phone: (225) 925-4660 Fax: (225) 925-4548 • Donald D. Akers, Jr. Assistant District Attorney, Elderly Protective Services 16th Judicial District of Louisiana 300 Iberia Street, Courthouse Suite 200 New Iberia, LA 70560-4583 Phone: 337-369-4420 Direct Ph: 337-365-3886 Direct Fax: 337-365-3886 • Additional Ph: 337-367-8451 Alternate Fax: 337-365-7034 email: dakersjr@cox.net • Website: www.16jda.com