Hence small distributors must pay the ACTUAL price

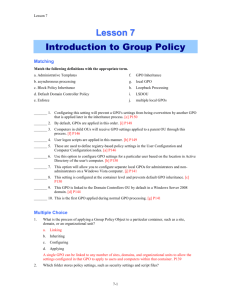

An Illustration of How the

Media’s Report on “Price

Gouging” by Small Drug

Distributors is Misleading and

Untruthful, in Most Situations

As Presented by Pat Earl,

Principal and CEO of Secure

Pharma Distributor Network

RISING DRUG SHORTAGES IN U.S.

Source: U.S. Food and Drug Administration

Year No. of Reported Shortages

2005 61

2006

2007

56

90

2008

2009

110

157

2010

2011

178

200 and growing

Reasons for Rising Drug Shortages in U.S.

Source: U.S. Food and Drug Administration

Rank Why Drug is Short Supply % of Reasons

1 Quality Problems

2 Delays Related to Capacity

54%

21%

11% 3 Company Discontinuing

Production

4 Raw Material Supply

5 Increased Demand Due to

Another Shortage

6 Loss of Manufacturing Site

7 Shortage of Packaging

Components

5%

4%

3%

2%

Pharmacist Michael O'Neal, manager of procurement at

VUMC, holds the drug propofol, which has been in short supply. / Samuel M. Simpkins / The Tennessean

Growing Drug Shortage Leaves Patients in the

Lurch… as reported in The Tennessean on October 6, 2011

• According to a pharmacist who is manager of procurement at Vanderbilt University

Medical Center “…I don’t know if this is a market adjustment because the whole generic drug industry has become so commodified that you can buy a bottle propofol that can be used in surgery much cheaper than you can buy a bottle of water.”

Propofol is the generic version of Diprivan, the anesthetic drug used in Hospital Operation Rooms

Price: When No-Adverse Market

Supply Issue:

Manufacturer A Published Wholesale

Acquisition Cost (WAC)

GPO Contract Price

Discount off Published Wholesale

Acquisition Cost (WAC)

On Major GPO

Contracts

$5.60

$0.48

$5.12

Percent Discount Savings 91.43%

Actual Pricing that a Small Distributor Pays for

Propofol when Purchasing for Normal Supply

Price Between Two Distributor Trading

Partners, i.e. an ADR to Distributor

No GPO

Contract

The WAC Price to Authorized Distributors

ADR Invoice Price to Small Distributor

Cost Plus Invoice Price to Distributor

Percent Markup on ADR to Distributor

$5.60

$6.60

$1.00

17.86%

Selling Price that a Small Distributor Offers to

Hospital at15% Markup on its Purchase Price

Price If Market Supply Channel is Disrupted:

Market

Price

Small Distributor Acquisition Price from ADR

Sell Price to Hospital - Non GPO Eligible

Cost Plus Mark-up on Sale to Hospital

Percent Markup on Small Distributor Price

$6.60

$7.60

$1.00

15.15%

These Illustrations Show a 15%-18% Markup to

Cover the Costs of Picking, Packing and Shipping

Transactions for Propofol… NO GOUGING HERE!

On vs. Off

Contract

Cost Impact on hospital pricing as reported to GPO:

GPO negotiated contract price on APP product

Non-GPO authorized distributor sale at

WAC+

Additional Cost to Purchase Off-Contract

Alternative

$0.48

$7.60

$7.12

Cost Impact for hospital reporting to GPO 1483.33%

Drugs in the “Market”

• Manufacturers bid low prices in exchange for sole source GPO awards

• One supplier then corners the market for multiple years of contracts

• Artificial price controls drive competition to discontinue that product

• Limited distribution conspires to drive drugs into commodity exchanges

• Artificially low pricing leads to unnecessary shortages

Growing Drug Shortage Leaves Patients in the

Lurch… as reported in The Tennessean on October 6, 2011

• Many of the drugs are old-line treatments with low profit margins for their makers

• The general public reads the headlines about the drug shortage crisis, and they assume we are talking about these blockbuster drugs that are so…expensive .

• In reality, we are talking about generics that are $2 each that are proven to work, that patients are now not able to obtain

Drug Shortages are a direct result of GPO favoritism and their lossleader pricing strategies…

No other manufacturer will produce a drug at a loss !

.

Perceived “gouging” alluded to is A DIRECT cause of GPO and their chosen partners’ policies that create ”artificial price controls” for their favored member customers.

Small distributors are “restricted” by the manufacturers and the GPO’s from selling these contract items at the exclusive, artificially-set contract pricing

Hence small distributors must pay the ACTUAL price

Pat Earl, Principal and CEO of Secure

Pharma Distributor Network

From my viewpoint as an industry veteran…

“ I believe that it is rather disingenuous for

Premier Purchasing Partners, the other large national GPO’s and their partner manufacturers, in general, to point their fingers at the small drug distributors, who must pay a significantly higher price for their products. The market share for the smaller distributors is comparatively speaking…relatively insignificant.”