A Corporate View by Cognizant - C-Quel

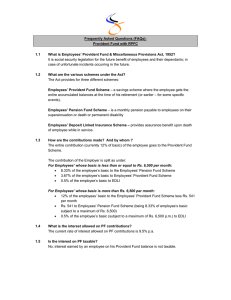

Social Security

-

A Corporate View

©2011, Cognizant

ESI- Highlights

Benefits

1. Super specialty treatment

2. Unlimited Dialysis

3 Special treatment to Eye & Bone

4. Disabled employee coverage

5. Benefits “ Anytime & Anywhere”.

6. Lower premium – Higher benefits

Technology

1 . IT Roll out – Employer support

2. Services of 24x7 Toll Free Helpline and facilitation center.

3. Reporting framework

2 | ©2010, Cognizant

Focus to Improvements

Maximizing Private Hospitals for all ailments

Online Pehchan Card

Employee Self Service - ESS in ESIC

Maximizing Cashless Hospitalization

One stop process of Claim reimbursement

3 | ©2010, Cognizant

ESI “Optimize & Attract”

“Nearest “hospitals networking

One Click approval for

Private hospitals

Value added preauthorization cashless treatment

Expand ESI counters in

Private Hospitals

Increase Women medical practitioners

Increase awareness of ESI procedures

4 | ©2010, Cognizant

Feedback recording….gains

In recent years, India, like several other developing countries, has established different types of social security scheme. The ESIS is one among such scheme. Its main objectives is to provide medical benefit’s for citizens who’s earnings fall under certain limit of income.

Scenario

IP 1 : I took my wife for antenatal care and for delivery to ESI hospital, Ayanavaram, Chennai. The treatment was very good

IP 2: I took my mother for asthma treatment to the ESI hospital Vellore. She was feeling better than when she was treated in a private hospital

IP 3: Fifteen days back I went to the ESI clinic with an ear ache. Medical services were good. I suffer from this complaint frequently.

And I visit ESI regularly for treatment. I am satisfied with their service.

These factors affect diverse groups of individuals differently and play distinctive roles in the decision to seek medical care

(mostly taken by the individual) and in the decision regarding the subsequent number of visits to ESI dispensaries or private facilities.

5 | ©2010, Cognizant

Feedback recording…focus to improve

Scenario

IP 1:

The conditions in the dispensaries are appalling. We have to ultimately go to a government hospital or arrange money for private treatment. What then, is the use of the ESI

IP 2:

The timing does not suit our working hours. We find it difficult to take leave or permission to go to the clinic in the morning hours. Finally we end up going to private doctors

IP 3 :

In the out-patient’s clinic there are not enough places; with many patients the place is not very comfortable. Receiving the OP card itself takes a long time. The sanitation conditions in these facilities are also not very good

IP 4 :

Not enough diagnostics facilities are available in these clinics. Where diagnostic facilities are available most of the doctors are men and female beneficiaries registered under this scheme are reluctant to approach them for diagnosis. They prefer getting treatment from private nursing homes or private clinics, several times out-of-pocket expenditure incurred for treatment and reimbursement at times takes several weeks

6 | ©2010, Cognizant

ESI – Current & Proposed Flow

Approaches ESI Hospital

IP

Register online in ESIC web portal

System calculates the eligibility and mail is triggered to the officer

Officers check the system and approves

ESIC should send

Instant SMS on every stage of the

Cashless cycle.

Helpline facility should be available for updates on the case

Case is received at PVt

Hospital & treatment is initiated

Proposed process

Case is received at

ESIC & payment is processed

Existing process

Medical Officers examine the patient

Medical Facility available

IP is treated in ESI hospital

IP is issued with reference letter and routed to Pvt Network hospital

Medical Facility unavailable

Approaches the Network

(empanelled) Hospital and produce the reference letter at reception

Based on the cap limit(eligibility certificate) the Hospital intimates ESiC

7 | ©2010, Cognizant

8

Provident Fund

©2011, Cognizant

EPF - gains

Provident Fund

Savings plan & Safety of returns

Loan options

Tax treatment

Interest earned

Withdrawal facility

Dependant eligibility for deceased

Pensionable Service Benefit

Data accuracy

9 | ©2010, Cognizant

International worker

Social security in home location

Lower taxability impact

One stop shop for SS benefits

Totalisation of period of contribution in the host country for determining the eligibility for social security benefits.

EPF - Focus to Improve

Administration

Robust online status tracking system

Improving on current SLAs, seasonal fluctuations

Business Enablers

Support Portfolio management

Inter regional transfer of funds

Robust Integrated System

Decentralized PAN India

Record Maintenance

10 | ©2010, Cognizant

Benefits

Provident Fund “post retirement” view

Repatriating contribution on gross salary

> 36 months Interest Loss

Plan should permit to change investment selections – corporate view

Loans /pensions scheme – eligibility tenure optimization with changing market

PF – Current & Proposed Flow

11

Submitted @ RPFC

Forms

3 days-60 days

RPFC, Chennai moves

Form to relevant section within or relevant RPFC of other region

15-30 days

Relevant RPFC(Regional

Provident Fund

Commissioner) moves required -Annexure k for

EPF transfer

30 – 45 days

Receipt of Annexure K,

NEFT Transfer is made to employee’s current PF a/c

On transference of the amount RPFC should send instant

SMS about the PF transfer , closure status

| ©2010, Cognizant

RPFC, Chennai moves Form to relevant section within or relevant

RPFC of other region

The minimum period of

PF transfer to take effect is 2 months if it is within Tamilnadu and around 3 months for transfer across interstate

RPFC offices.

and Closure 2 months.

Proposed process Existing process

The minimum period of

PF transfer to take effect is around 6 months if it is within

Tamilnadu and around a year for transfer across interstate RPFC offices.

30- 60 days

Relevant RPFC(Regional

Provident Fund

Commissioner) moves required documents(Cheque &

Annexure k) for EPF transfer

90 days

Receipt of cheque and its realization is handled RPFC

Chennai (Group 30)

Processed only at year end

Group 30 at RPFC reflects the transferred amount to associate’s

PF a/c

Processed only at year end

On transference of the amount RPFC confirms about the PF transfer completion.

Confirms only during annual statement release

12

Thank You

©2011, Cognizant