Gary Humble, Senior Associate

OPEN MINDS

April 18, 2013

Updates On

Health Care

Reform

Nationally and

in Washington

State

OPEN MINDS © 2013. All rights reserved.

2

1.

2.

3.

4.

5.

6.

7.

Medicaid expansion

Employer mandate implementation

Individual mandate implementation

Health insurance exchanges

Essential health benefit requirement

Medical loss ratio requirements

End of disproportionate share payments to

hospitals

OPEN MINDS © 2013. All rights reserved.

3

The Medicaid expansion provision of PPACA extends

Medicaid eligibility to all Americans who earn less

than 133% of the poverty level (approximately

$14,000 for an individual and $29,000 for a family

of four)

New rules go into effect on January 1, 2014

OPEN MINDS © 2013. All rights reserved.

4

Adoption of Medicaid expansion provision of PPACA, by state,

as of January 17, 2013

Committed to

expand coverage

• Arizona, California, Colorado, Connecticut, Delaware,

Hawaii, Illinois, Maryland, Massachusetts, Minnesota,

Michigan, Nevada, New Jersey, New Mexico, New York,

Ohio, Oregon, Rhode Island, Vermont, Washington,

Washington D.C.

Declined to

expand coverage

• Alabama, Georgia, Iowa, Louisiana, Maine, Mississippi,

North Carolina, Oklahoma, Pennsylvania, South

Carolina, South Dakota, Texas, Wisconsin, Wyoming

Undecided

• Alaska, Arkansas, Florida, Idaho, Indiana, Kansas,

Kentucky, Missouri, Montana, Nebraska, New

Hampshire, North Dakota, Tennessee, Utah, Virginia,

West Virginia

OPEN MINDS © 2013. All rights reserved.

5

Effective January 1, 2014

Medicaid will be expanded to include individuals between the

ages of 19 up to 65 (parents, and adults without dependent

children) with incomes up to 138% FPL

Anticipate enrolling up to new 254,000 participants in next few

years

OPEN MINDS © 2013. All rights reserved.

6

•

•

•

•

Forecasted to save $142 million in State

funding in the next State Bi-annual budget

Will bring in an additional $1.2 billion in

federal funds to the State

Create 10,282 jobs (direct or indirect) as a

result of Medicaid Expansion

Savings for Businesses- Reducing Cost

Shifting of uncompensated care in their

insurance premiums

OPEN MINDS © 2013. All rights reserved.

7

Employers must provide health care coverage for employees or pay a

tax penalty

Employers with at least 50 FTE must provide health care coverage that

meets requirements and provides the “essential health benefits

package”

Tax credit incentives are currently in place for small business (less than

25 employees) offering health insurance

Tax penalties of $2,000 for each FTE, beyond the company’s first 30

workers, begin in 2014

OPEN MINDS © 2013. All rights reserved.

8

Individuals are required to purchase health insurance or pay a “tax”

of $695 or 2.5% of income, whichever is higher

Individuals must purchase health insurance if the monthly premium

is less than 8% of their monthly income

Individual penalties will go into effect in 2016

OPEN MINDS © 2013. All rights reserved.

9

System in which individuals can compare and purchase

health insurance policies with baseline levels of coverage

State options include state-run exchange, federal/state

partnership exchange, and federal-run exchange

States will begin open

enrollment October 2013

Federal grants available

for states through the end

of 2014

Exchanges must be selffunding starting in 2015

OPEN MINDS © 2013. All rights reserved.

10

Application Status Of Health Insurance Exchange, By State,

As Of December 14, 2012

State run (19)

• California, Colorado, Connecticut, Hawaii, Idaho,

Kentucky, Massachusetts, Maryland, Minnesota,

Mississippi, Nevada, New Mexico, New York, Oregon,

Rhode Island, Vermont, Utah, Washington, Washington

D.C.

State-federal

partnership (6)

• Arkansas, Delaware, Illinois, Iowa, North Carolina, West

Virginia

Will not operate

own exchange (23)

• Alabama, Alaska, Arizona, Georgia, Indiana, Kansas,

Louisiana, Maine, Missouri, Montana, Nebraska, New

Hampshire, New Jersey, Ohio, Oklahoma, Pennsylvania,

South Carolina, South Dakota, Tennessee, Texas,

Virginia, Wisconsin, Wyoming

Undecided (3)

• Florida, Michigan, North Dakota

OPEN MINDS © 2013. All rights reserved.

11

•

•

•

•

State of Washington will operate their own

Health Insurance Exchange

The Insurance Exchange could serve as

many as 400,000 Washington residents

The Washington State Health Care Authority

(HCA) will oversee the development of the

Insurance Exchange

Enrollment begins in October, 2013 for a

January 1, 2014 effective date

OPEN MINDS © 2013. All rights reserved.

12

The name of the

Washington Insurance

Exchange is Health Plan

Finder

Received 24 letters of

Interest from health and

dental insurance carriers to

participate in State’s online

health insurance exchange

Interested plans include

Regence BlueCross

BlueShield of Oregon, Group

Health Cooperative, Kaiser,

Molina Health Plan

OPEN MINDS © 2013. All rights reserved.

13

Essential Health Benefits Categories

1. Ambulatory patient services

2. Emergency services

3. Hospitalization

“Essential health benefits”

determined by each state – going

live with HIE @October 2013

4. Maternity and newborn care

5. Mental health and substance use disorder services, including behavioral

health treatment

6. Prescription drugs

7. Rehabilitative and habilitative services and devices

8. Laboratory services

9. Preventive and wellness and chronic disease management

10. Pediatric services, including vision and oral care

OPEN MINDS © 2013. All rights reserved.

14

•

Law Enacted in 2012

◦ Specifies selection of the largest small group plan

as the benchmark for establishing essential health

benefits

◦ Regulations require every plan to cover a list of 10

“essential” benefits

◦ Standardized coverage levels: “bronze” coverage;

“silver” coverage; 80 “gold” coverage; “platinum”

coverage

◦ For those under Age 30, preventive/catastrophic

coverage with a high deductible

OPEN MINDS © 2013. All rights reserved.

15

Medical Loss Ratio is the percentage of premiums that the health

insurance plan uses to reimburse providers

Plans that fail to meet the minimum must rebate the difference back

to consumers

MLR standards:

1. Health plans in large group markets must spend at least 85% of premiums

2. Health plans in the individual and small group markets must spend at least

80% of premiums

MLR requirements were effective January 1, 2012

OPEN MINDS © 2013. All rights reserved.

16

Disproportionate share: Federal funds to hospitals for indigent care

Medicaid disproportionate share in Washington: $185, 197, 033 million in FY 2011

$21 billion U.S. In 2011 FYI: $11 billion Medicare DSH and $10 billion in Medicaid

DSH)

Rationale for reducing DSH payments followed from the expected reduction in the

number of uninsured as a result of Medicaid expansion and implementation of health

insurance exchanges for those not qualifying for Medicaid

Medicare DSH payments will

decrease by 25% in FY 2014

Medicaid DSH payments will

decrease by $14.1 billion

between 2014 and 2020

OPEN MINDS © 2013. All rights reserved.

17

Health care

reform moves

ahead

“Bend the cost

curve” is the

theme

“Beyond FFS” is

the model

Focus on

complex highcost consumers

OPEN MINDS © 2013. All rights reserved.

18

1.

Medicaid expansion likely in all states

except five: Texas, Louisiana, Florida, South

Carolina, Mississippi

2.

3.

Managed care across all populations more

common to control financial risk

Medical loss ratio rules (MLR) and ACOs

causing disintermediation of health

insurance companies

◦ Risk-based partnerships with ACOs

◦ Acquisition of provider capacity

4.

Health exchanges and employer mandates

move ahead

OPEN MINDS © 2013. All rights reserved.

19

1.

2.

3.

4.

5.

6.

Federal and state deficits

Insurers and managed care plans

under price pressure

Consumers paying more out of

pocket

Rising cost per person – aging

population, longer life expectancies,

new technologies

Rising proportion of population

uninsured and uncertain future of

reform

All the ‘easy’ cost savings have been

made

Paying for

Medicare is

taking up all

the Federal

budget

conversation

Paying for

Medicaid is

taking up all

the “oxygen” in

state budgets

OPEN MINDS © 2013. All rights reserved.

20

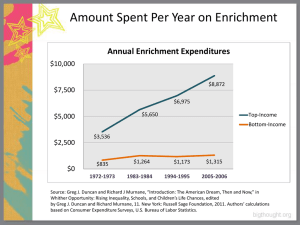

5% of U.S. population

account for half (49%) • $11,487 per person

of health care spending

50% of population

account for only 3% of

spending

• $664 per person

OPEN MINDS © 2013. All rights reserved.

21

•

•

Services to support

chronic illnesses

contribute to 75% of

the $2 trillion in U.S.

annual spending

Patients with comorbid chronic

conditions costs 7x

as much as patients

with one chronic

condition

Nine Highest-Cost

Chronic Conditions

1.

2.

3.

4.

5.

6.

7.

8.

9.

Arthritis

Cancer

Chronic pain

Dementia

Depression

Diabetes

Schizophrenia

Post traumatic conditions

Vision/hearing loss

OPEN MINDS © 2013. All rights reserved.

22

Coordination

more

important

than

integration

Integration of

Primary Care &

Chronic Disease

Management

Integration of

Primary Care &

Behavioral

Health

Integration of Primary

Care & Behavioral

Health Coordination

of behavioral health

services and primary

care services to

improve consumer

services and

outcomes

Integration of Primary

Care & Chronic

Disease Management

Coordination of

services to manage

and address multiple

chronic disease states

within or parallel to

primary care

OPEN MINDS © 2013. All rights reserved.

23

97%

100%

Percent of Total Expenditures

90%

80%

80%

64%

70%

60%

49%

50%

40%

30%

22%

20%

3%

10%

0%

Top 1%

Top 5%

Top 10%

Top 20%

Top 50%

OPEN MINDS © 2013. All rights reserved.

Bottom 50%

24

•

•

•

•

•

•

Management via ACOs,

medical homes, and primary

care

Specialist role is secondary

Focus on prevention and

wellness

Consumer self-care and

consumer convenience is key

Web presence (optimization,

reputation, etc.) critical for

consumer referrals

Health information exchange

a requirement

Primary care

relationships with

clearly defined

specialty service

Consumer

‘experience’ (and

preference) critical

Web presence key

referral mechanism

Health information

exchange

capabilities

OPEN MINDS © 2013. All rights reserved.

25

• Coordination of medical,

behavioral, and social service

needs by specialty group

within larger system

◦ Health homes

◦ Waiver-based HCB programs

◦ PACE programs

◦ Specialty care management

programs

• Assumption of performance

risk (with or without financial

risk)

Cross-specialty and

cross-system care

coordination

capability

EHR system and HIE

with real-time care

management

metrics

Performance-based

contracting and

risk-based

contracting

capabilities

OPEN MINDS © 2013. All rights reserved.

26

New Functionality In

Telecommunications

Synergistic Environmental

Factors In Current Market

New Health Data Systems

& Informatics

Emerging

Developments in

Neuroscience

OPEN MINDS © 2013. All rights reserved.

27

28

29

30

31

32

33

34

OPEN MINDS © 2012. All rights reserved.

35

36

Ipad With Patient Self-Reporting Tools

OPEN MINDS © 2012. All rights reserved.

38

More P4P

New

Service

Delivery

Models

OPEN MINDS © 2013. All rights reserved.

Less FFS

43

Integrated care is a model

of health care delivery that

engages people in the full

range of physical,

behavioral, preventive and

therapeutic services to

support a healthy life.

In an integrated care

setting, behavioral

health and medical

providers work together to

coordinate treatment and

follow-up of a person’s

health care.

OPEN MINDS © 2013. All rights reserved.

44

FFS Financing

Beyond FFS Financing

Payer (or MCO) maintains risk for unit cost

and quantity of services used

Payer (or MCO) contracts with provider

organizations to deliver services to a

population for a fixed amount of dollars

Consumers request services

Consumers request services

MCO “approves” service

Provider organizations deliver services

and are reimbursed based on volume

Provider organizations determine type and

amount of service, delivers service, and

manage pool of dollars

OPEN MINDS © 2013. All rights reserved.

45

The overarching reasons for health care

reform are to achieve the Triple Aim:

• Improve the health of the defined

population

• Enhance the patient experience (including

quality, access and reliability)

• Control or at least, control the per capita

cost of care

OPEN MINDS © 2013. All rights reserved.

46

External Changes

• Successful Behavioral Health Organizations will be

able to identify their customers’ needs and fill them

• Successful Behavioral Health Organizations must

know who their customers are today and how that

customer base will change in the future

• Successful Behavioral Health Organizations must

demonstrate their value and effectiveness to their

customers

OPEN MINDS © 2013. All rights reserved.

47

Examples of Customers:

• Hospitals

◦ Now responsible for meeting certain Medicare

quality measures

◦ Financial penalties are imposed if measures are not

met. Could mean millions of lost revenue.

◦ One major metric hospitals are now measured- 30

day readmission rate for certain diagnoses

◦ Behavioral health patients pose a unique challenge

for hospital discharge planners

OPEN MINDS © 2013. All rights reserved.

48

Health Plans

• State run Health Insurance Exchange

• May be involved down the road for both Medicaid

and/or Medicare/Medicaid (Dual Eligible) clients

• Have certain HEDIS measures that they are

responsible for meeting

• In some states, financial rewards/penalties are

associated with those health plans meeting/not

meeting these standards

OPEN MINDS © 2013. All rights reserved.

49

Primary Care Practices

Many will be

involved in

becoming a Patient

Centered Medical

Home (PCMH)

Typically, these

practices do not

have the expertise

to work with our

population

Will be held

accountable for the

care coordination

and ultimately, for

reducing the cost

of their patients’

care

OPEN MINDS © 2013. All rights reserved.

50

Accountable Care Organizations (ACOs)

• Responsible for managing the care of their ACO

members

• Will again need the expertise of the behavioral

health community in order to manage both the

medical and behavioral health needs of the patient

• Will require creativity in service design to

adequately manage our population (i.e. housing)

OPEN MINDS © 2013. All rights reserved.

51

Other External Changes:

• Technology usage in the area of chemical dependency (i.e. telemedicine, smart

phones)

• Treatment Philosophy issues- Abstinence based versus Medication Assisted

Treatment (MAT)

• Possibility of merging, strategically aligning, partnering with other providersMental Health Agencies, Federally Qualified Health Centers (FQHCs), hospitals,

ACOs

OPEN MINDS © 2013. All rights reserved.

52

Health Care Reform is creating a tremendous amount of

upheaval in our industry. But opportunities will exist for

those organizations that are willing to change and take risks

The missions of your organizations do not have to be

compromised in order to survive in this era of reform

The methods in which you provide services may need to be

changed and/or modified (individualized treatment plans,

technology, customer/referral base)

OPEN MINDS © 2013. All rights reserved.

53

Organizations that are willing to

change, consider other treatment

methods, look to fill the various

customers’ needs will be well

positioned for the future

Organizations that are not open to

exploring various business

relationships or are unwilling to

change the way they do business

because, after all, we’ve always

done it this way will be hard

pressed to survive.

OPEN MINDS © 2013. All rights reserved.

54

It is not necessary to change.

Survival is not Mandatory

Peter Drucker

OPEN MINDS © 2013. All rights reserved.

55

Questions?

OPEN MINDS © 2013. All rights reserved.

56

Upcoming Education Events

2013 Planning & Innovation Institute

June 11-13, 2013 New Orleans, Louisiana

2013 Executive Leadership Institute

September 11-143 2013 Gettysburg, Pennsylvania

OPEN MINDS © 2013. All rights reserved.

57

The market intelligence to navigate.

The management expertise to succeed.

www.openminds.com

openminds@openminds.com

717-334-1329 | 877-350-6463

163 York Street, Gettysburg , Pennsylvania 17325

![The mysterious Benedict society[1]](http://s2.studylib.net/store/data/005310565_1-e9948b5ddd1c202ee3a03036ea446d49-300x300.png)