THE AFFORDABLE CARE ACT: AN OVERVIEW OF THE

advertisement

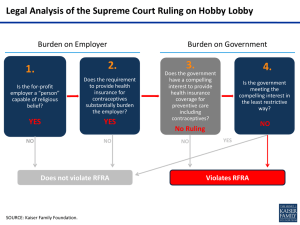

NLKJ Newby, Lewis, Kaminski & Jones, LLP 916 Lincolnway La Porte, Indiana 46350 219-362-1577 jwkaminski@nlkj.com mlphillips@nlkj.com Few hospitals for those communities with hospitals, doctors often treat patients without charging a fee Doctors are generalists; many also practice as veterinarians Treatment of most illnesses at home No real diagnostic or disease management Doctors often paid through bartering Before 1920, costs associated with health care was not medical expenses, but loss of work wages due to illness (Bureau of Labor Statistics) Technology and pharmacy breakthroughs begin with such things as: The invention of X-ray Penicillin Understanding of bacteria to develop immunology technique Hospitals increase with understanding of antiseptic treatments People seek medical help at hospitals and doctor’s homes / offices American Medical Association formed and lobby for doctors Consumers recognize need to treat illness, and with higher wages, consumers pay more for medical services on a fee for service basis (Journal of American Medical Association, 1922) 1930 – Dallas teachers’ contract with Baylor University for Health Insurance; Blue Cross-Blue Shield is born; pay fixed rate, per day, for hospital services 1939 – California Physicians Service is first prepayment plan to cover physicians services; physician plans with a fixed fee for service payment system are incorporated into Blue Cross-Blue Shield (Monthly Labor Review, 1944) American Medical Association opposes health insurance programs as “bureaucratic” and “freedom limiting”; strongly opposes President Theodore Roosevelt’s suggestion of a nationalized health insurance During World War II, federal government implements wage controls so many employers offer health insurance as an added benefit Blue Cross-Blue Shield is not-for-profit and to uphold its charity status, must rate “community” – both sick and healthy to set rates on a payment by service Commercial insurance is born; carriers can pick better risk pool and thus offer lower premiums than Blue Cross-Blue Shield, causing a “boom” of commercial insurance President Truman’s plan for National Health Insurance for all citizens fails; criticized by American Medical Assc. 1965 – President Johnson signs into law Medicare, provides federally funded health coverage for all citizens over age 65, regardless of health status; Part A – hospital services; Part B – physician Medicaid, a federal/state program for impoverished also begins Rates to providers charged by Medicare at “usual, customary and reasonable rate” from 1965 to 1983 1983 – Medicare adopts a prospective payment system based on diagnosis and type of treatment; pay fixed fee for diagnosed illness, not just paying a fee for each service encounter 1980 sees explosion of “private” health care businesses (i.e., “for profit” entities) 1990 – cost of health care exploding, managed care model developed to mitigate costs (HMOs) By 2000, health care costs deemed a crisis by most employers Medicare’s annual fee schedule increasingly ignores the actual costs Medicare providers incur while providing treatment Prescriptive drug and diagnostics exploding, increasing cost of care With costs of care increasing, all insurance premiums increased, leading to increase of uninsured population Insurers decreasing coverage to manage risk Medicare reimbursement not rising with costs; Medicare paying increasingly larger amount for care in the last year of life of participants Cost shifting to private insurers by health care providers Cover more lives Extend coverage to “working Americans” who otherwise would not be insured Poverty ridden citizens – stay on Medicaid Low income – 133% to 400% offered tax credits to pay for private insurance and won’t pay more than 6.3% of income on premiums If low income does not opt to participate, tax penalty assessed Some employers mandated to provide coverage or pay penalty Provide more coverage terms to public: Insurance companies not allowed to discriminate based on pre-existing conditions Can rate based on age, family composition, tobacco use and rating area, but plans must offer basic health coverages Requires a taxpayer to obtain “minimum essential coverage” for health insurance or else pay a “shared responsibility payment” (in the form of an excise tax) Mandate begin 01/01/2014 To qualify, an individual must have coverage through: Employer sponsored coverage, including COBRA, retiree coverage and health flex plans (Employer plans required to have) Government sponsored programs, like Medicare / Medicaid, CHIP (Children’s Health Insurance Program) Individual plans, including plans purchased on exchanges Health plans certified by Health & Human Services If cost of minimum coverage exceeds 8% of total household income or if income is so low that no return is required to be filed – exempt: Native Americans: exempt in federally recognized tribes Certain religious objections: exempt and must request exemption (i.e. Amish; Mennonites; etc) Illegal immigrants People with coverage gaps lasting less than 3 consecutive months General Board of Pension and Health Benefits Tax penalty which is the greater of: 2014: $95.00 per uninsured person (up to 3 individuals) in household or 1% of taxable income 2015: $325.00 per uninsured person or 2% of taxable income 2016: $695.00 per uninsured person or 2.5% of taxable income Compliance will be monitored through federal tax returns. Individuals can get tax credits for premium payments if income is at 400% or less of federal poverty level; the more income – the smaller the credit. Example: In 2013, a family of 4 with $35,000.00 household income would get a $10,742.00 tax credit to purchase insurance with $12,130.00 premium annually while the same family with $90,000.00 household income would get a $3,580.00 credit. Tax credit paid directly to insurer. Individuals will be able to purchase coverage through Health Insurance Exchanges or market places. Exchanges will be run by states, federal government or partnership (Indiana is federal). Essentially, an online purchasing site, operational October 1st of this year! Exchanges will offer “essential health benefits” with 10 broad categories: Ambulatory patient services Emergency services Hospitalization Maternity and newborn care Mental health and substances disorder services, including behavioral health treatment Prescriptive drugs Rehabilitative and habilitative services and devices Laboratory services Preventive and wellness and chronic disease management Pediatric services, including oral and vision care Plan costs will vary based on “acturial value” or expected costs plan will cover. Coverages defined as bronze, silver, gold and platinum. • Bronze will have lowest premium, but highest deductible. • Bronze covers 60% of expected costs versus “platinum” which will cover 90% of expected costs. THE EMPLOYER MANDATE PPACA - Patient Protection and Affordable Care Act ACA - Affordable Care Act HCR - Health Care Reform OBAMACARE HOW ABOUT E-ANA? • Individual Mandates • Employer Mandates • Creation of Insurance Exchanges • Subsidized Health Insurance for Poor and Unemployed • Funding Through New “Taxes” COVERED EMPLOYERS MUST OFFER Additional Rules to be Used in Determining the Number of Full-Time Employees: 4. Creating a Stability Period – at least 6 months, but not less than Initial Measurement Period – to be used by employer under “look back” rules to determine status of employee 5. Creating an optional “Administrative Period” – a period of time not greater than 90 days after Initial Measurement Period and before the Stability Period to be used by employer to determine if employee averaged 30 or more hours per week during Initial Measurement Period. 6. Allowing different Initial Measurement Periods, Stability Periods, and Administrative Periods for employees in different union groups (mandatory subject of bargaining?), salaried versus hourly workers, and employees in different states. Covered Employer must offer health coverage under employer’s health plan to a deemed full time employee within 90 days of Start Date or pay penalties. If variable hour or seasonal employee averages 30 hours per week or 130 hours per month during his/her Initial Measurement Period s/he must be treated as a full time employee during the following Stability Period. Employers with 50 or more FTE’s must offer “affordable” “minimum value” health insurance to at least 95% of their “full time” employees or pay an annual penalty (tax), but only if one or more of that employer’s employees purchases health insurance from a state or federal insurance exchange and receives a premium subsidy in order to purchase the insurance. To be affordable, employee’s share of premium costs must not exceed 9.5% of employee’s household income. Household income includes income of employee, employee’s spouse, and all household dependents. Affordability test also subject to complex safe harbor rules that require, in some instances, an employer to obtain the opinion of an actuary. “Experts” claim that to meet affordability test, an employer should offer at least one coverage option for a single employee that costs $90 or less per month. Insurance plan must pay at least 60% of allowable costs to meet test of “Minimum Value” and provide certain minimum coverages, including abortions. The free-rider penalty applies only to businesses that have more than fifty (50) full-time employees or full-time equivalents. An employee is eligible for a premium subsidy if s/he meets both of these conditions: (1) the employee’s total household income must be less than 400% of the federal poverty level. This poverty level varies with family size. For a family of four, 400% of the current federal poverty level equals $88,200. Household income includes the income of the employee, the employee’s spouse, and all other dependent members of the household; and (2) the employee’s portion of the insurance premiums on the employer’s plan must exceed 9.5% of the employee’s household income. The amount of the employer’s free-rider penalty varies depending upon whether the business does or does not provide health insurance. If the business does not provide health insurance, the annual penalty that the employer must pay equals $2,000 x the total number of the employees in the firm minus 30. For example, if the business does not provide health insurance, and employs 200 people, the annual free-rider penalty owed by the employer is $340,000 = ((200-30) x $2000). If the business does provide health insurance, but the insurance is either not “affordable” or does not provide “minimum value”, its annual free-rider penalty equals the lesser of (1) the number of subsidized employees x $3,000, or (2) the number of employees in the firm minus 30 x $2000. In addition to the free-rider penalties that may be owed by an employer, beginning in 2018, an employer may also owe additional penalties if it provides a “Cadillac” plan. A Cadillac plan is defined as a health insurance plan where the annual cost for single coverage exceeds $10,200 or where the annual cost for family coverage exceeds $27,500. Beginning in 2018, the law will begin imposing an excise tax on Cadillac plans in the amount of 40% of the costs that exceed the thresholds. Example: In 2018, employer has 200 full-time employees on family plan and premium cost for family plan is $35,000. Employer’s “Cadillac” tax would be $600,000 per year. $35,000 - $27,500 = $7,500 x .40 = $3,000 x 200 = $600,000 1. 2. Know your workforce Restructure jobs – Be aware of potential issues under ERISA – Section 510 of ERISA makes it unlawful for an employer to discriminate against a participant by interfering with the attainment of any right under an employee benefit plan. Under ERISA, the term participant means “any employee . . . who is or may become eligible to receive a benefit of any type from an employee benefit plan which covers employees of such employer. . .” Under case law, reclassification of a worker to deprive him of benefits under an employee benefit plan is a violation of ERISA. Isbell v. Allstate Ins. Co., 418 F.3d 788 (7th Cir. 2005) Additional case law holds that changes in an employee’s employment status that emanate from benefit-based motivations violate ERISA. Penalties for ERISA violations can include make whole remedies, injunctive relief, and cease and desist orders, plus payment of the employee’s legal fees and costs. 3. Pay closer attention to summer hires, project workers, and temps. 4. Adopt a 90-day waiting period for coverage 5. Adopt the maximum allowed initial measurement and stability periods 6. Review coverages to make certain yours are affordable and provide minimum value. Do what the labor unions are now doing HOPE