Balance of Payment and exchange rate overshooting

advertisement

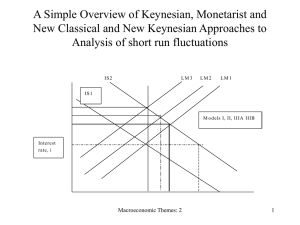

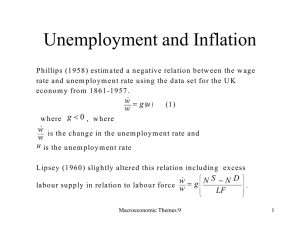

Balance of Payment and Exchange Rate Overshooting T hre approaches to the balance of pay m ent K ey nesian or A bsorption (U K E xperience 1970-90) M onetary approach (G erm an and Japanese E xperience) E lasticity (M arshall- L erner-R obinson conditions) Internal and E xternal B alance and T inbergenian A ssignm ent P roblem E xchanger R ate O vershooting B alance O f P ay m ent: P x X P M KA 0 M Macroeconomic Themes:10 1 Open Economy Model: Equilibrium in Six Different Markets B alance o f P aym e nt a nalysis: G rap hical ap p ro ach L ab o ur M arket LD LS G oo d s and M o ne y M o ney m arket IS AS LM MD MS W age i D o m estic b o nd s BS BD i F o reign B o nd s i* F oreign E xc ha nge i Interest rt L Y M /P DB FB exchan ge rate O utp u t Y E m p lo ym e nt O utp ut P P rice R eal m o ne y b alance Macroeconomic Themes:10 P ortfo lio allo catio n e 2 Internal and External Balance Under the Fixed Exchange Rate Regime analysis o f internal and e xternal stab ility u sin g IS -L M and in ternatio nal fina ncial inte gratio n line ca n b e A nalysis o f Internal and E x ternal S tab ility Interest R ate i i * BOP + U ne m p l. K inflo w C o nverge nce p ro cess to m acro eq uilib riu m BOP+ Inflatio n/B o o m K -in flo w ESM EDG BOP+ ESM ESG BOP+ B O P = X -M = 0 BOPU ne m p lo ym en t K -o utflo w BOPB oo m K -O utflo w ESG EDM BOP+ BOP=0 ESM EDG BOP- EDM EDG BOP- EDM ESG BOP- YF N o tes: Y F full e m p lo ym e nt o utp ut, B O P = B alance o f P aym ent, K = cap ital, E S G = E xcess su p p ly o f go o d s, E D G = E xcess d e m and fo r go o d s, E S M = exce ss sup p ly o f m o ne y, E D M = e xcess d e m a nd fo r m o ne y co nd ucted usin g this d iagra m . Macroeconomic Themes:10 3 Policy Spill-over Effects in Interdependent Economies A nsw er: U se a tw o country M und ell-F lem in g M odel E xp ansio nary fiscal p o licy in co u ntry 1 Im p act in co u ntry 2 i2 = i2 * i1 = i1 * BOP LM 2’ LM 2 LM 1 LM 2 IS 2 IS 2 ’ IS 1 ’ O y0 y1 IS 1 y2 o y0 y2 y1 Y In fix ed ex change rate w ith perfect capital m obility: g Macroeconomic Themes:10 0 ; Y * g 0 R ; g 0 R * ; g 0 4 BOP: Keynesian Approach C a p ita l a c c o u n t E x p o rts , im p o rts a n d tra d e b a la n c e to In c o m e KA+ Im p o rts CA e x p o rts tra d e b a la n c e In te re s t ra te In c o m e KA- In te re s t R a te in te re s t ra te In te re s t ra te Macroeconomic Themes:10 E x te rn a l b a la n c e In c o m e 5 Monetary Approach to BOP M oney dem and M oney supply M d pf Y , r M s RD G row th rate of reserves: g r y g y g 0 1 d G row th of incom e raises reserves and favourable to B O P H as just opposite result than the K ey nesian M odel. Macroeconomic Themes:10 6 BOP: Elasticity Approach T rade b alance: P x X P M M KA 0 C o untry 1 C o untry 2 PD PM A B C S E I J K O E E xp o rt F O G H H o m e Im p o rt P* L M P* PP* N O P R V W Q S F oreign im p o rt O T Macroeconomic Themes:10 U F oreing E xo p o rt 7 BOP: Elasticity Approach (Marshall-Lerner Condition) N et ex port function NX X eM * NX X Y , e eM Y , e F or sim plicity assum e that NX X eM . T hen three are three sources of ch an ges in the net ex ports: 1. E x ports 2. Im po rts and 3. E x chan ge rate NX X M e e M NX X e M M e D ivide each term b y X , X X X X e 1 M 1 X eM NX 0 N o w using the fact that w he n the trad e is b ala nced ( ); and . X M X e NX X M e NX X e M e 0 1 => X X M e X X e M e Macroeconomic Themes:10 8 Exchange Rate Overshooting G o o d s and M o ne y m arket eq uilib riu m a nd the e xc han ge rate E xchan ge R a te O versho o tin g G o od s m arket G oo d s m arket eq . P rice P rice L e vel c 0 a e e 1 b p p m o ne y m arket eq . E xchange R ate Macroeconomic Themes:10 E xchan ge R a te 9 Internal and External Balance and Tibergenian TargetInstrument Assignment Problem Fiscal and Monetary Policies for Stability B ud get S urp lu s B ud get surp lus E xcess d em a nd B oom Inflatio n E xcess sup p ly R ecessio n B O P surp lus BOP deficit Internal b alance E xternal b alance Interest rate Interest rate B ud get S urp lu s D eflatio n a nd B O P surp lus F iscal P o lic y Inflatio n and B O P d eficit EB Interest rate m o netary p o lic y Macroeconomic Themes:10 IB 10 Assignment Problem in the Mundel-Fleming Model A ssuring Internal and ex ternal stability usin g the fiscal and m onetary policies U nd er im p erfect C ap ital M o b ility S cenario LM 2 LM 1 Interest rate b a BOP IS 2 IS 1 Y* Inco m e O riginally the internal equilibrium is at point a w here both goods and m one y m arket are in equilibrium but the ex ternal account is im balance b y am ount ab. M one y supply is reduced to raise the interest by shifting L M 1 to L M 2. H ow ever, this policy action w ill create an intern al im balance and unem plo ym ent w ill result because econom y is operating und er full capacity at point c. A ccom m odatin g fiscal polic y can shift IS 1 to IS 2 at point b w here both internal and ex ternal account are balan ces and stability is achiev ed. H ow does this curve look like und er a p erfect capital m obility condition? Macroeconomic Themes:10 11 Exchange Rate in the Long Run P u rch asin g p o w er p arity : p EP * M o n ey d e m an d at h o m e M KY p M o n ey d e m an d ab ro ad : M * K *Y * p* * * E M K Y KY M* E p P* L o n g ru n ex ch an g e rate e m m * k * k y * y Macroeconomic Themes:10 12 J-curve hy pothesis: d ev alu ation o f a cu rren cy d eterio rates th e trade b alan ce con d ition in th e sho rt run b ecau se im p o rts can n o t d ecrease an d expo rt cann o t in crease im m ed iately. H ow ev er ov er tim e ad ju stm en ts w ill tak e p lace so th at expo rts in crease and im p o rts can d ecrease Im p act o f d ev alu atio n o n n et expo rts N et E x po rts T im e Macroeconomic Themes:10 13 A Small open economy model of trade P referen ce (C D orC E S ): U U ( D , M ) expenditure : PY P D P M D M T ran sform ation fu n ction (C E T ) : T T (E , D ) (1) T otal (2) (3) PY P D P E (4) D E D = dom estically produced and consum ed good M = im ports E = exports F rom optim izing behaviour on the dem and side, T otal Incom e : U P T P D D E E R eal exch an ge rate: Macroeconomic ; Themes:10 U P (1 t ) T D PD M M 14 Economy wide Income and Trade Balance in a Small Open Economy E conom y w ide incom e, I, trade balance and m arket clearing conditions: D om estic sales exports and T ariff: IP DP ER (6) D E T rad e B alan ce con d ition : P M P EB (7) M E D em an d an d su p p ly of d om estic good s: DD DS (8) P P M and E w orld prices of im ports and exports. D om estic econom y is too sm all to change the w orld price. Macroeconomic Themes:10 15 Global Trade model P roduction : INT j ,i , r Y min i,r ai , j , r 1 r , K r L i,r i,r (1) D om estic S upply and exports: 1 i,r i , r i , r Y YD (1 ) X i,r i,r i,r i,r i,r (2) 1 i,r i , r i , r A YD (1 ) M i,r i,r i,r i,r i,r A rm ington: T ran sp ortation : T H ou seh old In com e: R even u e: (8) (3) P referen ces: P u b lic sector: i,r ,s i,r ,s M i,r ,s Ur C i,r i,r (4) (5) I r wr L rr K RV r i,r i,r r i Gr GD i ,r i ,r (6) (7) G r rr K r w w r L r P Y P INT i,r i,r i,r j ,i , r N ,r i,r k Macroeconomic Themes:10 16 Equilibrium in the Global Trade Model G oods M arket: Y i,r INT a C i, j ,r r , j , i r , i r rr , j C apital M arket K r K r , ri r i,r L abour M arket: LS r LS i,r i (9) (10) (11) E quilibrium in the global trade m odel: A co m p etitive eq uilib riu m in th is glo b al eco no m y is suc h that, given the p rices o f co m m o d ities and facto rs, d e m a nd s fo r go o d and sup p ly o f go o d s are eq ual at the reg io nal as w ell as the glo b al level; facto r m arke t clears fo r each reg io n and at the w o rld le vel; co n sum e rs o f eac h regio n m a xim ise their utility sub ject to their inco m e co nstraints; a nd the go vern m e nt b ud get and trad e are b alanced fo r each regio n. Macroeconomic Themes:10 17 Dornbusch (1976) Model of Exchange Rate Overshooting r r* x In terest rate p arity co n d itio n : (1 ) A d ju stm en t o f th e in terest to th e d ev iatio n o f th e ex ch an g e rate: x e e (2 ) m p r y M o n ey d e m an d : (3 ) B y su b stitu tin g (1 ) an d (2 ) in (3 ) m p r * e e y p m r * e e y (4 ) In th e lo n g ru n , * e e 0 p m r y U sin g th is in (4 ) p m p m e e e e 1 p p e e 1 (5 ) p p (6 ) T h u s th e cu rren t ex ch an g e rate d ep en d s o n th e lo n g ru n ex ch an g e rate p lu s th e d ev iatio n o f cu rren t p rice fro m its tren d . Macroeconomic Themes:10 18 N ow suppose the aggregate dem and fun ction of the econom y is given b y an IS curv e in the open econom y m odel ln D u e p 1 y r (7) In crease in the price is proportional to the ex cess dem and p ln D u e p 1 y r Y In run (8) the lon g p 0 . u e p 1 y r 0 e p 1 y r u e p 1 1 y u (9) S im plify (8 ) using (9) p ln D u e p 1 y r Y p u p p 1 1 y r * u 1 y r p u p p r r * Macroeconomic Themes:10 19 U sing the relation from (2) and (3) r r * e e and ee 1 p p p p p e e p p p p p p p v p p w here v T he tim e path of the price level thus is (6) p p p t p p p exp vt . 0 e e 1 p p ee 1 F rom the tim e path e t e e e exp vt 0 of the p p exp(-vt) exchange Macroeconomic Themes:10 rate is 20 References K . A .C hrystal a nd S im o n P rice (1 9 94 ) C o ntro versies in M acro eco no m ics, H arve ster W heatshea f, chap ter 6 . D o rnb usc h R ud iger (1 9 7 6 ) E xp ectatio ns and E xc han ge R ate, Jo urnal o f P o litical E co no m y, v o l. 8 4 , no .6 , p p . 11 6 1 -1 17 6 . F le m in g J. M arcus (1 9 6 2 ) D o m e stic fina ncial p o licies u nd er fixed a nd und er flo atin g excha n ge rates, IM F sta ff p ap er 9 , N o vem b er , 3 6 9 -3 7 9 . K rug m a n P aul (1 9 7 9 ) A M o d el o f B alance o f P a ym e nt C risis, Jo urna l o f M o ne y C red it and B an king, 1 1 , A u g. K rug m a n P . and L . T aylo r (1 9 7 8) “C o ntractio n ary E ffects o f D e valuatio n” Jo urnal o f Intern atio nal E co no m ics, 4 4 5 -5 6 . M iller, M arcus; S alm o n, M ark W he n D o es C o o rd inatio n P a y? Jo urnal o f E co no m ic D yn a m ics a nd C o ntro l, July-O ct. 1 9 9 0 , v. 1 4 , iss. 3 -4 , p p . 55 3 -6 9 M und ell R . A (1 9 6 2 ) C ap ital m o b ility a nd stab ilisatio n p o licy und er fixed and fle xib le exch an ge rates, C anad ia n Jo urnal o f E co no m ic and P o litical S cie nce, 2 9 , 4 75 -8 5 . S eb astian E (1 9 8 6 ) A re D evalua tio ns C o ntractio nary? R eview o f E co no m ics a nd S tatistics, vo l. 6 8 , 3 , 5 01 508. G .K .S ha w , M . J. M cC ro stie and D . G reena w a y (2 0 0 1 ) M acroeco no m ic s: T heo ry a nd P o licy in the U K , B lack w ell. T aylo r M ark (1 9 9 5 ) T he E co no m ics o f E xcha n ge R ate s, Jo urnal o f E co no m ic L iterature, M arch, vo l 3 3 , N o . 1 , pp . 13 -4 7 . Macroeconomic Themes:10 21