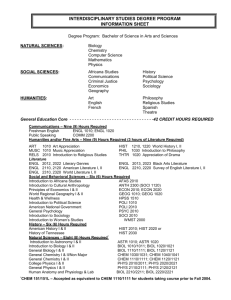

CHAPTER

8

Cost-Benefit Analysis

McGraw-Hill/Irwin

Copyright © 2010 by the McGraw-Hill Companies, Inc. All rights reserved.

Projecting Present Dollars into the Future

R0 = $1000

R1 = $1000*(1+.01) = $1010

R2 = $1010*(1+.01) = $1020.10

R2 = $1000*(1+.01)2 = $1020.10

RT = R0*(1+r)T

8-2

Projecting Future Dollars into the Present

R0 = $1000

R1 = $1000*(1+.01) = $1010

R2 = $1010*(1+.01) = $1020.10

R2 = $1000*(1+.01)2 = $1020.10

RT = R0*(1+r)T

Present Value R0 = RT/(1+r)T

discount factor

discount rate

8-3

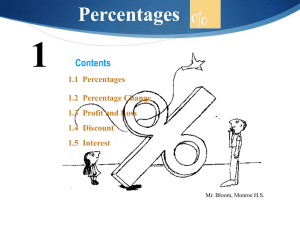

Present Value of a Stream of Money

R1

R2

RT

PV R0

...

2

T

(1 r ) (1 r )

(1 r )

8-4

Inflation

(1 ) R1

(1 ) 2 R2

(1 ) T RT

PV R0

...

2

2

(1 )(1 r ) (1 ) (1 r )

(1 ) T (1 r ) T

8-5

Private Sector Project Evaluation

B2 C2 B3 C3

BT CT

PV B1 C1

...

2

T

1 r

(1 r )

(1 r )

Annual Net Return

PV

Admissible

Year

R&D

Advertising

R=

R&D

Advertising

0

$1,000

-$1,000

0

$150

$200

Preferable

Present Value Criteria

1

600

0

0.01

128

165

2

0

0

0.03

86

98

3

550

1,200

0.05

46

37

0.07

10

-21

8-6

Internal Rate of Return

B2 C2 B3 C3

BT CT

PV B1 C1

...

0

2

T

1

(1 )

(1 )

Project

Year 0

Year 1

ρ

Profit

PV

X

-$100

$110

10%

$4

3.77

Y

-$1,000

$1,080

8%

$20

18.87

8-7

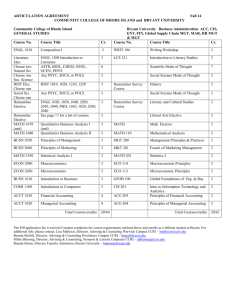

Benefit-Cost Ratio

B1

B2

BT

B B0

...

2

T

1 r (1 r )

(1 r )

C1

C2

CT

C C0

...

2

T

1 r (1 r )

(1 r )

Benefit-cost ratio = B/C

8-8

Problems with the Benefit-Cost

Ratio

Method

B

C

B/C

I

$250

$100

2.5

II

$200

$100

2.0

I: Subtract

$40 mistake

from B

I: Add $40

mistake to C

$210

$100

2.1

$250

$140

1.79

8-9

Discount Rate for Government

Projects

• Returns in Private Sector

• Social Discount Rate

– Paternalism

– Market Inefficiency

• Discounting and the Economics of Climate

Change

• Government Discounting in Practice

8-10

• Market Prices

• Adjusted Market Prices

– Shadow price

• Monopoly

• Taxes

• Unemployment

• Consumer Surplus

Price per pound

of avocados

Valuing Public Benefits and Costs

$2.89

$1.35

e

b

d

Sa

c

g

Sa’

Da

A0

A1 Pounds of

avocados per year

8-11

Inferences from Economic

Behavior

• The Value of Time

• The Value of Life

– Lost earnings

– Probability of death

8-12

Valuing Intangibles

• Subverting cost-benefit exercises

• Reveal limits on intangibles

• Cost-effectiveness analysis

8-13

Games Cost-Benefit Analysts Play

• The Chain-Reaction Game

• The Labor Game

• The Double-Counting Game

8-14

Distributional Considerations

• Hicks-Kaldor Criterion – a project should be

undertaken if it has positive net present value,

regardless of distributional consequences

• Government costlessly corrects any

undesirable distributional aspects

• Weighted benefits

8-15

Uncertainty

Project

Benefit

Probability

EV

X

$1,000

1.00

$1,000

0

0.50

Y

$2,000

0.50

$1,000

Certainty Equivalent

8-16

Are Reductions in Class Size

Worth It?

•

•

•

•

Discount rate

Costs

Benefits

The Bottom Line and Evaluation

8-17

Use (and Nonuse) by Government

• Using Cost-Benefit Analysis

• Not Using Cost-Benefit Analysis

– Clean Air Act

– Endangered Species Act

– Food, Drug, and Cosmetic Act

8-18

Utility

Calculating the Certainty Equivalent Value

U

U(E + y)

U*

U(E)

Certainty Equivalent

Expected income

E

C

I*

E+y

Income per year

8-19