chapter2 negotiable instrument

advertisement

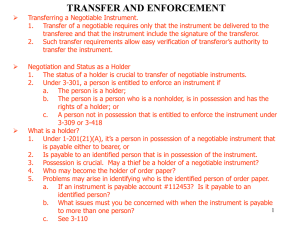

International Settlement L/O/G/O Chapter One Introduction Concept Category Evolution Players and theirs roles Factors in payment decisions Characteristics and developing trend Correspondent banking relationship Chapter two Negotiable instruments • General introduction • Bill of Exchange/Draft • Promissory Note • Check General introduction • Definition of a negotiable instrument? • Circulation forms • Characteristics & Functions of negotiable instruments • Parties to a negotiable instrument • Title to a negotiable instrument • Negotiable instrument laws Definition of negotiable instruments • in a broad sense, a negotiable instrument refers to any commercial title ownership. • in a narrow sense, a negotiable instrument is a written document that contains an unconditional promise by the drawer to pay the payee or an unconditional order by the drawer to the drawee to pay the payee a fixed amount of money at a definite time Circulation forms 转让形式 • Assignment (过户转让) 非流通 特点:书面形式 转让通知原债务人或登记过户 受让人权利受前手缺陷的影响 当事人:转让人、受让人、原始债务人 例如:股票、债券 • Transfer (交付转让) 准流通或半流通 特点:交付背书转让 不通知原债务人 受让人的权利受前手权利缺陷的影响 当事人:转让人,受让人 例如:提单、仓单、栈单 • Negotiation (流通转让) 完全流通 特点:正当受让人权利优于前手,不受其缺陷的影响 例如:汇票、本票、支票 举例说明:A欠B100元而出具以乙为债权人的字据给 B,让其凭字据找C去取,同时B原来曾欠C30元未还, 随后B将此字据又转让给D。问D能否从C处获得全额 款项? 如是字据,按民法原则,C可采取将其对B的30元债 权转让给D的办法来冲抵而只需付70 如是票据,按票据法原则,必须全额付款,而不能用 B的权利缺陷来对抗D的正当票据权利 Characteristics of negotiable instruments • • • • • Non-causative Nature(无因性) Negotiability(流通转让性) Requisite in Form(要式性) Presenting for payment (提示性) Returnability (返还性) Functions of negotiable instrument • 支付工具payment instrument • 流通工具transferable instrument • 信用工具credit instrument • 融资工具financing instrument Parties to a negotiable instrument • 出票人drawer • 付款人payer/drawee • 收款人payee • 背书人endorser • 承兑人acceptor • 持票人holder Parties to a negotiable instrument • Drawer: the person who draws a bill of exchange or a check upon the drawee for the payment of a certain amount of money. Question1: Status? Debtor or creditor? Answer: Main debtor before acceptance while the secondary debtor after acceptance Question2 : He will be responsible to? Answer: Holder or any endorsers. Parties to a negotiable instrument • Drawee: the person upon whom a bill of exchange or a check is drawn. He is also known as the addressee of a draft. Question: Is the drawee the main debtor? Answer: No, cause he didn’t sign in the bill. He doesn’t take the liability that the bill will must be honoured. Parties to a negotiable instrument • Payee: the person to whose order the drawee is to make payment or to whom the money is to be paid. Question: What’s his status? Debtor or creditor? Answer: Creditor and the first holder as well. He has the right to collect money by presenting the bill or to transfer it to another party. Parties to a negotiable instrument • Endorser: When a payee or a holder signs his name on the back of an instrument for the purpose of transferring it to another person, he is called an endorser. He is liable to his subsequent endorser, his endorsee or any subsequent holder of the instrument. Question: What’s his status? Debtor or creditor? Answer: Debtor cause he is liable to his subsequent endorser i.e the endorsee. Parties to a negotiable instrument • Endorsee: An endorsee is the person to whom an instrument is endorsed. He is the holder of an instrument, which has been transferred by the endorser. Parties to a negotiable instrument • Holder: A holder is the possessor of an instrument, namely the payee, the endorsee or bearer. He may sue, if needed, on the instrument in his own name. Parties to a negotiable instrument • Holder for value : the person who possesses an instrument for which value has been given by himself or by some other persons. • Holder in due course : the person who is in possession of an instrument that is ①complete and regular on its face, ②taken before maturity without notice of its previous dishonor, ③taken in good faith and for value and ④taken without notice of any infirmity in the instrument of defect in the title of the person negotiating it. He is also called a bona fide holder, who may claim payment from all parties liable on the instrument. Parties to a negotiable instrument • Guarantor: the person who guarantees the acceptance and payment of a bill of exchange, though he is not a party liable thereto. The obligations of the guarantor are the same as those of the guranteed. • Acceptorfor honor: the person who himself is not a party liable on a bill of exchange but with the consent of the holder may intervene and accept the bill supra prostest. A B Drew a draft on B C Accepted the draft Endorsed and lost it D Picked it up and transferred it to E for value F E Gave it as a present Acts of negotiable instrument • To issue: Two acts A. to draw and sign a draft B. to deliver it to the payee. Usually after issuance, the drawer becomes the main debtor of an instrument and the last one to be claimed against when the instrument is dishonored. Acts of negotiable instrument • Endorsement It is an act of negotiation. Prerequisites (先决 条件)for a valid endorsement. l Should be normally effected on the back of a draft and signed by the endorser; Must be made for the whole amount of the draft. Acts of negotiable instrument • Four kinds of endorsement 1.Blank endorsement: shows an endorser’s signature only and specifies no endorsee. It is also called a general endorsement. For A Co., London Signature Acts of negotiable instrument • Four kinds of endorsement 2.Special to Nov. Exchange forendorsement: GBP 500.00 specifies an endorsee London, 10 whom or to whose order the draft is to be paid, in addition an endorser. At sight paytotothe thesignature order of CofCo., the sum of Pounds five hundred only Pay to the order of B Co., London For A Co., London To Signature B Bank, London For A Company, London Signature Acts of negotiable instrument • Four kinds of endorsement 3.Restrictive endorsement it is restrictive when it prohibits further transfer of the draft. eg. Pay to A Bank only Pay to A Bank for account of B Co., Pay to A Bank not negotiable Pay to A Bank not to order Acts of negotiable instrument • Four kinds of endorsement 4.Conditional endorsement:a special endorsement adding some words thereto that create a condition bound to be met before the special endorsee is entitled to receive payment. The endorser is liable only if the condition is fulfilled. • eg. Pay to the order of B Co. On delivery of B/L No. 123 For A Co., London Signature • 开出的汇票必须是无条件的支付命令,作成背书却是可 以带有条件的,附带条件仅对背书人和被背书人有约束作 用,与付款人、出票人无关。 Acts of negotiable instrument • Presentment A draft must be duly presented for payment if it is a sight bill or duly presented for acceptance first and then presented for payment at maturity if it is a time bill. Acceptance is a signification by the drawee of his assent to the order given by the drawer. He engages, by signing his name across the face of the bill that he will pay when it falls due. Acts of negotiable instrument • Acceptance So presentment for acceptance is legally necessary to fix the maturity date of a draft payable after sight. Valid acceptance requires 2 conditions: ① the word “accepted” must be written on the bill to be followed by the signature of the acceptor and the date of acceptance. A mere signature of the acceptor without additional words is also justified. ② It ought not be expressed that the drawee will carry out his promise by any other means than the payment of money. Types of acceptance Z General acceptance without any restrictions while confirming acceptance Z Qualified acceptance Acts of negotiable instrument • Partial Acceptance for example, supposing the amount is GBP 1000.00 ACCEPTED 3 June, 2004 Payable for amount of GBP 800.00 only For ABC Bank Ltd., London Signature • Local Acceptance ACCEPTED 5 June, 2004 Payable at The Hambros Bank and there only For ABC Bank Ltd., London Signature Acts of negotiable instrument • Qualified Acceptance as to time for example, supposing the tenor is 3 months after date (of issue) ACCEPTED 5 June, 2004 Payable at 6 months after date For ABC Bank Ltd,, London Signature • Conditional acceptance ACCEPTED 1 June, 2004 Payable on delivery of Bills of Lading For ABC Bank Ltd., London Signature Acts of negotiable instrument • Payment: Act of payment is performed when a draft is paid. A bill is discharged by payment in due course only when such payment is made by or on behalf of the drawee or the acceptor. Acts of negotiable instrument • Dishonor: Act of dishonor is a failure or refusal to make acceptance on or payment of a draft when presented l Dishonor by non-acceptance l Dishonor by non-payment Payment is impossible because of the payer’s bankruptcy, death or his evading. Acts of negotiable instrument • Notice of dishonor: A notice on which default(不履约/违约) of acceptance or of payment by the drawee or the acceptor is advised, to be given by holder of a draft to the drawer and all the endorsers whom he seeks to hold liable for payment. A notice of dishonor must be given by or on behalf of the holder or an endorsee on the next working day after the dishonor of the draft. Acts of negotiable instrument • Right of recourse : In the event of a draft being dishonored, the holder has a right of recourse against the other parties thereto, that is, a right to claim compensation from the drawer or any endorser. Recourse: The right to claim a refund from another party . Acts of negotiable instrument • Guarantee : Act of guarantee is performed by a third party called guarantor, who engages that the bill will be paid on presentation if it is a sight bill or accepted on presentation and paid at maturity if it is a time bill. Titles to a negotiable instrument • Claim for payment(第一次请求权,主权利) • Recourse (第二次请求权) • Only when the claim of holder for payment can’t be satisfied, can recourse right be effected. Negotiable instrument laws • British law UK Bills of Exchange Act of 1882 US Uniform Commercial Code of 1962, Article 3 • French and German law • Uniform law for Bills of Exchange and Promissory Notes of Geneva of 1930 • Convention Providing a Uniform Law for International Bills of Exchange and International Promissory Notes and Convention Providing a Uniform law for International Checks United Nations 1988 • Negotiable Instrument Law of People’s Republic of China Bill of exchange • Concept • Essential items required in a bill of exchange • Acts relating to a bill of exchange • Classification of bills of exchange • Practice of bills of exchange definition • section 3, bill of exchange act, 1882,UK A Bill of exchange is an unconditional order in writing, addressed by one person to another, signed by the person giving it, requiring the person to whom it is addressed to pay on demand or at a fixed or determinable future time a sum certain in money to or the order of a specified person or to bearer. 汇票是由一个人(drawer) 向另一个人签发的(drawee)/受票人 无条件的unconditional 书面命令order in writing 要求其在见票时或在未来某一规定的或可以确定的 时间(tenor) 将一定金额的款项支付给某一特定的人或指定的人 ,或持票人(payee) Essential items required in a draft • Absolutely necessary items • Relatively necessary items • Items at will Main Parties involved l Drawer l Drawee l Payee Acts relating to a bill of exchange • • • • • • • • • 出票(Issue) 背书(Endorsement) 提示(Presentation) 承兑(Acceptance) 保证(Guarantee or Aval) 付款(Payment) 拒付(Dishonor) 追索(Recourse) 参加承兑和参加付款 (Acceptance/Payment for honor) Classification of bills of exchange • According to the drawer: Banker’s draft and trader’s draft • According to the acceptor: Banker’s acceptance and trader’s acceptance • According to the tenor Demand draft/sight draft and time/usance draft • According to whether commercial documents are attached thereto Clean draft and documentary draft Practice of bills of exchange • Discounting of a bill of exchange • Accommodation bill融通汇票 Discounting of bills of exchange • Discounting is to sell a time bill already accepted by the drawee but not yet fallen due to a financial institution at a price less than its face value. • Calculating formula: D=Vхtхd/360 N= V- D D:discount interest V:face value t:tenor rate(n% p.a.) • d:discounting N:net proceeds Creditworthiness: Standing of the drawer and the accepter Drawn clause showing the reason for issuing the draft Accommodation bill 被融通人开出融通汇票,没有付给对价,要 求融通人(高资信的非债务人)承兑汇票(提高 汇票的信用身价以便贴现),再交给贴现人予以 贴现,获得票款;等到汇票到期日前,被融通人 应把足额票款交给承兑人,此时贴现人向承兑人 提示要求付款,承兑人使用被融通人交来资金付 款 给 贴 现 人 , 结 清 这 笔 融 资 业 务 。 图示 伦敦出口公司向墨尔本一家公司出口货款为6600英镑,由出 口商开出远期汇票,出票后60天付款。伦巴第银行为伦敦某承兑 公司。 Exercises • 1.The issue of a draft A draft for USD 100,000.00 is drawn by The American Exporter Co.,Ltd, Tampa, Florida, U.S.A on the French Issuing Bank, Paris, France payable at 60 days after sight to the order of ourselves dated 15 May., 2006 marked “Drawn under The French Issuing Bank,Paris, France L/C No.12345 dated 25 Feb., 2006.” • 2.A draft indicates that “at 10 days from 11 may, 2006 pay to the order of A company…”, the maturity of the draft falls on ______ • 3.A draft is partly shown as follows: exchange for GBP12,500.00 New York, 23 May 2006 at 60 days after B/L date 23/ May/2006 pay to the order of ourselves the sum of US dollars one thousand only. Suppose the accepted draft was discounted on 23 may, 2006 by the collecting bank, Bank of Asia, London at the rate of 9% per annum. Please calculate discount amount and net proceeds. 1. Exchange forUSD100,000.00 Tempa, 15 May,2006 At 60 days after sight pay to the order of Ourselves the sum of US dollars one hundred thousand only. “Drawn under The French Issuing Bank, Paris, France L/C No.12345 dated 25 Feb., 2006” To The French Issuing Bank. For The American Exporter Co., Paris Ltd , Tempa signature 2. When ISBP does not put into force, the maturity falls on 20 May,2006 when ISBP puts into force, the maturity falls on 21May,2006 3. Discount amount:12500*60/365 *9/100=184.93 Net Proceeds=12500-184.93 Promissory note • What is a promissory note • Essential items of a promissory note • The difference between a bill and a note • Types of notes Meaning of Promissory note • 本票是出票人签发的,承诺自己在见票时无条件支付确定的金额 给收款人或持票人的票据。 • UK Bills of Exchange Act of 1882, Article 83 A promissory note is an unconditional promise in writing made by one person to another, signed by the maker, engaging to pay on demand or at a fixed or determinable future time a sum certain in money to or to the order of a specified person or to bearer. • Uniform Law for Bills of Exchange and Promissory notes of Geneva of 1930 Essential items of a promissory note • The word “promissory note” • An unconditional promise to pay • Name of the payee • Signature of the maker • Place and date of issue • Tenor • A sum certain in money • Place of payment difference between a bill and a note • An order to pay & a promise to pay • Basic parties involved:three-party instrument &two-party instrument • Forms :in a set& one copy • Acts involved: for a promissory note, never accepted • Main obligor: for a draft, the drawer is primarily liable for payment before acceptance, but after acceptance the acceptor becomes primarily liable for payment. for a promissory note, maker is always primarily liable for payment. • When dishonor, protest is needed for foreign bill but not for promissory note. Types • Trader’s notes • Banker’s notes • 国际小额本票(International Money Order) • 旅行支票(Traveller’s Cheque) • 中央银行本票(Central Banker's Notes) • Negotiable certificates of deposit • Various bonds Cheques • Concept and essential items • Difference between a bill and a cheque • Types Concept and essential items • 出票人签发的,委托办理支票存款业务的银行或其他金 融机构在见票时无条件支付确定金额给持票人或收款人的票 据。 A check is a bill of exchange drawn on a bank payable on demand; A check is an unconditional order in writing, signed by the person giving it, requiring the bank to whom it is addressed to pay on demand a sum certain in money to, or to the order of , a specified person or to bearer. Difference between a bill and a cheque • Check-payment instrument&bill-payment and credit instrument • Acts:certified and crossed • Limitations on the drawer and drawee: for a check, the drawee must be the bank with which the drawer opens a checking account • A check can be cancelled before payment while for a bill, the payment is irrevocable after acceptance • in a set& one copy Types • 划线支票(crossed check):a crossing is in effect an instruction by the drawer or holder to the paying bank to pay the fund to bank only instead of over the counter of the paying bank. 现金支票(open check) • 保付支票(certified check) Certified checks A check is certified by the drawee bank. Once a check is certified by the drawee bank, all other obligors on the check will be discharged of the liability of the payment. 保付&保证: 1) 保付只是支票的行为,保证是三种票据的共同行为 2) 保付只能由支票的付款人作出,保证人则可是除票据债务人以外 的任何人 3) 保付人成为绝对的债务人,出票人和背书人的责任便免除,保证 人和被保证人都是汇票的债务人 4) 全额保付 5) 支票保付人向持票人支付了支票金额,票据关系消灭,保证人支 付后,还可向被保证人和其前手追索 Absolutely necessary items(一) The word “exchange” An unconditional order to pay A fixed amount of money Name of the payee 1)限制性(Restricted Order) 不能流通转让,只有汇票上指 定的收款人才能接受票款 e.g.pay to ***only;not tranferrable 2)指示性(Demonstrative Order) 可经背书转让 pay to the order of ***/pay to *** (or order) 3)来人抬头(我国不允许)pay to bearer Absolutely necessary items(二) Date of issue to determine the expiry date and paying date; make sure whether the drawer has disposing capacity Name of drawee The signature of the drawer without the signature of the drawer or forged signature makesan instrument invalid. Relatively necessary items Place of issue Place of payment Tenor • 即期付款(pay on demand/at sight) • 远期付款:出票后定期certain days after date 见票后定期certain days after sight 定日付款fixed date 提单日后定日付款certain days after B/L Calculating the due date of a bill 严格按照汇票的文义推算,月为日历月,半15天,如遇节假日则 顺延 at 30 days after date; at 60 days from *** Items at will 利息、利率及汇率(interest ,interest and exchange rate) 提示期限(Limit of time for presentation) 出票依据(Drawn Clause) 免作退票通知或放弃拒绝证书(Notice of Dishonor Excused or Protest Waived) 付一不付二 预备付款人(Referee in case of need) Issue payee payer drawer Comprises : 1)to draw and sign a bill; 2)to deliver it to the payee According to the negotiable instrument law: • • The bill should be complete in form stipulated by the negotiable instrument law in the place of issue; By drawing a bill,the drawer engages that on due presentment the bill will be accepted and paid and that, if dishonored, he will compensate the holder。 Endorsement • The payee or holder signs on the back of the bill and delivers it to the endorsee Notes: A valid endorsement should be an endorsement of the entire bill; By endorsing an instrument,the endorser guarantee that on due presentment the bill shall be accepted and paid as specified. Types : 1) Special endorsement 记名背书/特别背书/正式背书/ 完全背书 Pay to the order of ABC Co., signed 2) Blank endorsement 空白背书 3) Restrictive endorsement 限制性背书 Pay to A only/not transferable/not negotiable/pay to A bank for account of B Co. 4) Endorsement for collection 委托取款背书(托收背书 ) 5) Endorsement for pledge质押背书 endorsee endorser C E date A First endorsement B Second endorsement C Third endorsement D Fourth endorsement Acceptance • The drawee sign on the face of bill, and deliver it to the person presenting for acceptance, by which the drawee shows his assent to the order of drawer • Forms : the word “accepted”;date;signature of the drawee • Types : general acceptance: without any qualification qualified acceptance: 1)a conditional acceptance(refuse to accept) e.g. accepted payable providing goods in order; accepted payable at some place(local acceptance);payable at a longer time after date 2)partial acceptance Guarantee • This act is usually performed by a third party called guarantor, who engages to pay on presentment for a sight bill and accept and pay at maturity for a time bill. Notes: 1)the guarantor stands for a debtor such as drawer, endorser,or acceptor and assumes his indebtedness to the holder 2)when the guarantor is compelled to pay, his right of recourse arises against the guaranteed and all the prior parties of the guaranteed. Recourse • In the event of a draft being dishonored, the holder in due course can sue every person who signed the draft prior to him. • Qualifications to exert and preserve the right of recourse: Completeness in form of the draft Presenting for acceptance and payment on the due time Notice of dishonor拒付通知 When dishonored by non-payment or non-acceptance, the holder must give notice to all the parties who remain liable that the draft has been dishonored to preserve their liabilities on the draft. Protest拒绝证书 A written statement certified by a notary public or other authorized person for the purpose of giving evidence that a bill has been presented for acceptance or for payment but dishonored. 图示 Protest 拒绝证书(Certificate of Protest):是在拒付地点证明拒付事实 的要式公证书。我国则是规定拒绝证明及其等效形式有: • 承兑人或付款人出具的拒绝承兑书、拒绝付款书及退票理 由书; • 承兑人、付款人或代理付款银行直接在汇票上记载提示日 期、拒绝事由及拒绝日期并盖章; • 承兑人或付款人死亡、逃匿的有关证明(如死亡证明、失 踪证明等); • 人民法院的有关司法文书(如破产裁定书);有关行政主 管部门的处罚决定。 Acceptance/payment for honor Acceptance for honor When a draft has been protested for non-acceptance, any person not being a party already liable on the draft may,with the consent of the holder, by writing on the bill, accept the bill for the honor of any party to the draft. Payment for honor When a draft has been protested for non-payment, a party not liable on the draft may intervene and pay it for the honor of a party liable on the draft or even the drawer. any person can act as a payer for honor without the consent of the holder. 案例分析 1997年8月,某市A公司与新加坡B商签订了一份进口胶合板的合同。合同 总金额为700万美元,支付方式为付款交单,允许分批装运。第一批价值为60万 美元的胶合板准时到货,质量良好,对双方合作很满意。就在第二批交货期来 临之际,B商向A公司提出:鉴于贵公司资金周转困难,为了帮助贵方,我方允 许贵公司采取远期付款。 贵公司作为买方,可以给我方开出一张见票后一年付 款700万美元的汇票,请中国人民建设银行某市分行承兑。承兑后,我方保证将 700万美元的胶合板在一年内交货。贵方全部收货后,再付给我方700万美元的 货款。A公司以为现在不付款,只开张远期票据就可得到货物在国内市场销售, 于是欣然接受了B商的建议,给B商签发了一张见票后一年付款700万美元的汇票。 但A公司始料不及的是,B商将这张承兑了的远期票据在新加坡的美国银行贴现 600万美元。从此却一张胶合板都不交给A公司。事实上,B商将这笔巨款骗到手 后便无影无踪了。 一年后,新加坡的美国银行持这张承兑了的远期票据请建行某市分行付款。 尽管B商没有交货,某市分行却不得以此为理由拒绝向善意持票人美国银行支付 票据金额。最后,由于本案金额巨大,报请国务院批准,由建行某市分行付给 美国银行600万美元而结案。 • 对于这张远期票据,A公司为出票人,B商为收款人,建行某市分 行为付款人。A公司与B商之间的胶合板买卖合同是该票据的原因 关系,使得A公司愿意向B商开立这张汇票。A公司曾经向建行某 市分行提供了资金,它们之间的这种资金关系使得建行某市分行 愿意向A公司提供信用,承兑了这张远期汇票。美国银行与B商之 间有对价关系,美国银行善意地付了600万美元的对价而受让, 从而成为这张汇票的善意持票人。但票据的最大特点就是,票据 法律关系一经形成,即与基础关系相分离。票据基础关系的存在 和有效与否并不对善意持票人的票据权利而产生影响。所以,B 商实际上没有交货,或者A公司并没有足够的美元存在建行,都 不影响美国银行对承兑人的付款请求权。对美国银行来说,这张 票据上并没有写胶合板,只有一句话:“见票后一年付700万美 元”。票据法律关系应依票据法的规定加以解决,票据基础关系 则应以民法规定加以解决。B商正是利用了票据的特性才行骗得 逞的。 举例:甲交给乙一张经付款银行承兑的期票,作为向乙 订货的预付款,乙在票据上背书后转让给丙以偿还原欠 丙的借款,丙于到期日向承兑银行提示取款,恰遇当地 法院公告该行于当天起进行破产清理,因而被退票。丙 随即向甲追索,甲以乙所交货物质次为由予以拒绝,并 称已于10天前通知银行止付,止付通知及止付理由也已 通知了乙。在此情况下丙再向乙追索。乙以票据系甲开 立为由推诿不理。丙遂向法院起诉,被告为甲、乙与银 行三方。你认为法院将如何判决? 甲、乙的拒付理由不成立,银行已破产清理,只需向甲、 乙追索即可。