CHAPTER 16

Managing Bond

Portfolios

Investments, 8th edition

Bodie, Kane and Marcus

Slides by Susan Hine

McGraw-Hill/Irwin

Copyright © 2009 by The McGraw-Hill Companies, Inc. All rights reserved.

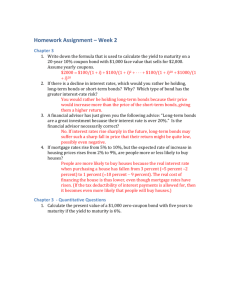

Bond Pricing Relationships

• Inverse relationship between price and yield

• An increase in a bond’s yield to maturity

results in a smaller price decline than the

gain associated with a decrease in yield

• Long-term bonds tend to be more price

sensitive than short-term bonds

16-2

Figure 16.1 Change in Bond Price as a

Function of Change in Yield to Maturity

16-3

Bond Pricing Relationships Continued

• As maturity increases, price sensitivity

increases at a decreasing rate

• Price sensitivity is inversely related to a

bond’s coupon rate

• Price sensitivity is inversely related to the

yield to maturity at which the bond is selling

16-4

Table 16.1 Prices of 8% Coupon Bond

(Coupons Paid Semiannually)

16-5

Table 16.2 Prices of Zero-Coupon Bond

(Semiannually Compounding)

16-6

Duration

• A measure of the effective maturity of a

bond

• The weighted average of the times until

each payment is received, with the

weights proportional to the present value

of the payment

• Duration is shorter than maturity for all

bonds except zero coupon bonds

• Duration is equal to maturity for zero

coupon bonds

16-7

Duration: Calculation

wt CF t (1 y )

t

Price

T

D t wt

t 1

CFt Cash Flow for period t

16-8

Spreadsheet 16.1 Calculating the

Duration of Two Bonds

16-9

Duration/Price Relationship

Price change is proportional to duration and not

to maturity

(1 y )

P

Dx

P

1

y

D* = modified duration

P

D * y

P

16-10

Rules for Duration

Rule 1 The duration of a zero-coupon bond

equals its time to maturity

Rule 2 Holding maturity constant, a bond’s

duration is higher when the coupon rate is

lower

Rule 3 Holding the coupon rate constant, a

bond’s duration generally increases with its

time to maturity

Rule 4 Holding other factors constant, the

duration of a coupon bond is higher when the

bond’s yield to maturity is lower

Rules 5 The duration of a level perpetuity is

equal to: (1+y) / y

16-11

Figure 16.2 Bond Duration versus

Bond Maturity

16-12

Table 16.3 Bond Durations (Yield to

Maturity = 8% APR; Semiannual

Coupons)

16-13

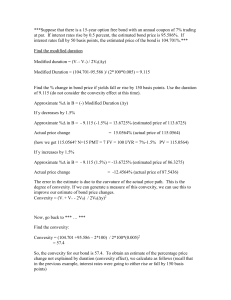

Convexity

• The relationship between bond prices and

yields is not linear

• Duration rule is a good approximation for only

small changes in bond yields

16-14

Figure 16.3 Bond Price Convexity: 30Year Maturity, 8% Coupon; Initial Yield to

Maturity = 8%

16-15

Correction for Convexity

1

Convexity

P (1 y ) 2

CFt

2

(1 y )t (t t )

t 1

n

Correction for Convexity:

P

D y 1 [Convexity (y ) 2 ]

2

P

16-16

Figure 16.4 Convexity of Two Bonds

16-17

Callable Bonds

• As rates fall, there is a ceiling on possible

prices

– The bond cannot be worth more than its

call price

• Negative convexity

• Use effective duration:

P / P

Effective Duration =

r

16-18

Figure 16.5 Price –Yield Curve for a

Callable Bond

16-19

Mortgage-Backed Securities

• Among the most successful examples of

financial engineering

• Subject to negative convexity

• Often sell for more than their principal

balance

– Homeowners do not refinance their loans

as soon as interest rates drop

16-20

Figure 16.6 Price -Yield Curve for a

Mortgage-Backed Security

16-21

Mortgage-Backed Securities Continued

• They have given rise to many derivatives

including the CMO (collateralized mortgage

obligation)

– Use of tranches

16-22

Figure 16.7 Panel A: Cash Flows to Whole

Mortgage Pool; Panels B–D Cash Flows to

Three Tranches

16-23

Passive Management

• Bond-Index Funds

• Immunization of interest rate risk:

– Net worth immunization

Duration of assets = Duration of liabilities

– Target date immunization

Holding Period matches Duration

16-24

Figure 16.8 Stratification of Bonds into

Cells

16-25

Table 16.4 Terminal value of a Bond Portfolio

After 5 Years (All Proceeds Reinvested)

16-26

Figure 16.9 Growth of Invested Funds

16-27

Figure 16.10 Immunization

16-28

Table 16.5 Market Value Balance Sheet

16-29

Cash Flow Matching and Dedication

• Automatically immunize the portfolio from

interest rate movement

– Cash flow and obligation exactly offset each

other

• i.e. Zero-coupon bond

• Not widely used because of constraints

associated with bond choices

• Sometimes it simply is not possible to do

16-30

Active Management: Swapping

Strategies

•

•

•

•

•

Substitution swap

Intermarket swap

Rate anticipation swap

Pure yield pickup

Tax swap

16-31

Horizon Analysis

• Select a particular holding period and predict

the yield curve at end of period

• Given a bond’s time to maturity at the end of

the holding period

– Its yield can be read from the predicted

yield curve and the end-of-period price can

be calculated

16-32

Contingent Immunization

• A combination of active and passive

management

• The strategy involves active management

with a floor rate of return

• As long as the rate earned exceeds the floor,

the portfolio is actively managed

• Once the floor rate or trigger rate is reached,

the portfolio is immunized

16-33

Figure 16.11 Contingent Immunization

16-34