What is a discounting fee?

advertisement

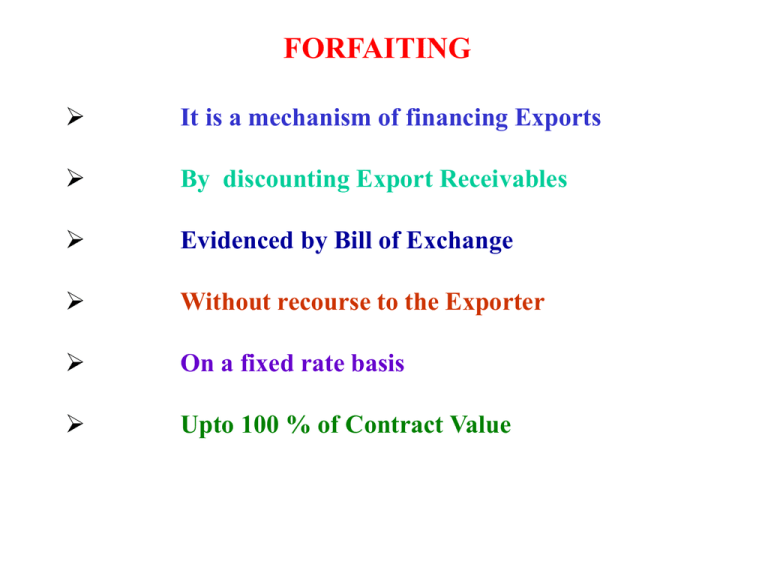

FORFAITING It is a mechanism of financing Exports By discounting Export Receivables Evidenced by Bill of Exchange Without recourse to the Exporter On a fixed rate basis Upto 100 % of Contract Value Major Conditions Contract in Major Currencies e.g. US $, Deutsche Mark, Sterling Pound, Japanese Yen Minimum Contract Value US$ 5,00,000 Duration of Receivable between one year and five years Availability of Forfaiting Quote will depend upon Forfaiting Agency’s perception of Risk Quality of Export Receivables from that country How does forfaiting work? (A) Indian Exporter negotiates with prospective buyer for Quantity, Price, Currency of Payment, Delivery Period, Credit Terms (B) Exporter obtains (through Exim Bank) indicative forfaiting quote from forfaiting agency including discount, commitment fees and documentation fees (C) Exporter finalises terms with the buyer in such a way that discounted proceeds equal to price on cash payment terms Exporter finalises terms with Forfaiting Agency (through Exim Bank) (D) (E) Exporter enters into commercial contract with buyer and also executes contract with Forfaiting Agency (through Exim Bank) Exim Bank issues a certificate to the exporter regarding commitment fees and discounting charges (G) Exporter ships the goods to the buyer (H) Exporter sends invoice to the buyer along with Bill of Exchange for buyer’s acceptance and co-acceptance avalisation by buyer’s banker. Avalised Bill of Exchange comes back to Exporter (I) (J) (K) Exporter endorses avalised Bill of Exchange to Forfaiting agency with words “ without recourse ” Forfaiting Agency pays discounted value to the Exporter On maturity of Bill of exchange, Forfaiting Agency collects payments from Aval What is the role of Exim Bank? • Exim Bank acts as a facilitator between Exporter and overseas Forfaiting Agency • At the request of an Exporter, Exim Bank obtains indicative and firm Forfaiting quotes discount rate, commitment charges and documentation fees • Exim Bank receives avalised Bill of Exchange and sends to forfaitor for discounting. • Also arranges for discounted proceeds to be remitted to Exporter • Exim bank also issues appropriate certificates to enable Exporter to remit commitment charges and other fees. What is a commitment fee? Fee payable by Exporter to Forfaitor for latter’s commitment to forfaiting transaction at a firm discount rate within specified time. It is essentially an opportunity cost for Forfaitor. What is a discounting fee? Interest payable by Exporter for the total credit period and is deducted by forfaitor from amount payable to Exporter against avalised Bill of Exchange. Are forfaiting services available in India? 1. HSBC 2. ABN AMRO 3. Nat West Bank 4. MEGHRAJ Financial Services representing London Forfaiting BENEFITS TO EXPORTER FROM FORFAITING q q q q q q q q Converts deferred payment into cash transaction, improves liquidity and cash flow Frees Exporter from cross-border political or commercial risk Finance upto 100 % of Value Being without recourse to drawer, it does not impact exporter’s borrowing limits. It is an additional source of finance. Provides fixed rate finance, hedges against exchange and interest risk Frees exporter from credit administration and collection problems. Exporter saves on insurance cost since forfaiting obviates need for export credit insurance Exporter can consider exporting to countries which are risky FORFAITING IS A FINANCING TOOL AS WELL AS A RISK MANAGEMENT TOOL