Inventories

advertisement

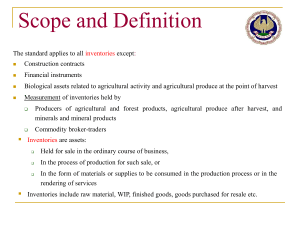

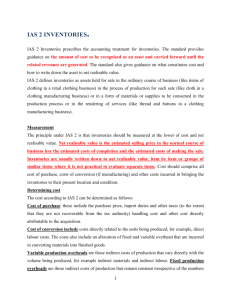

Inventories IAS 2 Overview of session 1. Introduction – scope and definitions 2. Measurement 3. Recognition 4. Disclosure 5. Other Issues Slide 2 Inventories 1. Introduction – scope and definitions Scope of IAS 2 Covers all inventories other than: WIP under construction contracts Financial instruments (Not in IGAAP) Agricultural and forest products (Not in IGAAP) Mineral ores and biological assets to the extent they are measured at NRV (IFRS excludes only measurement of inventories) Commodity broker traders when measured at fair value less costs to sell Additionally, IGAAP exempts WIP of service providers also Slide 4 Definitions Inventories are assets: - (a) held for sale in the ordinary course of business; - (b) in the process of production for such sale; or - (c) in the form of materials or supplies to be consumed in the production process or in the rendering of services Slide 5 Inventories Measured at lower of : Cost and Net Realisable Value Raw Materials Work in Progress Finished Goods Slide 6 NRV vs Fair value NRV is entity specific value, Fair value is not NRV may not equal fair value less costs to sell Slide 7 Inventories 2. Measurement Net Realisable Value Net Realisable Value The estimated selling price in the ordinary course of business less the estimated costs of completion and estimated costs necessary to make the sale Selling Price X Trade Discounts (X) Costs to Completion (X) Marketing, Selling and Distribution Costs (X) Net Realisable Value X Slide 9 Cost Cost of Production: Cost of Purchase Other Costs Cost of Conversion Slide 10 Cost Formulas Specific identification Benchmark Treatment: • First in First Out (FIFO) formula • Weighted Average Cost formula Slide 11 Use of cost formula Same cost formula for all inventories having a similar nature and use to the entity Inventories with a different nature or use, different cost formula may be justified IGAAP does not provide any specific guidance Slide 12 Deferred settlement terms Financing element i.e. difference between purchase price for normal credit terms and the amount paid is recognised as interest expense over the period of financing. IGAAP does not specify this treatment Slide 13 Inventories 3. Recognition Recognition Inventory is expensed… …when the related revenue is recognised The expense of a write down to NRV is recognised… …when the write down occurs Reversal of write down when • Circumstances that caused write down no longer exist • Increase in NRV due to changed economic circumstances IGAAP does not provide above guidance Slide 15 Inventories 4. Disclosures Disclosures in IGAAP and IFRS Accounting policies including the cost formula Total carrying amount Carrying amount in appropriate classifications Slide 17 Additional disclosures in IFRS Carrying amount of inventories carried at fair value less costs to sell Amount of inventories recognised as expense during the period Amount of write down recognised Amount of reversal of write down Circumstances or events that led to reversal of write down Carrying amount pledged as security for liabilities Slide 18 Inventories 5. Other Issues Service providers Para 8 specify that in case of service providers, inventories include the cost of services Para 19 provides guidance on cost of inventories of service provider. Measured at cost of production. Does not include non attributable overheads even though included into price charged by service providers. Para 29 provides guidance on determination of NRV for service providers. Each service for which a separate selling price is charged is treated as a separate item. Slide 20 Machinery spares Guidance now contained in AS 10 Accounting for fixed assets Slide 21 Thank You Slide 22