Murabahah

advertisement

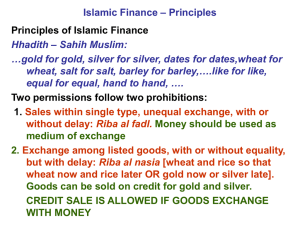

Murabahah and Murabahah for Purchase Orderer Islamic Financial Transactions Faizal Jaffar 0800907 Omer Bin Thabet 0800944 Huzaifa Baffa 0700410 1 Purpose To highlight key features and appropriate accounting treatments associated with Murabahah and Murabahah for Purchase Orderer contracts Outlines ● Definition ● Key elements ● Recognition and Measurement ● Illustration 2 Murabahah is the most widely used financing instrument Contract Murabahah Definition Key conditions Sale of goods at acquisition cost plus an agreed profit mark up. Seller should disclose to the purchaser the: ● Sale of specified goods at ● Price at which the acquisition cost plus an goods is purchased Murabahah for agreed profit mark up based (acquisition cost); Purchase Ordrer on promise (wa’d) to and (MPO) purchase given by the ● Amount of profit purchaser. ● Promise to purchase may be binding or non-binding 3 Transaction structures Murabahah Transactions description: (1) Islamic bank purchase the goods for murabaha sale from the vendor and pays for it. (2) Islamic bank enters into a murabaha contract with customer and delivers the good. (3) The customers pays the bank in installments/cash over the contract period. Risk exposure ● Holding inventory of acquired goods 4 Transaction structures Murabahah for Purchase Orderer Transactions description: (1) Customer place an order with Islamic bank to purchase goods with the promise (may be binding or non binding) (2) Islamic bank purchase and pays for the goods from the vendor. (3) Islamic bank executes a murabaha contract of sale with customer and delivers the goods. (4) The customer pays for the goods on an installment/cash basis to the bank. Risk exposure ● Holding inventory of acquired goods in the event that the customer fails/cancel the purchases Risk mitigation measure/ instruments ● Islamic bank accept Hamish Jiddiyyah (security deposit) or Urboun 5 Risk mitigation measure Hamish Jiddiyyah ● The amount paid by the purchase orderer upon request of the seller. This is to ensure that the orderer is serious in his order of the asset. ● Islamic bank (the seller) may recover the actual loss incurred from the amount of Hamish Jidiyyah in the event that the customer fails to fulfill the binding promise to purchase; or ● refund the deposit to customer under the non-binding promise Urboun ● The amount paid by the customer (purchase orderer) to the seller. ● The amount of Urboun shall form part of the purchase price in the event that the customer proceeds with the sale and takes delivery of the asset 6 Recognition and Measurement and Journal Entries 7 Recognition and Measurement and Journal Entries No. Transaction 1 Purchase of Asset by Bank 2 Murabaha sale 3 Installment receipt 4 Recognition of profit as each installments received 5 Termination of contract 6 Rebate for early payment DR CR Equipment Cash/AP Murabah financing (cost=profit) Equipment (cost+deferred profit) cash Murabah financing Deferred profit Profit &loss A/R Murabah financing Deferred profit Murabah financing 8 Measurement of Murabah financing Assets Upon acquisition of Assets: With obligation : Assets should be measured at lower of historical cost. Without Obligation: Assets should be measured at cash equivalent value. (reflect current value & protect the bank/ financier). 9 Measurement of Murabah financing Assets Price discount if obtained after acquisition should not be treated as revenue but to reduce the cost of the relevant goods unless agreed by SSB. Upon financing the customer: Murabaha receivables should be recorded (by the bank) at face value (cash equivalent value) less provision for doubtful debts 10 Measurement of Murabah financing Assets Income recognition of Murabaha financing assets Profits are recognized at time of contracting for cash or credit transaction not exceeding the current financial period. If credit period is one financial period with a single installment , the recognition methods are: Accrual basis method recognizes profit based on a proportionate allocation of profits whether cash is received or not. Cash basis method recognizes profit as and when the installments are received 11 Measurement of Murabah financing Assets Principle of matching expenses with income is applied. Deferral profits (unearned) shall be offset against Murabaha receivables in the balance sheet. Settlement amount is based on outstanding financial amount (accrual basis) 12 Accounting Illustration An Islamic financial institution provides a financing of $100,000 at a constant rate of return of 10% for a period of 5 years and requires an annual installment payment of $ 30,000. solution: Unearned income = (5 x 30,000) – 100,000 = RM 50,000. Income = 10000(10% of RM100,000) per year. 13 Accounting Illustration Balance sheet: Year 0 Year 1 Year 2 Year 3 Year 4 Murabaha financing 150000 120000 90000 60000 30000 Unearned income (50000) (40000) (30000) (20000) (10000) Net receivable 100000 80000 60000 40000 20000 Income Statement: Murabaha Income 10000 14