Principles of Microeconomics

advertisement

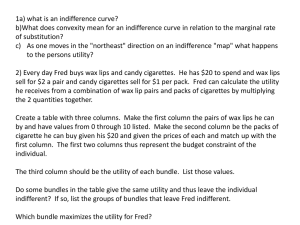

Utility Theory Stephen Chiu University of Hong Kong 1 Utility Theory The cardinal approach The ordinal approach Consumer choice problem Intertemporal choice problem 2 The cardinal approach In the 18th century, Bentham proposed that the objective of public policy should be to maximize the sum of happiness in society Economics became the study of utility or happiness, assumed to be in principle measurable and comparable across people Marginal utility of income was higher for poor people than for rich people, so that income ought to be redistributed unless the efficiency cost was too high 3 The ordinal approach Lionel Robbins (in 1932) argued that, Comparability of utility across people is not needed so long we are concerned about predicting choices Economics is about “the relationship between given ends and scarce means”, and how the “ends” or preferences came to be formed was outside its scope Only stable preferences are needed Robbins didn’t think that public policy could be analyzed within a formal economic framework 4 The cardinal approach An agent’s utility level is like length or weight of an object that is objective and measurable An agent with utility level 3,000 is happier than another agent with utility level 200 But … John always looks happy and enthusiastic, and Smith unhappy and worrisome… 5 The cardinal approach They both come to class... … given the same income and prices, John always spends his income the same way as Smith does 6 The cardinal approach Clothing (units per week) W2=1M W3=1T W1=1000 U3=610 Both John and Smith have the same indifference curve map!!! U2=600 U1=500 Food (units per week) 7 Why diversity in consumption? Cardinal approach – diversity because of diminishing marginal utility Ordinal approach – diversity despite no diminishing marginal utility; what is needed is MU/$ being equalized 8 Consumer Choice problem Ordinal utility function indifference curve map Numbering of ICs unimportant, as long as they are order preserving Some regularity conditions (a.k.a. axioms) on ICs Budget constraint The problem becomes to max utility subject to budget constraint 9 Perfect Substitutes Apple Juice (glasses) 4 Perfect Substitutes 3 Two goods are perfect substitutes when the marginal rate of substitution of one good for the other is constant. 2 1 0 1 2 3 4 Orange Juice (glasses) 10 Perfect Complements Left Shoes 4 Perfect Complements 3 Two goods are perfect complements when the indifference curves for the goods are shaped as right angles. 2 1 0 1 2 3 4 Right Shoes 11 Properties of ICs Map Y U0 More is better Two ICs do not cross Bending toward origin U1 A C X This is ruled out! 12 Budget Constraints Clothing (units per week) (I/PC) = 40 Pc = $2 Pf = $1 I = $80 Budget Line F + 2C = $80 A B 30 As consumption moves along a budget line from the intercept, the consumer spends less on one item and more on the other. D 20 E 10 G 0 20 40 60 80 = (I/PF) Food (units per week) 13 Consumer Choice Clothing (units per week) Pc = $2 Pf = $1 I = $80 40 Market basket D cannot be attained given the current budget constraint. D 30 20 U3 Budget Line 0 20 40 80 Food (units per week) 14 Consumer Choice Clothing (units per week) Pc = $2 Pf = $1 Point B does not maximize satisfaction because there exist some point A which is attainable and yields a higher satisfaction. 40 30 I = $80 B -10C A Budget Line 20 U1 +10F 0 20 40 80 Food (units per week) 15 Consumer Choice T Optimal consumption budget is found where budget line and an IC are tangential to each other P B U A R U3 U1 O S Z Q V 16 Corner solutions are still possible coffee coffee U2 U1 U0 tea tea Tangency condition need not hold 17 The cardinal approach Clothing (units per week) W2=1M W3=1T W1=1000 U3=610 U2=600 U1=500 Despite different numbering of ICs, John and Smith both choose the same bundle Food (units per week) 18 An application: Intertemporal Choice Our framework is flexible enough to deal with questions such as savings decisions and intertemporal choice. Suppose you live two periods: period 1 and period 2 You earn an income of 1,000 in period 1 and a pension of 500 in period 2 Interest rate r. That is, by saving $1 in period 1, you get back $(1+r) in period 2 You consider period 1 consumption and period 2 consumption perfect complement Question: how much should you save now? 19 Intertemporal choice problem Income in period 2 C2 u(c1,c2)=const 1600 Slope = -1.1 Intertemporal budget line 500 1000 C1 Income in period 1 20 Intertemporal choice problem 1000-C1=S 500+S(1+r)=C2 Substituting (1) into (2), we have 500+(1000-C1)(1+r)=C2 Rearranging, we have 1500+1000r-(1+r) C1=C2 > C Using C1=C2=C, we finally have (1) (2) 1500 1000r 2000 1000r 500 C 2r 2r 500 1000 2r 21 Conclusions Ordinal utility theory is good enough so long as we want to study choice Cardinal utility theory is needed if we want to study public policy Happiness = subjective well being Happiness survey shows that average happiness in a nation remains the same level once per capita income reaches a certain level More on happiness if time permitted 22