Lecture - Academics

advertisement

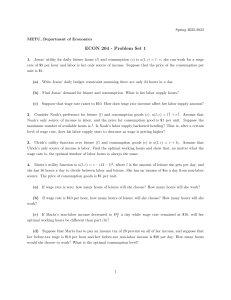

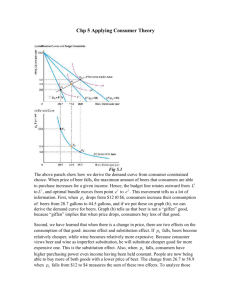

Economics 324: Labor Economics 1. For next time, please read Angrist & Evans (AER, 1998) 2. • For the answer to a question which came up in class last time, see the last bullet point below. It seems that UI (unemployment insurance) is indeed taxed as regular income. • Benefits • * In general, benefits are based on a percentage of an individual's earnings over a recent 52-week period - up to a State maximum amount. • * Benefits can be paid for a maximum of 26 weeks in most States. • * Additional weeks of benefits may be available during times of high unemployment (see Extended Benefits). Some States provide additional benefits for specific purposes. • * Benefits are subject to Federal income taxes and must be reported on your Federal income tax return. You may elect to have the tax withheld by the State Unemployment Insurance agency. Source: http://www.workforcesecurity.doleta.gov/unemploy/uifactsheet.asp • Changing Non-labor Income • What happens to hours of work when we change V? – Shock = V due to bigger dividends, beneficiary in a will, bigger unemployment insurance check, etc. • Wage is held constant • Leisure could be normal or inferior good • Income effect = impact on the D for leisure of a change in non-labor income, holding the wage constant (L/ V) |w > 0 or equivalently, (h/ V) |w < 0 , if Leisure is a normal good (which we will assume) • How does V affect the reservation wage? • 2 effects of V : (1) lowers the probability of working (WRES) (2) decreases hours worked, if you work Changing the Wage Rate • What happens to hours of work when we change w ? – Shock = w due to a raise at work, perhaps • Non-labor income (V) is held constant • Total effect is ambiguous – Two competing effects (1) Income effect: higher w greater purch power demand more L (2) Substitution effect: higher w higher Pleisure demand less L • Isolating the Substitution effect: – Draw the new budget line. Move this new budget line parallel to itself until it is tangent to the old IC (at point Y) SE = (L/ w) |U,V < 0 • Isolating the Income effect: – Draw a new IC tangent to the new budget line at some point. Individual’s Labor Supply Curve • • • • Backward-bending Labor Supply curve (h/ w) |V > 0 SE > IE (h/ w) |V < 0 SE < IE SE dominates initially, but IE is stronger eventually Empirically, data shows that female labor supply is backward-bending, while men generally have a positive slope, with a short vertical range ($10-20/hour) Commuting costs and labor supply curve – Won’t work 1 hour per week – Enter LF at h* hours (say 20) IE > SE w SE > IE Wreservation 0 h* Hours of work Which Effect Dominates? • The size of the income effect depends on where you start • bigger at point A than B • Z is the extreme, IE = 0 C • Empirically: Cross-sectional data reveals that IE and SE are small for men (estimates for women are complicated by child care and household work) A B Z 0 Leisure Optimal Labor-Leisure Choice example C U=? • Suppose Jack’s utility function is given by U = L C (wT+V) • Find the demand function for leisure hours, L* = L (w, V, T) • Assuming = ¾, = ¼, V = 0, T = 400 C* = ? and w = $4 what are the initial optimal values? V • Now suppose welfare program passed giving $200 of income if you don’t work at all. As you earn income benefits are L* = ? 0 scaled back $0.20 per dollar earned. h* = ? • What is the break-even point and what h L are the effects on labor supply? Initial • Decompose, graphically and numerically, the change in demand due to the subsidy subsidy and tax into the substitution and income Tax: SE effects. Tax: IE • What if U = L¼ C¾ ? E0 T Leisure Work C U Labor Supply Elasticity • • • • • • Definition Consensus estimate for prime-aged men is -0.1 +.1 for SE, -.2 for IE When estimates are negative the income effect dominates Labor supply for men tends to be inelastic As time period increases, labor supply becomes more elastic • Why so many elasticity estimates? – – – – – Measurement error (Whipple effect for hours of work) tends to overemphasize the importance of the income effect relevant marginal wage rate for salaried workers sample selection bias Nonlabor income Labor supply of women • Substantial cross-country differences in women’s labor force participation rates • Over time, women’s participation rates have increased • In most studies on women, substitution effects dominate income effects • Reverse causality -- Angrist & Evans (AER, 1998) Cross-Country Relationship Between Growth in Female Labor Force and the Wage, 1960-1980 7 Netherlands Female Participation Growth Rate of 6 5 A us tralia J apan 4 Italy 3 S weden USS R Is rael B ritain S pain 2 Franc e Germany 1 United States 0 1 2 3 4 5 6 7 8 9 Perc entage Change in Wage • Source: Jacob Mincer, “Intercountry Comparisons of Labor Force Trends and of Related Developments: An Overview,” Journal of Labor Economics 3 (January 1985, Part 2): S2, S6.