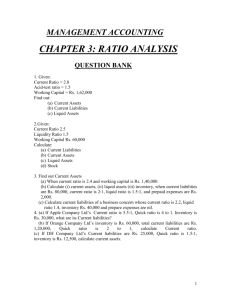

Ratio

advertisement

17 Accounting Ratio Reference: Chapter 1 and 11 (Book 2) 1 A Profitability Ratios (盈利能力比率) •Profitability refers to the ability to make profit. 2 1 Mark-up (加成) Mark-up =Gross profit ÷ Cost of sales X 100% e.g.:Cost of sales = $4 Gross profit = $1 Ans.:Mark-up = $1 ÷ $4 = ¼ or 25% Explanation: Every $4 cost has $1 profit 3 2 Gross profit margin (毛利率) Gross-profit margin=Gross profit ÷ Sales X 100% e.g.: Sales = $5 Gross profit= $1 Ans.: Gross profit margin = $1 ÷ $5 = 1/5 or 20% Explanation: Every $5 sales has $1 profit. 4 The relationship between mark-up and margin Mark-up changes to gross profit margin If mark-up is ¼ Denominator (分母)+1 Gross profit margin is 1/5 Gross profit margin changes to mark-up If gross profit margin is 1/3 Denominator (分母)-1 Mark-up is 1/2 5 3 Net profit margin (純利率) Net profit margin = Net profit ÷ Sales X 100% e.g.:Sales = $100 Net profit = $40 Ans.:Net profit margin = $40 ÷ $100 X 100% = 40% Explanation:Every $100 sales has $40 net profit. 6 4 Expenses–sales ratios • shows how much of expenses spends on every $100 of sales Expenses-sales ratios =(Operating expenses ÷Sales)× 100% e.g.:Operating expenses = $400 Sales = $1000 Ans:Expenses–sales ratios = ($400 ÷ $1000)× 100% = 40% Explanation:Every $100 Sales spends $40 expenses。 7 5 Rate of returns on capital employed •Rate of returns on capital employed gives an overall picture of the profitability of the company. Rate of returns on capital employed =(Net profit ÷ Capital employed*)× 100% *Capital employed: can be average capital e.g.:Capital = $1000 Net profit = $200 Ans.:Rate of returns on capital employed = ($200 ÷ $1000)× 100% = 20% Explanation:Every $100 capital earned $20 8 net profit. B Liquidity Ratios •Liquidity ratios measure the ability to meet the company’s debts. 9 1 Current ratio / Working capital ratio • Current ratio measures current assets against current liabilities. Current ratio=Current assets÷Current liabilities Or Current ratio=Current assets : Current liabilities =Z:1 10 e.g.:Current assets = $200 Current liabilities = $100 Ans.:Current ratio= $200 : $100 =2:1 Explanation:Current assets are double to current liabilities. • If the current ratio is too high (Normal level is 2:1), the firm may have excessive current assets。 • If the current ratio is too low, the firm may have insufficient current assets to meet its 11 short-term liabilities. 2 Quick ratio / Acid test ratio • Quick ratio is a stricter measure of liquidity . • Current asset, can be converted into cash quickly, compares with the current liabilities. Current =(Current -Stock)÷ Current ratio assets Liabilities or Current =(Current -Stock) : Current ratio assets Liabilities =Y:1 12 e.g.:Current assets = $200 Current liabilities = $100 Stock = $50 Ans:Current ratio= $200 - $50 : $100 = 1.5 : 1 Explanation:The current assets excluding stock is 1.5 times to the current liabilities. • High quick ratio shows the ineffective use of current assets of the the company. • Quick ratio is less than 1:1 means there is not enough current assets to pay current liabilities. 13 C Efficiency Ratios •Efficiency ratios check whether the company utilises the assets efficiently (manages efficiently). 14 1 Stock turnover rate • Stock turnover rate measures the efficiency of the stock management. Stock turnover rate = Cost of goods sold ÷ Average stock = Y times or Stock turnover rate =(Average stock ÷ Cost of goods sold)× 365 days* = Y days Average stock = (Opening stock+Closing stock)÷ 2 *365 days or 56 weeks or 12 months 15 e.g.:Cost of goods sold= $100 Opening stock= $10 Closing stock = $30 Ans.:Average stock = ($10 + $30)÷ 2 = $20 Stock turnover= $100 ÷ $20 = 5 times or Stock turnover=($20 ÷ $100)×365 days = 73 days Explanation:The higher the stock turnover, the more profit we make. • The lower the stock level , the higher the stock turnover rate. 16 2 Debtors collection period / Debtors days / Credit period allowed to trade debtors • Debtors collection period shows how long on average our debtors pay us. Debtors collection period =(Debtors ÷ Sales)× 365 days* = Y days *365 days or 56 weeks or 12 months 17 e.g.:Debtors= $100 Sales= $1000 Ans.:Debtors collection period =($100 ÷ $1000) × 365 days = 36.5 days Explanation:The debtors need 36.5 days to pay the debts. The shorter the period, the better the liquidity of the company. 18 3 Creditors repayment period / Creditors days/ Credit period received from trade creditors • Creditors repayment period shows how long we pay our creditors. Creditors repayment period =(Creditors ÷ Purchases)× 365 days * = W days *365 days or 56 weeks or 12 months 19 e.g.:Creditors= $100 Purchases= $800 Ans.:Creditors repayment period =($100 ÷ $800) × 365 days = 45.6 days Explanation:The company needs 45.6 days to pay the debts. • The longer to pay the debts, the company losses the possible cash discounts. • Too early payment affects the financial status of the company. 20 D Steps on ratios analysis 1. Explain the type of ratios it belongs to , e.g. Profitability ratio. 2. Compare the changes of each ratio, i.e. increase or decrease. 3. Explain the effect of the increase or decrease of each ratio on different aspects, e.g. profitability. 4. Check whether there is any effect on other ratios. 21