Operating Income

advertisement

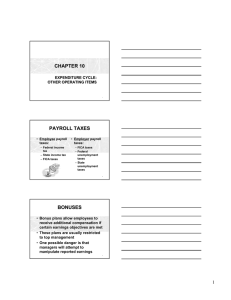

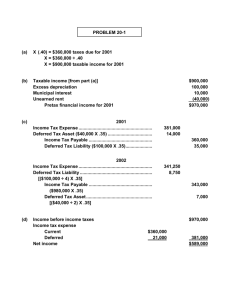

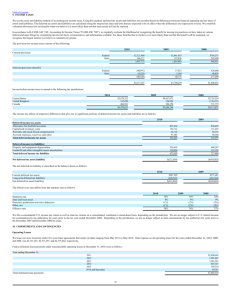

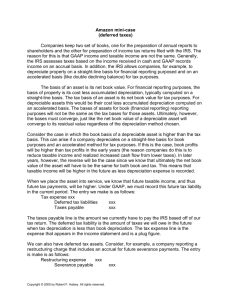

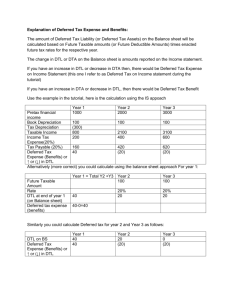

Module 5 Reporting and Analyzing Operating Income Revenue Recognition Revenue recognition criteria 1. 2. realized or realizable, and earned Realized or realizable means primarily that cash is collected or a receivable is collectible. Earned means that the seller has performed its duties under the terms of the sales agreement. Revenue may be questioned, when… Rights of return exist Continuing involvement by seller in product resale Contingency sales Revenue Recognition Challenges Case 1: Channel stuffing Case 2: Barter transactions Case 3: Mischaracterizing transactions as arm’s-length Case 4: Pending execution of sales agreements Case 5: Gross versus net revenues Case 6: Sales on consignment Case 7: Failure to take delivery Case 8: Nonrefundable fees Percentage-of-Completion Method appropriate for sales made with longterm contracts: construction, defense contracts, project services The percentage-of-completion recognizes revenue by the proportion of costs incurred to date compared with total estimated costs. Subject to manipulation of the estimated costs. Percentage-of-Completion Assume that Bayer Construction signs a $10 million contract to construct a building. Bayer estimates construction will cost $4,500,000 the first year and $3,000,000 for the second year. Research and Development (R&D) Expenses Expense all R&D costs as incurred unless those assets have alternative future uses (in other R&D projects or otherwise). For example, a general research facility housing multi-use lab equipment is capitalized and depreciated like any other depreciable asset. However, project-directed research buildings and equipment with no alternate uses must be expensed. How is R&D Reported by Cisco? 13% of sales Restructuring Expenses Restructuring costs typically consists of three components: Employee severance or relocation costs Asset write-downs Other (i.e., contract termination costs, legal expenses, etc.) Accounting standard requires: formal restructuring plan approved by its board of directors identify the relevant employees and notify them of the plan. Each year, the company must disclose in its footnotes liability (accrual), liability amount settled this period and any changes in estimates. Income Tax Expenses Companies maintain two sets of accounting records, one for preparing external financial statements another for reporting to tax authorities. Two sets of accounting records are necessary because the U.S. tax code is VERY different from GAAP. Income Tax Differences Timing Differences Depreciation Bad debts expense Warranties % completion vs completed contract on revenues Permanent Differences Life insurance of officers Entertainment above limits Income from state and local bonds Deferred Tax Liabilities and Assets Deferred tax liabilities Arise when reported income is higher than taxable income. Example: Depreciate faster for tax return than fin. report Deferred tax assets Arise when reported income is lower than taxable income. Unearned revenues are revenues for tax return Bad debt expenses are projected in fin. report, but only write-offs allowed for tax return Loss Carryforwards When a company reports a loss for tax purposes, it can carry back that loss for up to two years to recoup previous taxes paid. Any unused losses can be carried forward for up to twenty years to reduce future taxes. This creates a benefit (an “asset”) on the tax reporting books for which there is no corresponding financial reporting asset and thus the company records a deferred tax asset. Income Tax Footnotes Income tax expense reported in its income statement (called the provision) consists of the following two components (organized by federal, state and foreign): Current tax expense - the amount payable (in cash) to tax authorities Deferred tax expense - the effects on tax expense from changes in deferred tax liabilities and deferred tax assets Pfizer’s Income Tax Footnote Income tax expense (provision) is the sum of 1. Taxes currently payable 2. Deferred income taxes Earnings Per Share Global Accounting – R&D U.S. GAAP expenses all R&D costs IFRS allows capitalization and subsequent amortization of certain development costs that meet a list of requirements.