Introduction into FBT & Electronic Log Book by Navman Wireless

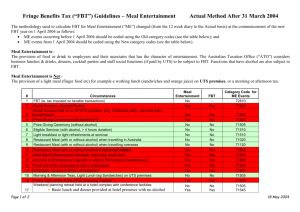

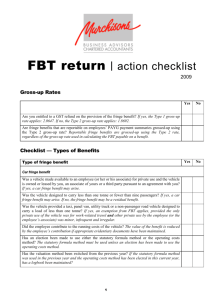

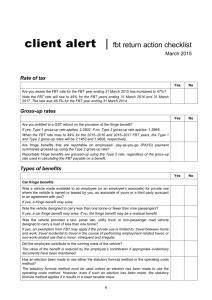

advertisement

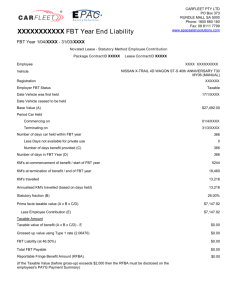

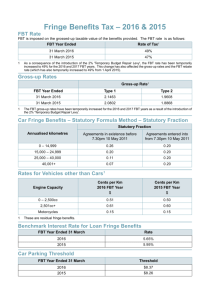

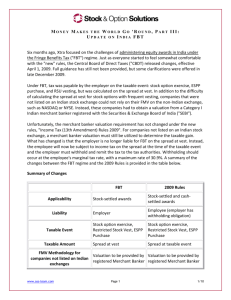

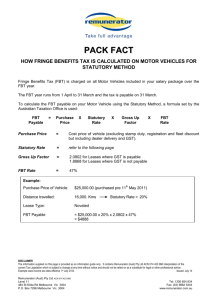

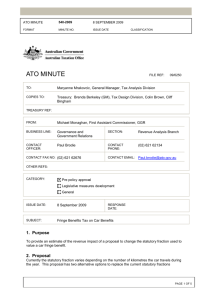

Vehicle FBT Reporting Electronic Log Books Navman Wireless Electronic Log Books 1. Background 2. Working Example 3. Where Navman Wireless come in 4. Return on Investment Confidential | 2 Background • FBT is a tax paid on all work vehicles that are also made available for PRIVATE use • There are 2 methods to calculate your FBT liability each year: Method How Motivation Statutory Fraction Estimate using a standard formula Easy to do Operating Cost Actual vehicle costs and business / private Cost savings use provided via 12 week log-book More accurate • The Henry Report in 2011 legislated that Statutory Fraction will now be 20% across all distances and applicable vehicle classes. This is a 3-fold increase in FBT liability for vehicles doing more than 40,000Km a year • Statutory fraction is now increasing the tax burden on businesses and affecting the bottom line Which method to use? • Already using Statutory Fraction? – Tax savings if move to Operating Cost – Achievable by using Navman Wireless automated log books – Introduce visibility of fleet utilisation and operating costs of your fleet • Already using Operating Cost? – – – – Reduce back-office administration costs through automation Eliminate hassle and negativity of paper log books Increase visibility of fleet utilisation and operating costs of your fleet Accuracy across 365 days allows you to identify the 3 months of the year that best reflect your true private use Working Example • $35,000 vehicle with the following typical running costs Maintenance and Repairs $1000 Petrol $3,276 9L fuel per 100km. Fuel = $1.40/L Distance 26,000km Insurance $750 Rego $750 Confidential | 5 Working Example : Statutory Fraction Simple method which applies a fixed % to the taxable value of a car Taxable Value Taxable Value = Stat Frac X Base Value of Car X Days available 1 1 – Days available is Days in FBT Year divided by Days available for private use – typically 365 days unless car stays on site every day Year Statutory Fraction Base Value Private % Taxable Value FBT Paid 1 17% $35,000 100% $5,950 $5,712 2 20% $35,000 100% $7,000 $6,720 3 20% $35,000 100% $7,000 $6,720 TOTAL = $19,152 FBT Paid = Taxable Value * 2.0647 * 46.5% Confidential | 6 Working Example : Operating Cost This method takes into account all the costs of operating the vehicle for each tax year e.g. fuel, lease cost, maintenance, rego etc. It then applies a true private use % to the value of the vehicle derived from log-books over a continuous 12 week period. Assumes private KMs are 10%. Taxable Value Taxable Valu = Year Operating Costs Operating Cost X Private Use % Lease Cost Private % Taxable Value FBT Paid 1 $5,776 $40,776 10% $4,077 $3,914 2 $5,776 $40,776 10% $4,077 $3,914 3 $5,776 $40,776 10% $4,077 $3,914 TOTAL = $11,742 FBT Paid = Taxable Value * 2.0647 * 46.5% Lease Finance costs not included in above Operating costs Confidential | 7 Where Navman Wireless come in • Automates paper-less log-book collection Confidential | 8 Where Navman Wireless come in • Make Operating cost model achievable for large company fleets • Allows businesses to monitor and control PRIVATE use and limit their FBT exposure Confidential | 9 Return on Investment • • Potential tax saving moving to Operating cost model Method FBT Payable Operating Cost (10% Private) $11,742 Statutory Fraction $19,152 Difference per vehicle (3 Years) $7,410 Difference per vehicle (Annual) $2,470 Reduce cost if on Operating cost model Cost Reduction Annual Saving Reduce head-count to process paper log books 1 FTE per 100 vehicles $60,000 Reduce driver time ($30/hr) to produce log books 25mins per week $625 per driver Confidential | 10 The End