3.6 * Mathematics of Finance

advertisement

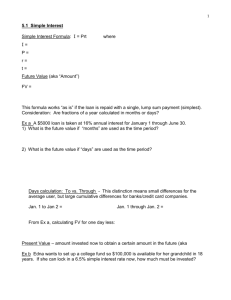

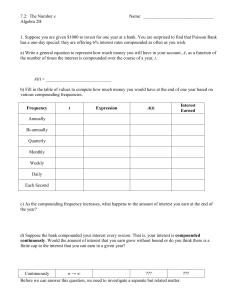

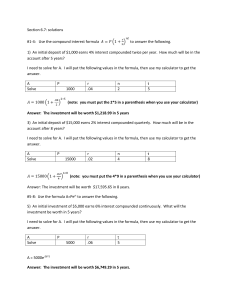

3.6 – Mathematics of Finance By the end of today, you will be able to: • Find the value of an investment in which interest is compounded annually, a specified amount of times per year, and continuously • Compute and Compare Annual Percentage Yields • Calculate the Present and Future values of an annuity Interest Compounded Annually Find the amount A accumulated after investing a principal P for t years at an interest rate r compounded annually. P = $12,000, r = 7.5%, t = 7 Interest compounded k times per year You Try! Find the amount A accumulated after investing $1500 for 5 years at an interest rate of 7% compounded quarterly. Interest compounded continuously You Try! Find the amount A accumulated after investing a principal amount of $1250 for 6 years at interest rate of 5.4% compounded continuously Annual Percentage Yield (APY) • Used to compare investments • It is the percentage rate that, compounded annually, would yield the same return as the given interest rate with the given compounding period Comparing annual percentage yields (APYs) Which investment is more attractive, one that pays 8.75% compounded quarterly or another that pays 8.7% compounded monthly? Ordinary Annuities: A sequence of periodic payments made at the end of each period at the same time the interest is posted in the account. Future Value of an Annuity An IRA Account: Amy contributes $50 per month into the Lincoln National Bond fund that earns 7.26% annual interest. What is the value of Amy’s investment after 25 years? Present Value of an Annuity 1 (1 i) PV R i n You Try! Find the present value (PV) of a loan with an annual interest rate of 4.7%, and periodic payments of $815.37 for a term of 5 years, with payments made and interest charged 12 times per year. Annual Percentage Rate (APR) The annual interest rate charged on consumer loans Ex) What is Kim’s monthly payment for a 4-year $9000 car loan with an APR of 7.95% from Century Bank? Homework Pg.342-343 2, 8, 10, 16, 18, 22, 46, 48

![Practice Quiz 6: on Chapter 13 Solutions [1] (13.1 #9) The](http://s3.studylib.net/store/data/008331662_1-d5cef485f999c0b1a8223141bb824d90-300x300.png)