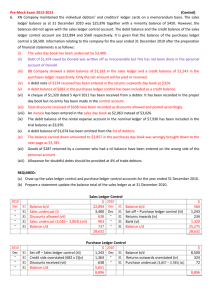

The General Journal

advertisement

The General Journal Introduction The General Journal is used for any transaction which will not fit in the four special journals: • Cash Receipts Journal, • Cash Payments Journal, • Credit Purchases Journal (stock) & • Credit Sales Journal. Format • • • • Traditionally, the account(s) being debited are recorded first, followed by the credit entry. The account to be credited is indented slightly. The value of the debit entry(ies) will equal the value of the credit entry(ies). A narration (a short explanation) is used to describe the transaction. The narration includes a reference to the relevant source document (e.g. memo). Date Details 1 Apr Debit Entry Credit Entry Narration General Ledger DR CR xxx Subsidiary Ledger DR CR xxx The Use of the General Journal As previously stated the General Journal is used when a transaction does not occur frequently or if it does not fit into any of the four special journals. There are FIVE main situations that will require the use of the General Journal Establishing a double entry system (pages 135-138) Contribution or withdrawal of (non-cash) assets by owner (p138 – 139). Note: When non-cash assets are contributed, an agreed value is determined by the owner. Donations of stock and business advertising (p140) Bad debts (pages 140-143) Note: If some cash is collected, this is recorded in the cash receipts journal. The amount to be written off as bad is recorded in the cash payments journal. Correcting recording errors. (See pages 143 – 145). Eg where the entry was to the wrong account or wrong side of an account, or the wrong amount was recorded. GJ & the Ledger Posting to the Ledger Each entry must be posted individually to the ledger accounts. The process is actually quite simple as the general journal entry states what is to be debited and what is to be credited. Subsidiary Ledgers This involves the use of an extra two columns to record both the general and subsidiary ledger accounts. An amount will be posted to the Debtors Control, Creditors Control or Stock Control account depending on the transaction. There also needs to be an individual posting to each affected Subsidiary Debtor or Creditor Ledger Account SAC HINTS – OUTCOME PART B Mark-ups If a business uses a 100% mark-up this means the selling price is DOUBLE the cost price – to be recorded in the Cost of Sales column in the Cash Sales Journal (and then posted to Stock Control & Cost of Sales ledger accounts) Posting to the Ledger Cash at bank ledger account DR – Cash Receipts Total CR – Cash Payments Total Stock Control ledger account DR – Cash Payments “stock” column – cross reference = “cash at bank DR – Credit Purchases “stock” – cross reference = creditors control CR – Cost of sales column from both Cash Payments and Credit Purchases journals – cross reference = Stock Control Creditors/Debtors Control ledger accounts Remember – the discount has been accounted for – post the total of the debtors/creditors columns Remember – when posting to the individual ledger accounts – use the amount from the debtors/creditors column NOT the bank column. Cash Receipts Journal • • • • Payments received from DEBTORS – don’t forget the DISCOUNT Cash sales Injection of extra CASH from owner (CAPITAL) Loan received from bank - CASH Cash Payments Journal • • • • • Payments made TO creditors – don’t forget the discount Payment of LOANS Payment of expenses Cash purchase of ASSETS (not stock) Drawings of CASH by owner Credit Purchases Journal • Credit purchase of STOCK Credit Sales Journal • Credit sales of STOCK General Journal • • • • • • Creating a Double Entry system Credit sales of ASSETS Donations of STOCK (advertising) Writing off Bad Debts Correcting errors Withdrawal or contribution of ASSETS (not cash) by owner Credit Purchases Journal • Credit purchase of STOCK Credit Sales Journal • Credit sales of STOCK General Journal • • • • • • Creating a Double Entry system Credit sales of ASSETS Donations of STOCK (advertising) Writing off Bad Debts Correcting errors Withdrawal or contribution of ASSETS (not cash) by owner