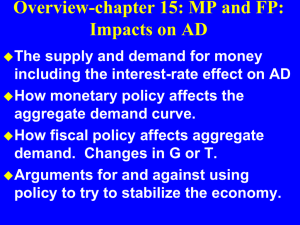

CHAPTER

Fiscal Policy

Chapter 12

Part I

1

Countercyclical Fiscal Policy

• A change in government spending or net

taxes (taxes or transfer payments)

designed to reverse or prevent a recession

or a boom

• Fiscal policy affects AE and has in the

short run demand-side effects on output

and employment

• We will discuss supply-side effects later

2

Short-run Countercyclical Fiscal Policy

Real AE ($ billions)

A

AE1

AE2

Consumption

B

Function

45°

$9,000

(Recession Output)

Initially, equilibrium

is at full-employment

output of $10,000

billion (Point A). Then

a decrease in private

investment spending

(IP) or consumption

spending (C) shifts

the aggregate

expenditure line

down to AE2, and the

economy starts

heading toward point

B - a recession.

$10,000 Real GDP ($ billions)

(Full-Employment Output)

3

Recessionary Gap:

Real AE ($ billions)

A

AE1

AE2

Consumption

B

Function C

Recessionary Gap:

Distance B to C = $1,000

45°

$9,000

(Recession Output)

$10,000 Real GDP ($ billions)

(Full-Employment Output)

4

Countercyclical Fiscal Policy

Policy Option: Increase Government Spending

• Direct way to address a recession

– increase G and shift the aggregate

expenditure line upward

– ΔGDP = (Multiplier) ˣ ΔG

– where the simple multiplier = 1/(1-MPC)

• If the MPC is 0.75, how much should G

increase to close the recessionary gap of

$1,000?

5

Countercyclical Fiscal Policy

Policy Option: Cut Net Taxes

• Increase disposable income

– increase consumption spending (less

direct than increasing G)

– aggregate expenditure line shifts upward

– ΔGDP = (tax multiplier) ˣ Δ Net taxes

– tax multiplier = - MPC/(1-MPC)

6

Policy Option: Cut Net Taxes

• Increase disposable income

– increase consumption spending (less

direct than increasing G)

– aggregate expenditure line shifts upward

– ΔGDP = (tax multiplier) ˣ Δ Net taxes

– tax multiplier = - MPC/(1-MPC)

Another multiplier!

7

Policy Option: Cut Net Taxes

• Increase disposable income

– increase consumption spending (less

direct than increasing G)

– aggregate expenditure line shifts upward

– ΔGDP = (tax multiplier) ˣ Δ Net taxes

– tax multiplier = - MPC/(1-MPC)

• If the MPC is 0.75, how much should

taxes decrease or transfers increase to

close the recessionary gap of $1,000?

8

Countercyclical Fiscal Policy Close the

The government

Recessionary Gap

Real AE ($ billions)

AE1

A

AE2

Consumption

B

Function

C

ΔG↑ or ΔT↓

45°

$9,000

(Recession Output)

could shift the AE

line back to its

original position by

increasing spending

(G), or by decreasing

net taxes (T) with a

change in tax or

transfer policies.

ΔY

If the change were

enacted quickly

enough, the

government could

prevent the

$10,000 Real GDP ($ billions)

recession.

(Full-Employment Output)

9

Short-run Countercyclical Fiscal Policy

• Combining fiscal changes

– Government might decide to increase

government purchases, cut taxes, and

increase transfer payments

• all at the same time !

– The final impact on equilibrium GDP

• add up the separate multiplier effects of

each policy change

10

Combining Different Types of Fiscal

Stimulus

© 2013 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as

permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

11

Short-run Countercyclical Fiscal Policy

• Another policy option would be to

increase government purchases and

net taxes by equal amounts

• Why? No increase in the budget deficit

– GDP rises by the same amount

• Balanced budget multiplier

– The multiplier for a change in government

purchases that is matched by an equal

change in taxes

12

Case Study: American Reinvestment

and Recovery Act (ARRA) -2009

–A roughly two-year fiscal stimulus

• Originally estimated at $787 billion, and later

revised to $862 billion

–One-third was tax cuts - T↓

–One-third was increased government

purchases - G↑

–One-third was increased transfer

payments - T↓

13

Range of Estimates for Multipliers in the ARRA

Spending multiplier estimates larger than tax and transfer

payment multiplier estimates.

One-time payments and one-year tax cuts the lowest estimates.

14

Problems with Countercyclical Fiscal Policy

• Timing problems

–Recognition lag

–Implementation lag

–Response lag

• Irreversibility

– Spending should be temporary offsetting

temporary reduction in private spending

• Taxes and forward looking behavior

– Temporary vs. permanent!

• The reaction of the Federal Reserve

15

The Multiplier

•All of the multipliers we derive are a sub-set

of a general macro model for an open

economy with taxes and imports that depend

on the level of income (Y).

•The process described on the following slides

is to first define the model and then through a

series of substitutions, solve for the

equilibrium level of income (Y).

16

The Multiplier

• The model for an open economy when

taxes and imports depend on the level of

income (Y) is described by the

following eight equations:

17

The Multiplier

• (1) Y = C + I + G + (X – M), equilibrium condition

from chapter 11.

• (2) C = a + b (Yd), consumption equation from

chapter 11.

• (3) Yd = Y – T, disposable income as defined in

chapter 11.

• (4) T = T0 + t(Y), tax equation, this is new.

• (5) I = IP, planned investment from chapter 11.

• (6) G = G0, government spending from chapter 11.

• (7) X = X0, exports from chapter 11.

• (8) M = mY, import equation, this is new.

18

Equations (4) and (8) are new formulas

• T = T0 + t(Y), tax equation. This says the T is

equal to some fixed level plus a fraction (t) of Y.

• t is the tax rate. If t=0.33, households pay 33 cents

of each extra dollar earned to the government.

• M = mY, import equation. This simply says as Y

increases household import more stuff.

• Little m is called the marginal propensity to

∆𝑀

import: m =

∆𝑌

19

The Multiplier

• Substitute equations (2) through (8) into the

equilibrium condition, equation (1):

• (9) Y = a + b(Y - T) + IP + Go + X0 - mY

• (10) Y = a + b(Y - (T0+ tY)) +IP+ G0+X0 – mY

•

• (11) Y = a + b(Y-T0 - tY) +IP+G0+X0 – mY

•

• (12) Y = a + bY- bT0 - btY+IP+G0+X0 - mY

20

The Multiplier

Now solve Equation (12) for Y:

(13) Y- bY+ btY+ mY = a - bT0+ IP+ G0+ X0

(14 )Y

a bT 0 I

(15 ) Y

P

G0 X

0

1 b bt m

a bT 0 I

P

G 0 X

0

1 b bt m

21

From Equation (15), the government spending and lump-sum

tax multipliers in an open economy with an income tax

system are:

Y

G

Y

T 0

1

1 b bt m

b

1 b bt m

22

What happens if there is no foreign sector (a closed economy)

and taxes are lump-sum. This is the model presented in

chapters 11 and 12 of Hall and Lieberman. Equations (7) and

(8) listed on the previous slide disappear and the tax rate (t) in

Equation (4) equals zero. X, t and m in Equations (14) are

equal to zero:

a bT 0 I G 0

P

Y

1 b

a bT 0 I G 0

P

Y

1 b

23

We get the investment spending, government

spending, and tax multipliers presented in

Chapters 11 and 12:

Y

I

Y

T

Y

G

1

1 b

b

1 b

24