The IS-LM model

advertisement

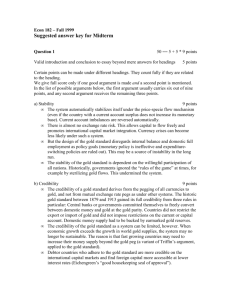

Chapter 17 The IS-LM Model Geog 3890: Ecological Economics Economics is a two digit science ….. Outline of Topics • • • • • • • • • • The Money Supply Theory of Income IS: The Real Sector LM: The Monetary Sector The Federal Reserve Bank Exogenous Changes in IS & LM Junk Bonds and Timber Companies Monetary vs. Fiscal Policy Why is the Fed anti-inflation? Relation of Bond Prices to Interest rate Transaction Demand for Money Inflation & Disinflation S – Savings I - Investment L – Demand for Money M – Money Supply Unemployment Macro-Allocation Liquidity Preference IS = LM MV = PQ Extending the Basic Market Equation? • Muxn*MPPax = Muyn*MPPay to all goods (x, y, z,...), all commodities (a, b, c, …), and all consumers (n, m, o, …) • Crippling from a policy perspective. In order to predict anything you have to know everything. • What are the policy tools at the macroeconomists disposal? • Monetary Policy (Money Supply and Interest Rates) • Fiscal Policy (taxes & govt spending) • IS-LM model (compromise between completeness & simplicity) • John Hicks (1937) ‘Two Digit” compromise • Real Sector (National Income, Savings, Investment, Rates of Productivity of Capital, Government Spending, Taxation) • Monetary Sector (Money Supply, interest Rates, Bond Sales) The “Velocity” of Money IS: The Real Sector • In equilibrium when: • Supply of Goods & Services (firms) = Demand for Goods & Services (households) • • • • • Leakages equal injections National Income (Y) = National Output (GNP) Leakages are Savings (S) Injections are Investments (I) Equilibrium Condition for Real Sector is S= I • (leakages = injections) • All of this is a function of interest rate ‘r’ and Income ‘Y’ • S(r, Y) = I(r, Y) Why does the IS curve slope downward? • • • • Lower interest rates -> more Investment (I) Higher interest rates -> more Savings (S) Low Income -> Low Savings High Income -> High Savings There are really two curves; One for S and one for I. We Look at how they vary with Two other variables: Income (Y) And interest rate ‘r’ An exercise for the student? LM: The monetary sector We hold cash to avoid the inconvenience of barter. ‘Transaction demand for money’ We also have a preference for ‘liquidity’ Higher the National Income the more money is needed for transactions. Real commodity money vs. Fiat or token money DM (demand for $) (M) SM (Supply of $) (L) SM = M = L(r, Y) Key: The LM curve consists of all those combinations of ‘r’ and ‘Y’ such that the aggregate demand for cash balances is equal to the given money supply. The ‘given money supply’ What’s up with that? Combining IS and LM • By combining IS and LM curves we find unique combinatin of ‘r’ and ‘Y’ (namely r* and Y*) that satisfies both S=I condition of the real sector and the L=M condition of the monetary sector. • The model is used in a comparative statics way to analyze the effect on ‘r’ and ‘Y’ of the • Endogenous Determinants • Propensity to Save • Efficiency of Capital Investment • Liquidity Preference How does economy move toward Equilibrium after policies try to Push it in a direction? (changing Taxes, Spending, Interest Rates, Money Printing, etc) Junk Bonds & Timber Companies Exogenous Changes in IS & LM • Changes outside domain of Monetary and Fiscal Policy • Example – Changes in the Marginal Propensity to Save • Such a change in savings rate might result from fears of an economic downturn that would lead to lower wages and greater unemployment. People decide to save more and spend less of their extra income. This means that now S > I for all the combinations of r and Y on the IS curve. We need a new IS curve for which S = I again. If people save more at every r, this means that S > I, or leakage greater than injection, so the flow of income will fall to the level at which S = I again. • In increase in the marginal propensity to save will therefore result in a fall in national income and a fall in the interest rate. • This is the Paradox of Thrift we saw earlier Shifting IS and LM Curves • This can be caused by exogenous forces: • Changes in Marginal propensity to save or change in marginal efficiency of investment • This can be caused by changes in Monetary and Fiscal Policy • Changes to Money Supply • Changes In Government Taxation and Spending Monetary Policy • Monetary policy basically affects the money supply. When the monetary authority (The Federal Reserve in the U.S.) increases money supply, the LM curve shifts downward and M > L, which drives interest rates down. Lower interest rates stimulate the economy, and income grows. If the money supply is increased too much, there can be too much money chasing too few goods, and inflation can be a problem. Reducing the money supply drives interest rates up, shrinks the economy, and can help control inflation. Fiscal Policy • Fiscal policy is bacially government expenditure and taxation. When the government spends money, industry has to produce more goods and services to meet the increased demand. This drives up income and also increases the demand for investments, driving up interest rates. The IS curve shifts to the right. Decreasing government spending has the opposite effect. A Steady – State Economy? Impacts of Monetary and Fiscal Policies on Interest Rates & Income If you are sitting on a lot of cash – What does inflation do to you? Biophysical Equilibrium vs. Economic Equilibrium