Chapter 6

advertisement

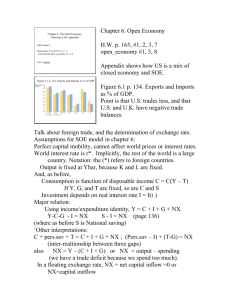

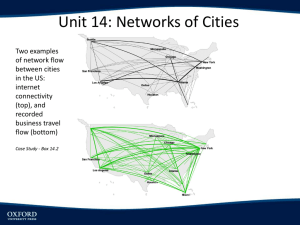

Chapter 6. The Open Economy. Glancing at the Appendix Old Chapter 5. Homework: P. 164-65 #1, 2, 3, 7 macromodel open_economy #1, 3, 8 Link to syllabus Fig. 6-1 p. 134. Imports and Exports as % of GDP, 2010 Trade is smaller (relative to GDP) in US than elsewhere. Note sizeable US trade deficit Table 6.1 p. 137. International Flows of Goods and Capital, Summary Figure 6-2 p. 142. Saving and Investment in a Small Open Economy (More detail next slide). Figure 6-2 p. 142. Saving and Investment in a Small Open Economy r* NX < 0 * If r were down here, the country would have a trade deficit. That’s a good description of the situation in the US today. The US Balance of Payments, 2007. (other text) The US Balance of Payments, 2007. Table from another text Exports minus Imports Net Capital Inflows ≈0 Point is that: current account + financial (capital) account ≈ 0 or, net exports = - financial account = - net capital inflows = net capital outflows. NX = S – I . (Mankiw, p. 136) Figure 6-3. P. 143. Fiscal Expansion in a Small Open Economy If G increases, NX falls; no change in real GDP, by assumption. Fig. 6-4 p. 144. Fiscal Expansion Overseas and a Small Open Economy How domestic economy is affected by foreign economic events. Fig. 6-5 p. 145. Shift of the Investment Curve in a Small Open Economy An increase in the demand for domestic investment lowers net exports. Figure 3.8 p. 71 Figure 3.9 p. 72 Crowding out of investment Figure 6.2 p. 142 Figure 6.3 p. 143 Crowding out of exports Fig. 6-6 p. 147. The Trade Balance and Savings/Investment in the U.S. Fig. 6-7 p. 152. Net Exports and the Real Exchange Rate Why? Consider the real exchange rate between US and UK. In this case ɛ= £/$ x PUS/PUK. Suppose the exchange rate £/$ increases from 0.8 £/$ to 1.4 £/$. This would cause US exports to fall. If the price of US exported wheat is $100/ton, then the price in England of US wheat will rise from £80 to £140 [$100 x 0.8 £/$]. So England will buy less US wheat, and our net exports will fall. An increase on the vertical axis causes a leftward movement along the horizontal axis. Depreciation of US $ Appreciation of US $ Fig. 6-7 p. 152. Net Exports and the Real Exchange Rate Link to x-rates.com Different Text!! The market for foreign currency in the U.S. The vertical axis in that book is the inverse of what it is in the Mankiw tex Fig. 6-8 p. 152 Determination of the Real Exchange Rate Fig. 6-8 p. 152. Determination of the Real Exchange Rate, Viewed as Supply and Demand for Dollars in Europe == Supply of Dollars: from net capital outflows from US Demand for dollars: Europe needs dollars to pay for its imports, which are US net exports. (See discussion alongside the graph in the textbook). ---=========== Quantity of US Dollars Fig 6-9, p. 153. Impact of Expansionary Fiscal Policy on the RER If G increases, NX falls: same result as Figure 6.3. This shows x-rate. Fig. 6-10 p. 154. The Impact of Expansionary Fiscal Policy Overseas on the RER Fig 6-11 p. 155. The Impact of an Increase in Investment on the RER Fig 6-12 p. 156. Impact of Protectionism on the RER Fig. 6-13 p. 158. Inflationary Differentials and the Nominal Exchange Rate Graphing %∆e and (π* - π), which is related to %∆e = %∆ ε + (π* - π), supposing %∆ ε is small. (p. ?). Fig 6-14 p. 159. Purchasing Power Parity Table 6-2 p. 161. Big Macs and PPP Summary: Comparison of Analyses of Three Events, Closed and Open Economies Event G↑ r*↑ Id ↑ Protectionism Chapter 3 Figure 3-9 Inv. ↓ N.A. 3-11 I constant; r↑ N.A. Figure 6-3 6-4 6-5 Chapter 6 Figure NX ↓ 6-9 NX ↑ 6-10 NX ↓ 6-11 6-12 ԑ↑ ԑ↓ ԑ↑ ԑ↑ NX constant Homework p 151 1. Use model of SOE to predict what will happen if: a. A fall in consumer confidence reduces consumption, raises saving b. Taste change leads us to want more Toyotas, fewer Fords c. Introduction of automatic teller machines lowers demand for M. 3. Town of Leverett is an SOE. A change in fashion results in a decline in demand for their exports. What happens to Leverett exports, saving, interest rate, exchange rate Will this encourage or discourage foreign travel from Leverettines. What could the L. gov’t do to taxes, to maintain previous x-rate? Further study guide hints: Chapters 3 and 6 S – national savings – can be affected by changes in the government deficit (T – G) or changes in personal saving, which will be affected by demographic factors like age, but not redistribution (Robin Hood). I is affected by technology, ‘animal spirits’, business taxes. In Chapt 6, I is also affected by the international (real) interest rate. NX – net exports – is affected by tariffs and technology. Also, for chapter 4, where the money multiplier = (1 + cr)/(rr + cr) there are obvious leads to trace through the impact on the money supply of changes in either cr or rr. Appendix Figure 6.20 P. 171 How the Net Capital Outflow Depends on the Interest Rate Figure 5.16 p. 154 Two Special Cases Mankiw: Macroeconomics, Seventh Edition Copyright © 2010 by Worth Publishers Appendix –previous edition Figure 5.17 p. 156. The Market for Loanable Funds in the Large Open Economy Figure 5.18 p. 156. The Market for ForeignCurrency Exchange in the Large Open Economy Figure 5.19 p. 157. The Equilibrium in the Large Open Economy Figure 5.20 p. 159. A Reduction in National Saving in the Large Open Economy Figure 5.21 p. 159. An Increase in Investment Demand in the Large Open Economy 2010 by Worth Publishers Figure 5.22 p. 160 An Import Restriction in the Large Open Economy Figure 5.23 p. 161. A Fall in the Net Capital Outflow in the Large Open Economy Mankiw: Macroeconomics, Seventh Edition Copyright © 2010 by Worth Publishers Figure 5.16 (a) Two Figure 5.16 (b) Two