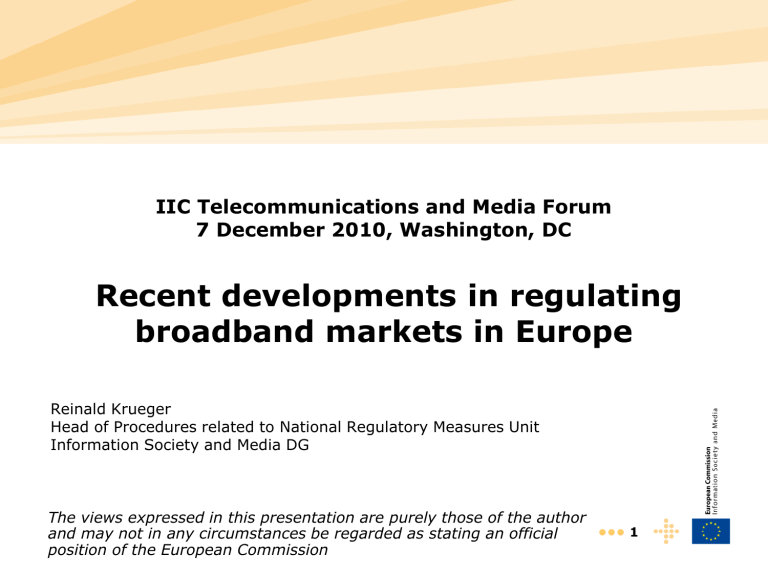

Broadband strategy & regulatory approach

IIC Telecommunications and Media Forum

7 December 2010, Washington, DC

Recent developments in regulating broadband markets in Europe

Reinald Krueger

Head of Procedures related to National Regulatory Measures Unit

Information Society and Media DG

The views expressed in this presentation are purely those of the author and may not in any circumstances be regarded as stating an official position of the European Commission

••• 1

Outline

•

Digital Agenda for Europe

•

Broadband strategy & regulatory approach

– Market-based regulation in the EU

– NGA Recommendation (next generation access)

•

Current fibre regulation in the EU

•

Outlook

••• 2

Digital Agenda for Europe

(Context)

•

One of seven lead initiatives of the Europe

2020 strategy

•

Aim:

• overcoming the crisis

• preparation for the challenges of the century

•

Function:

• work plan for the European Commission

• cross-portfolio approach

••• 3

Digital Agenda for Europe

(Priority areas)

• Creating a digital Single Market

• Enhancing the interoperability of ICT products

• Increasing trust and security of the Internet

• Establishment of faster Internet connections

• Increasing investment in research and development

• Enhancing digital literacy and skills

• Use of ICT to master societal challenges

••• 4

Digital Agenda for Europe

(Targets & Actions)

• EU2020 strategy:

• faster Internet as a basis for growth, productivity & social integration

• Targets:

• 2013:Broadband for all Europeans

• 2020:30 Mbit/s for all Europeans (50% of subscriber lines > 100 Mbit/s)

• Actions :

European Broadband Strategy

Foster investment in fibre rollout

(Measures in the area of spectrum policy)

••• 5

Broadband strategy & regulatory approach

(Fixed broadband subscribers by technology)

••• 6

Broadband strategy & regulatory approach

(Broadband fixed lines in international comparison)

••• 7

Broadband strategy & regulatory approach

(Market-based regulation in the EU - 1)

• Technological neutrality: what counts?

– Substitutability analysis (competition law principles)

– Competitive situation in the market

• Sector-specific regulation: when & for how long?

– In relevant markets which meet specific criteria

(the “three-criteria-test”!)

– In-built transition to “competition-law-only scenario”

• Interaction between national regulators and Commission

– Market analyses by NRAs using COM Recommendation on relevant markets

– Oversight by Commission with intervention possibilities

– BEREC

••• 8

Broadband strategy & regulatory approach

(Market-based regulation in the EU - 2)

• Stage 1:

Identify markets susceptible to ex ante regulation (“3 criteria test”)

– High and non-transitory entry barriers

– No tendency towards effective competition

– Insufficiency of competition law

• Stage 2:

Identify dominant operator (“SMP test”)

– Dominance concept under competition law

– Single or joint dominance

• Stage 3:

Impose regulatory remedies

– On dominant operator

– Regulatory toolbox in Directives

••• 9

Broadband strategy & regulatory approach

(Deregulation and remaining bottlenecks)

Source: European Commission, DG Information Society and Media as of 25/11/2010

••• 10

Broadband strategy & regulatory approach

(Fixed broadband lines - technology market shares)

Fixed broadband lines - technology market shares, July 2010

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

BE BG CZ DK DE EE EL ES FR IE IT CY LV LT LU HU MT NL AT PL PT RO SI SK FI SE UK EU

Other % 1% 56% 40% 15% 1% 36% 0% 1% 0% 12% 2% 0% 49% 59% 1% 14% 4% 3% 2% 22% 5% 57% 16% 44% 10% 25% 0% 6%

Cable modem % 44% 12% 22% 26% 10% 21% 0% 18% 4% 17% 0% 7% 8% 8% 17% 44% 46% 38% 29% 27% 40% 15% 24% 10% 15% 20% 21% 16%

DSL lines % 55% 32% 38% 59% 89% 43% 100% 80% 95% 71% 98% 92% 43% 33% 82% 42% 50% 59% 69% 51% 55% 28% 60% 45% 75% 55% 79% 78%

••• 11

Broadband strategy & regulatory approach

(NGA Recommendation - principles)

• Regulatory certainty through common EU approach

• Observed differences

• Cost of non-Europe

• Support of investment in fibre rollout while safeguarding competition

• Guidance for national regulatory authorities

• General principles for NGA regulation in each Member State

• Variation possibility for national/regional characteristics

• Primacy of market-based approach

• What is the state of competition observed?

• Forward-looking approach

••• 12

Broadband strategy & regulatory approach

(Fixed broadband lines by type of operator - 1)

Fixed broadband lines - operator market shares at EU level, January 2006 - July 2010

100,0%

90,0%

80,0%

70,0%

60,0%

50,0%

40,0%

30,0%

20,0%

10,0%

0,0%

50,3%

49,7%

Jan-06

Incumbents

52,3%

47,7%

Jul-06

53,1%

46,9%

Jan-07

New entrants

53,2%

46,8%

Jul-07

53,9%

46,1%

Jan-08

54,3%

45,7%

Jul-08

54,5%

45,5%

Jan-09

54,8%

45,2%

Jul-09

55,0%

45,0%

Jan-10

56,0%

44,0%

Jul-10

••• 13

Broadband strategy & regulatory approach

(Fixed broadband lines by type of operator - 2)

Fixed broadband lines - operator market shares, July 2010

100,0%

90,0%

80,0%

70,0%

60,0%

72% 72%

68% 67%

64% 62%

59% 57% 56%

56% 55% 54% 54% 52%

52% 51% 50% 49%

48% 48% 47% 46%

45%

38%

34% 32%

24%

EU average

50,0%

40,0%

30,0%

20,0%

10,0%

28% 28%

32% 33%

36% 38%

41% 43% 44%

44% 45% 46% 46% 48%

48% 49% 50% 51%

52% 52% 53% 54%

55%

62%

66% 68%

76%

0,0%

RO UK BG CZ PL SE HU NL SK FR SI PT DE BE MT IE LT LV EL EE AT ES IT DK LU FI CY

Incumbents New entrants

••• 14

Broadband strategy & regulatory approach

(Fixed broadband lines by type of operator - 3)

Fixed broadband share in the net adds by operator at EU level, January 2006 - July 2010

Incumbents New entrants

100,0%

90,0%

80,0%

70,0%

60,0%

50,0%

40,0%

30,0%

20,0%

10,0%

0,0%

58,4%

41,6%

64,3%

35,7%

58,1%

41,9%

53,7%

46,3%

60,7%

39,3%

60,0%

40,0%

57,8%

42,2%

59,8%

40,2%

62,0%

38,0%

Jan-06 Jul-06 Jan-07 Jul-07 Jan-08 Jul-08 Jan-09 Jul-09 Jan-10

82,9%

17,1%

Jul-10

••• 15

Broadband strategy & regulatory approach

(NGA Recommendation – market definition & dominance)

• As a matter of principle, fibre access seen as substitute to copper access

• Substitutability analysis

• Market 4: Wholesale physical infrastructure (LLU access)

• Market 5: Wholesale broadband access (bitstream access)

• Focus on remedies for SMP operators, but:

• Insisting on technological neutrality

• No regulation in markets with sufficient competition

• Co-investment & competition in downstream markets

• Access conditions

••• 16

Broadband strategy & regulatory approach

(New entrants` DSL lines by type of access)

New entrants` DSL lines by type of access at EU level, July

2007 - July 2010

30.000.000

25.000.000

20.000.000

15.000.000

10.000.000

5.000.000

0

Full ULL

Shared access

Bitstream

Resale

Jul-10

Jul-09

Jul-08

Jul-07

••• 17

Broadband strategy & regulatory approach

(NGA Recommendation – remedies)

• Imposition of access obligations recommended for:

• Ducts

• Terminating segments in the case of FTTH

• Unbundled fibre loops

• Co-location and backhaul

• Exception possible where several infrastructures prevail with competitive access

• In principle, cost-oriented access, but investment risk is considered

• risk premium

• price flexibility

• Co-investment

• More flexibility for bitstream access

• Functional separation

• Margin squeeze test

••• 18

Broadband strategy & regulatory approach

(NGA Recommendation – symmetric remedies & migration)

•

Possibility to impose “symmetric” measures

• Irrespective of SMP finding

• In-building wiring

• Shared access

•

Migration from copper to fibre networks

• Transparency

• Appropriate migration path to be negotiated between parties

• Access seekers to be informed sufficiently prior to decommissioning of points of interconnection

••• 19

Current fibre regulation in the EU

• Market definition – who is competing on the basis of which technology?

• Which access obligation?

• Which type of access price regulation?

• Migration obligations!

••• 20

Outlook

•

Implementation of NGA Recommendation

•

Enlarged supervision of Commission over national regulatory remedies

•

Guidance on access prices

– Cost methodology

– Static and dynamic consistency

•

Guidance on non-discrimination obligations

– Consistency and effectiveness

– Functional separation

••• 21

Thank you for your attention !

••• 22