Presentation - Bison Advantage | Workshop

advertisement

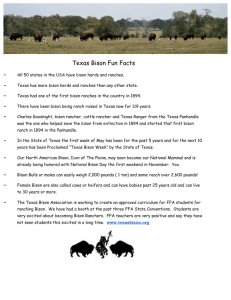

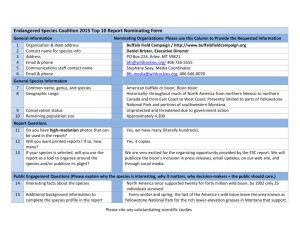

State of the Bison Business A Report from the National Bison Association Bison Advantage Workshop November 2011 Today’s U.S. bison business • 4,450 U.S. farms with 198,000 bison – Average herd of 44 animals • • • • Processing handled in small plants Major distributors now carry bison Major marketers focus on selected markets Market evenly divided between foodservice and retail Of bison and beef Beef Bison • Per-capita consumption of beef is 67 lbs. • 125,000 animals processed under USDA inspection daily • USDA-administered checkoff program generates $82 million for promotion and research yearly • Per-capita consumption of bison is 0.1 lb. • 52,900 animals processed under USDA inspection for all of 2010 • Voluntary checkoff generates roughly $50,000 yearly Prices strong at 2011 annual NBA sale $9,000 Ave. 2010 $3,000 Ave. 2011 $2,000 $1,000 2 Yr Old Bulls Yearling Bulls Bull Calves 2 Yr Heifers Yearling Heifers Heifer Calves $- Prices Per Animal Per Lb. 2009 Per Lb. 2010 Per Lb. 2011 Price Per Lb. Bull Calves $4,000 Yearling Bulls Ave. 2009 2 Yr Old Bulls $5,000 Heifer Calves $6,000 Yearling Heifers $7,000 $9.00 $8.00 $7.00 $6.00 $5.00 $4.00 $3.00 $2.00 $1.00 $- 2 Yr Heifers $8,000 Steady/strong growth • Young Bull prices up 213% over 2006 • Young heifer prices up 229% over 2006 • Tight supply limiting market growth $400.00 $350.00 $300.00 $250.00 $200.00 $150.00 $100.00 $50.00 $0.00 Beef Slaughter Price (Cwt.) Bison Bull Slaughter Price (Cwt.) Sept. Sept. Sept. Sept. Sept. Sept. Sept. 2005 2006 2007 2008 2009 2010 2011 Beef Oct. 2011 Source: USDA Crop & Livestock Reporting Service $400.00 $350.00 $300.00 $250.00 Beef Slaughter Price (Cwt.) Bison Heifer Slaughter Price (Cwt.) $200.00 $150.00 $100.00 $50.00 $0.00 Sep. 2005 Sep. 2006 Sep. 2007 Sep. 2008 Sep. 2009 Sep. 2010 Sep. 2011 Heifers Oct 2011 USDA monthly bison report YTD Processing male/female • 2009 YTD – 56% male 44% female • 2010 YTD – 58% male 42% female • 2011 YTD – 63% male 37% female Supply limiting market growth • Retail/foodservice sales estimated at $235.5 million in 2010 • Increase of 4.6% over 2009 • But…6.5% fewer bison processed in 2010 • Adjusted growth of 11.9% Source: NBA Annual Market Overview Annual Bison Slaughter - USDA Inspected 2000 60000 2001 50000 2003 2002 2004 40000 2005 30000 2006 2007 20000 2008 2009 10000 2010 0 Source USDA NASS How serious is the shortage? • 78% of marketers are shorting customers more than 10% • 40% of marketers are shorting customers more than 20% • Half of marketers feel they could sell at least 25% more product at today’s prices, if it were available. • We’re asking customers to be patient while we grow the herds Addl. marketing opportunities • Value-Added Products – Leather – Pet Food/treats – Bison Wool – Skulls – manure • Agri-Tourism – Hunts A future of opportunity • Affordable Start-Up • Profitable, growing markets • Producing a product, not a commodity • Connecting with consumers • NBA Resources • Willing mentors Bison Producers’ Handbook • 30+ authors • Experts from U.S. and Canada • All new information • Best resource available • Special FFA convention price!! On-Line Resources A new generation NBA resources • • • • • Mentors Workshops Bison 101/201 Junior Judging Business Planning Assistance and Thank You!! www.bisoncentral.com david@bisoncentral.com