2011 - Bapepam

advertisement

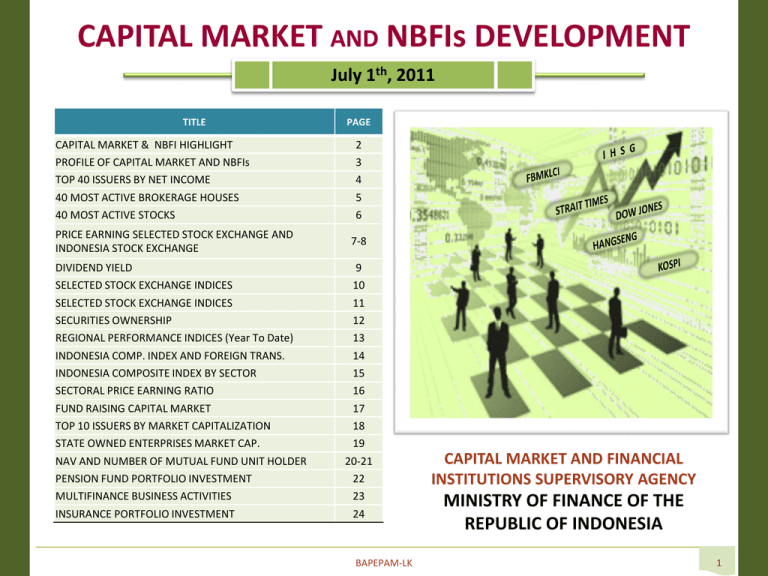

CAPITAL MARKET AND NBFIs DEVELOPMENT July 1th, 2011 TITLE CAPITAL MARKET & NBFI HIGHLIGHT PROFILE OF CAPITAL MARKET AND NBFIs TOP 40 ISSUERS BY NET INCOME 40 MOST ACTIVE BROKERAGE HOUSES 40 MOST ACTIVE STOCKS PRICE EARNING SELECTED STOCK EXCHANGE AND INDONESIA STOCK EXCHANGE DIVIDEND YIELD SELECTED STOCK EXCHANGE INDICES SELECTED STOCK EXCHANGE INDICES SECURITIES OWNERSHIP REGIONAL PERFORMANCE INDICES (Year To Date) INDONESIA COMP. INDEX AND FOREIGN TRANS. INDONESIA COMPOSITE INDEX BY SECTOR SECTORAL PRICE EARNING RATIO FUND RAISING CAPITAL MARKET TOP 10 ISSUERS BY MARKET CAPITALIZATION STATE OWNED ENTERPRISES MARKET CAP. NAV AND NUMBER OF MUTUAL FUND UNIT HOLDER PENSION FUND PORTFOLIO INVESTMENT MULTIFINANCE BUSINESS ACTIVITIES INSURANCE PORTFOLIO INVESTMENT PAGE 2 3 4 5 6 7-8 9 10 11 12 13 14 15 16 17 18 19 20-21 22 23 24 BAPEPAM-LK CAPITAL MARKET AND FINANCIAL INSTITUTIONS SUPERVISORY AGENCY MINISTRY OF FINANCE OF THE REPUBLIC OF INDONESIA 1 CAPITAL MARKET AND NBFI HIGHLIGHT End of December 2008 – July 1th ,2011 2008 Indonesian Composite Index Equity Market Capitalization (Trillion IDR) Corporate Bonds Outstanding (Trillion IDR) Government Bonds Outstanding (Trillion IDR) Total Securities Market Capitalization to GDP (%) Equity Market Cap to GDP (%) Corp. Bonds to GDP (%) Gov. Bonds to GDP (%) Net Asset Of Mutual Fund (Trillion IDR) Number of Mutual Funds Number of Issuers: Equity (Emiten) Bonds (Emiten Corporate) Net Asset Pension Fund (Trillion IDR) Multifinance Asset (Trillion IDR) Insurance Asset (Trillion IDR) 2009 2010 July 1st,2011 Change (%) Ytd 1.355,41 2.534,36 3.703,51 3.927,10 6.04 1.076,49 2.019,38 3.247,10 3.532,56 8.79 73.41 88,33 115,35 129.63 12.38 534.46 574,66 641,21 686.49 7.06 33,8 47,78 62,33 67.73 8.65 21,73 35,97 50,55 55.02 8.84 1,47 1,57 1,80 2.02 12.38 10,61 10,24 9,98 10.69 7.06 74.07 112,98 149,10 157.06 5.34 567 610 558 632 13.26 476 491 515 523 1.55 179 184 188 191 1.60 90,35 112,5 130.00* - 0.00 168,5 174,4 230,3* 250,77** 8.89 243,23 321,09 399,69* - 0.00 Source: Bapepam-LK, Bloomberg, IDX, E-Monitoring *) unaudited **) Per April 2011 unaudited • Indikator utama pasar modal dan lembaga keuangan bukan bank yang menunjukkan perkembangan IHSG, kapitalisasi pasar, rasio kapitalisasi pasar terhadap GDP, obligasi (korporat dan pemerintah) yang beredar, aktiva bersih reksadana, jumlah perusahaan yang menerbitkan saham dan obligasi, aktiva bersih dana pensiun, kegiatan pembiayaan, dan total nilai aset asuransi. BAPEPAM-LK 2 Profile of Indonesian Capital Markets and NBFIs July 1st ,2011 Capital Markets (July 1st 2011) : 141 Insurance Companies (Q4-2010/Unaudited): Assets = Rp399.69 trillion (6.22% of GDP 2010) Investment = Rp356.32 trillion (5.55% of GDP 2010) 272 Pension Funds (Semester II-2010): Net Assets = Rp130.00 trillion (2.02% of GDP 2010) Investment = Rp125.43 trillion (1.95% of GDP 2010) 192 Multifinance Companies (April 2011/Unaudited): Total asset = Rp250.77 trillion (3.90% of GDP 2010) Financing Activity = Rp203.39 trillion (3.17% of GDP 2010) 426 listed companies at Indonesia Stock Exchange with market capitalization reached Rp 3.532.56 trillion (55.02% of GDP 2010) In 2010, 188 corporate bond issuers with total value of issuance at Rp215.13 trillion (3.35% of GDP 2010) – in 2011, there is 24 corporate bonds issuance (Rp27.01 trillion) 99 Inv Mgrs and 632 Mutual Funds with NAV of Rp157.06 trillion (2.45% of GDP 2010) 147 Securities Firms Average Daily Trading Value at IDX is Rp4.99 trillion/day Source: Bapepam-LK, Notes: GDP 2010 = Rp.6422 triliun Profil jumlah emiten, manajer investasi, dan perusahaan efek per 1 Juli 2011; perusahaan asuransi per triwulan IV-2010, dana pensiun per Semester II-2010, dan perusahaan pembiayaan per April 2011. BAPEPAM-LK 3 TOP 40 ISSUERS BY NET INCOME (Billion IDR) Quarter 1-2007 --- Quarter 1-2011 N0 ISSUERS 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 TLKM IJ Equity ASII IJ Equity BBRI IJ Equity ANTM IJ Equity BBCA IJ Equity BMRI IJ Equity UNVR IJ Equity PGAS IJ Equity ISAT IJ Equity BDMN IJ Equity GGRM IJ Equity BBNI IJ Equity SMGR IJ Equity TINS IJ Equity AALI IJ Equity UNTR IJ Equity KLBF IJ Equity PTBA IJ Equity PNBN IJ Equity SMAR IJ Equity INDF IJ Equity EXCL IJ Equity SMMA IJ Equity MEGA IJ Equity BNII IJ Equity INTP IJ Equity TSPC IJ Equity ADMF IJ Equity BBKP IJ Equity LPKR IJ Equity LSIP IJ Equity PNLF IJ Equity BNLI IJ Equity BHIT IJ Equity NISP IJ Equity CPRO IJ Equity PNIN IJ Equity BMTR IJ Equity AUTO IJ Equity CTRS IJ Equity TOTAL GRAND TOTAL Q1-2007 N0 3,042.21 1,275.47 1,224.72 1,073.32 1,061.56 1,026.40 535.82 514.50 483.88 482.08 404.31 400.31 329.92 314.32 268.85 248.11 222.89 198.75 195.57 187.57 177.31 175.82 144.38 118.97 115.43 112.50 106.93 101.70 100.84 94.99 91.32 86.19 84.53 84.09 81.89 76.80 73.44 73.39 61.34 54.06 15,506.49 16,504.07 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 ISSUERS Q1-2008 N0 TLKM IJ Equity ASII IJ Equity BBRI IJ Equity BMRI IJ Equity BBCA IJ Equity AALI IJ Equity UNVR IJ Equity ANTM IJ Equity ISAT IJ Equity PGAS IJ Equity BDMN IJ Equity SMGR IJ Equity UNTR IJ Equity TINS IJ Equity SMAR IJ Equity INTP IJ Equity INDF IJ Equity GGRM IJ Equity ULTJ IJ Equity EXCL IJ Equity PTBA IJ Equity LSIP IJ Equity PNBN IJ Equity JSMR IJ Equity SGRO IJ Equity SMMA IJ Equity BNLI IJ Equity ADMF IJ Equity KLBF IJ Equity TRUB IJ Equity AUTO IJ Equity UNSP IJ Equity BBNI IJ Equity MEGA IJ Equity GJTL IJ Equity SMCB IJ Equity TBLA IJ Equity BISI IJ Equity PNLF IJ Equity TSPC IJ Equity 3,207.33 2,249.00 1,408.46 1,389.40 1,151.06 827.05 703.20 675.39 613.87 570.36 562.68 518.65 516.54 487.29 422.66 377.03 373.53 336.13 323.56 319.92 286.39 250.52 205.84 188.99 188.65 174.75 174.05 173.44 171.68 169.36 166.08 165.04 153.26 151.93 142.49 138.17 128.23 124.54 121.89 112.68 TOTAL GRAND TOTAL 20,421.08 24,026.64 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 ISSUERS TLKM IJ Equity ASII IJ Equity BBRI IJ Equity BBCA IJ Equity BMRI IJ Equity PGAS IJ Equity PTBA IJ Equity UNTR IJ Equity GGRM IJ Equity UNVR IJ Equity SMGR IJ Equity BBNI IJ Equity INTP IJ Equity INDY IJ Equity BDMN IJ Equity ADMF IJ Equity SMMA IJ Equity AALI IJ Equity KLBF IJ Equity JSMR IJ Equity TPIA IJ Equity BNLI IJ Equity CPIN IJ Equity MEGA IJ Equity TURI IJ Equity TSPC IJ Equity AUTO IJ Equity PNBN IJ Equity ISAT IJ Equity MLBI IJ Equity BYAN IJ Equity INDF IJ Equity LPKR IJ Equity BAEK IJ Equity LSIP IJ Equity BBKP IJ Equity JRPT IJ Equity ANTM IJ Equity BCIC IJ Equity JPFA IJ Equity TOTAL GRAND TOTAL Q1-2009 N0 2,457.88 1,875.00 1,718.62 1,631.94 1,400.40 1,219.57 920.57 812.33 780.49 769.06 681.13 635.24 502.72 451.37 393.13 293.98 269.20 217.72 212.88 196.54 192.80 165.36 143.78 143.54 140.28 134.41 132.30 130.73 119.52 114.52 113.22 110.44 108.47 103.65 103.14 97.40 96.56 89.88 85.20 78.57 19,843.53 16,798.83 BAPEPAM-LK 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 ISSUERS ASII IJ Equity TLKM IJ Equity BBRI IJ Equity BMRI IJ Equity BBCA IJ Equity PGAS IJ Equity BBNI IJ Equity UNVR IJ Equity GGRM IJ Equity UNTR IJ Equity SMGR IJ Equity INTP IJ Equity BDMN IJ Equity INDF IJ Equity EXCL IJ Equity GIAA IJ Equity CPIN IJ Equity SMAR IJ Equity PNBN IJ Equity PTBA IJ Equity ICBP IJ Equity ADMF IJ Equity JSMR IJ Equity INDY IJ Equity ISAT IJ Equity AUTO IJ Equity AALI IJ Equity SMMA IJ Equity BNLI IJ Equity KLBF IJ Equity GJTL IJ Equity MEGA IJ Equity POLY IJ Equity PNLF IJ Equity BNII IJ Equity SMCB IJ Equity ANTM IJ Equity MNCN IJ Equity BBTN IJ Equity MLIA IJ Equity TOTAL GRAND TOTAL Q1-2010 N0 3,014.00 2,776.59 2,150.60 2,003.44 1,931.01 1,770.97 1,025.82 971.78 927.79 907.45 802.49 786.36 700.56 631.87 598.43 448.46 447.69 439.07 420.17 373.03 368.07 332.71 303.07 291.74 277.99 277.98 271.98 270.03 268.58 256.30 246.48 236.01 227.23 211.15 208.45 204.92 201.94 191.61 187.85 168.15 28,129.82 34,281.67 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 ISSUERS ASII IJ Equity BMRI IJ Equity BBRI IJ Equity TLKM IJ Equity PGAS IJ Equity BBCA IJ Equity AKRA IJ Equity UNTR IJ Equity BBNI IJ Equity GGRM IJ Equity UNVR IJ Equity SMGR IJ Equity INTP IJ Equity BDMN IJ Equity PTBA IJ Equity EXCL IJ Equity INDF IJ Equity AALI IJ Equity CPIN IJ Equity BYAN IJ Equity SMAR IJ Equity APOL IJ Equity UNSP IJ Equity SMMA IJ Equity ISAT IJ Equity ICBP IJ Equity BORN IJ Equity POLY IJ Equity LSIP IJ Equity ADMF IJ Equity JSMR IJ Equity TINS IJ Equity ANTM IJ Equity GJTL IJ Equity BNLI IJ Equity KLBF IJ Equity PNBN IJ Equity HRUM IJ Equity BTPN IJ Equity JPFA IJ Equity TOTAL GRAND TOTAL Q1-2011 4,303.00 3,780.06 3,260.43 2,828.30 2,101.04 2,016.48 1,812.33 1,297.75 1,252.06 1,100.25 998.10 870.89 865.30 762.66 760.33 756.05 735.61 654.03 653.26 636.96 584.08 568.78 560.32 528.02 453.89 433.50 425.91 410.71 393.86 387.64 372.60 354.67 346.56 331.71 321.12 315.92 310.22 309.05 271.87 263.03 39,388.36 39,999.69 4 40 MOST ACTIVE BROKERAGE HOUSES IN TOTAL VALUE (Million IDR) April 1st, 2011 to July 1st, 2011 No 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 ID Credit Suisse Securities Indonesia J.P. Morgan Securities Indonesia Kim Eng Securities Bahana Securities CIMB-GK Securities Indonesia Deutsche Securities Indonesia CLSA Indonesia UBS Securities Indonesia eTrading Securities Macquarie Capital Securities Indonesia OSK Nusadana Securities Indonesia Mandiri Sekuritas Ciptadana Sekuritas Recapital Securities Danareksa Sekuritas Merrill Lynch Indonesia Indo Premier Securities BNI Securities Valbury Asia Securities Trimegah Securities Tbk Bhakti Securities UOB Kay Hian Securities Lautandhana Securindo Sinarmas Sekuritas Phillip Securities Indonesia Panin Sekuritas Kresna Graha Sekurindo Citogroup Securities Indonesia Reliance Securities Batavia Prosperindo Sekuritas Waterfront Securities Indonesia Arab-Malaysian Capital Indonesia Henan Putihrai BNP Paribas Securities Indonesia DBS Vickers Securities Indonesia Mega Capital Indonesia Hortus Danavest Andalan Artha Advisindo Sekuritas Semesta Indovest Samuel Sekuritas Indonesia SUB TOTAL TOTAL Buy Sell Overall % of Total 17.182.120,66 22.365.454,51 14.754.072,76 16.145.527,84 14.915.750,42 14.556.035,25 12.588.277,42 10.661.881,98 9.789.221,89 9.168.229,92 8.258.607,18 9.314.920,69 8.489.932,60 1.455.816,44 7.549.998,65 7.946.458,07 6.706.136,94 4.708.720,48 4.855.637,45 4.030.605,66 4.299.712,34 3.918.563,04 3.893.204,39 2.971.791,73 3.935.943,54 3.158.960,68 2.763.010,52 2.814.702,75 2.740.712,01 2.605.163,61 2.478.623,14 2.679.532,81 2.925.400,86 2.313.586,69 2.481.864,81 2.256.659,26 1.918.249,73 1.619.879,27 1.450.637,64 1.636.847,44 16.292.021,55 9.152.105,73 15.833.626,06 14.429.178,53 14.218.906,35 10.077.627,73 11.544.900,82 10.129.161,11 9.623.686,44 9.446.552,41 9.604.077,78 8.212.101,84 8.500.539,57 15.002.032,34 8.089.426,87 7.679.876,15 7.329.234,28 5.556.293,22 4.888.063,13 4.859.791,45 4.496.197,24 4.481.867,19 4.080.456,01 4.985.245,55 3.945.446,90 2.991.795,19 3.205.582,00 3.080.073,10 2.809.658,05 2.555.484,70 2.558.852,45 2.275.151,16 1.898.146,39 2.500.624,92 2.126.601,42 2.205.973,95 2.016.533,46 1.851.367,16 1.875.063,94 1.654.058,78 33.474.142,21 31.517.560,24 30.587.698,82 30.574.706,37 29.134.656,77 24.633.662,97 24.133.178,24 20.791.043,09 19.412.908,32 18.614.782,33 17.862.684,96 17.527.022,53 16.990.472,16 16.457.848,78 15.639.425,52 15.626.334,22 14.035.371,22 10.265.013,70 9.743.700,58 8.890.397,11 8.795.909,58 8.400.430,23 7.973.660,41 7.957.037,28 7.881.390,44 6.150.755,87 5.968.592,52 5.894.775,84 5.550.370,05 5.160.648,31 5.037.475,58 4.954.683,97 4.823.547,25 4.814.211,61 4.608.466,22 4.462.633,21 3.934.783,19 3.471.246,43 3.325.701,58 3.290.906,22 5,62 5,29 5,14 5,14 4,89 4,14 4,05 3,49 3,26 3,13 3,00 2,94 2,85 2,76 2,63 2,62 2,36 1,72 1,64 1,49 1,48 1,41 1,34 1,34 1,32 1,03 1,00 0,99 0,93 0,87 0,85 0,83 0,81 0,81 0,77 0,75 0,66 0,58 0,56 0,55 260.306.453,07 297.665.401,54 258.063.382,92 297.665.402,30 518.369.835,93 595.330.803,67 87,07 100,00 BAPEPAM-LK Source: Stockwatch 5 40 MOST ACTIVE STOCKS BY TOTAL TRADING VALUE April 1st, 2011 to July 1st, 2011 No Code Stock ID 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 BUMI BMRI BBRI ASII ADRO TLKM UNTR PGAS BBNI ITMG ENRG BBCA LPKR INDF SMGR BORN PTBA BJBR ELTY KLBF BNBR INDY EXCL HRUM UNSP INTP GGRM DOID BDMN INCO LSIP TINS TRAM DEWA CPIN UNVR JSMR ANTM AKRA AALI BUMI Bumi Resources Tbk Bank Mandiri (Persero) Tbk. Bank Rakyat Indonesia (Persero) Tbk. Astra International Tbk. Adaro Energy Tbk Telekomunikasi Indonesia (Persero) Tbk. United Tractors Tbk. Perusahaan Gas Negara (Persero) Tbk. Bank Negara Indonesia (Persero) Tbk. Indo Tambangraya Megah Tbk. Energi Mega Persada Tbk Bank Central Asia Tbk. Lippo Karawaci Tbk Indofood Sukses Makmur Tbk Semen Gresik (Persero) Tbk Borneo Lumbung Energi & Metal Tbk Tambang Batubara Bukit Asam (Persero) Tb Bank Pembangunan Daerah Jawa Barat dan B Bakrieland Development Tbk Kalbe Farma Tbk Bakrie & Brothers Tbk Indika Energy Tbk XL Axiata Tbk Harum Energy Tbk Bakrie Sumatra Plantations Tbk. Indocement Tunggal Prakasa Tbk Gudang Garam Tbk Delta Dunia Makmur Tbk Bank Danamon Indonesia Tbk. International Nickel Indonesia Tbk. PP London Sumatra Indonesia Tbk. Timah (Persero) Tbk. Trada Maritime Tbk. Darma Henwa Tbk Charoen Pokphand Indonesia Tbk Unilever Indonesia Tbk. Jasa Marga (Persero) Tbk Aneka Tambang (Persero) Tbk AKR Corporindo Tbk. Astra Agro Lestari Tbk. Bumi Resources Tbk SUB TOTAL TOTAL value (IDR) 21.561.467.512.500 12.907.959.000.000 12.779.904.975.000 12.031.157.050.000 8.017.156.837.500 7.212.427.025.000 6.333.463.175.000 6.214.810.900.000 5.083.301.550.000 4.568.548.800.000 4.468.476.608.000 4.142.531.525.000 3.665.915.100.000 3.586.598.700.000 3.421.324.025.000 3.407.266.635.000 3.359.828.900.000 3.212.141.575.000 3.180.870.982.500 2.842.316.475.000 2.743.961.535.000 2.738.056.737.500 2.712.006.550.000 2.710.070.725.000 2.635.868.357.500 2.584.772.850.000 2.529.334.625.000 2.495.519.360.000 2.418.949.675.000 2.389.002.287.500 2.264.028.225.000 1.943.582.412.500 1.943.046.500.000 1.898.776.815.000 1.886.804.575.000 1.842.932.950.000 1.814.246.675.000 1.716.343.365.000 1.679.804.742.500 1.520.243.200.000 25.768.441.585.000 176.464.819.513.000 226.754.358.634.000 % of Total Value Freq (Times) 9,51 5,69 5,64 5,31 3,54 3,18 2,79 2,74 2,24 2,01 1,97 1,83 1,62 1,58 1,51 1,50 1,48 1,42 1,40 1,25 1,21 1,21 1,20 1,20 1,16 1,14 1,12 1,10 1,07 1,05 1,00 0,86 0,86 0,84 0,83 0,81 0,80 0,76 0,74 0,67 8,94 77,82 100,00 159.275 102.331 126.576 97.105 107.259 79.429 63.424 72.663 61.287 59.366 134.031 53.821 60.578 56.333 41.809 87.279 42.847 96.023 121.070 70.365 110.820 38.869 40.227 31.716 60.485 45.023 35.798 49.958 37.167 51.925 39.818 42.615 9.810 111.114 70.955 38.044 31.563 57.859 54.781 29.685 225572 % of Total Freq 2,33 1,50 1,86 1,42 1,57 1,16 0,93 1,07 0,90 0,87 1,96 0,79 0,89 0,83 0,61 1,28 0,63 1,41 1,77 1,03 1,62 0,57 0,59 0,46 0,89 0,66 0,52 0,73 0,54 0,76 0,58 0,62 0,14 1,63 1,04 0,56 0,46 0,85 0,80 0,44 2,83 2.681.103 6.822.156 39,30 100,00 Source: Stockwatch BAPEPAM-LK 6 PRICE EARNING RATIO SELECTED STOCK EXCHANGE January 1st , 2008 - July 1st,2011 (Daily) SINGAPORE 14.4869 HONGKONG 12.1800 MALAYSIA 15.6515 THAILAND 11.6669 DOW JONES 12.6613 PHILLIPINES 14.3193 Source: Bloomberg Perbandingan gerakan rasio harga dengan earning (kali), beberapa bursa diluar negeri, dari 1 Januari 2008 sampai 1 Juli 2011. BAPEPAM-LK 7 INDEX AND PRICE EARNING RATIO INDONESIA STOCK EXCHANGE January 2010 - July 1st, 2011 (Daily) Composite Index; 3.927.10 Average PER = 13.18 Source: Indonesia Stock Exchange Perbandingan gerakan Indeks dan rasio harga dengan earning, Bursa Efek Indonesia, dari bulan Januari 2010 sampai 1 Juli 2011 (Harian). BAPEPAM-LK 8 DIVIDEND YIELD SELECTED STOCK EXCHANGE January 1st , 2008 - July 1st , 2011 (Daily) S. EXCH DIV. YIELD SINGAPORE 2.8269 HONGKONG 2.9196 MALAYSIA 3.4759 THAILAND 3.7011 INDONESIA 2.0194 DOW JONES 2.4134 Source: Bloomberg Perbandingan gerakan dividend yield, antara bursa efek Indonesia (JCI) dengan beberapa bursa diluar negeri, dari 1 Januari 2008 sampai 1 Juli 2011 (dalam prosentase). BAPEPAM-LK 9 SELECTED STOCK EXCHANGE INDICES January 1st, 2008 – July 1st, 2011 STOCK EXCHANGE INDEX JCI 3.927,10 STI 3.139,01 KLCI 1.582,94 DOW JONES NIKKEI Indonesian stocks advanced, with the banchmark index rising to a record, after inflation in June slowed for a fifth straight month. 12.414,34 9.868,07 Source: Bloomberg Perbandingan gerakan IHSG dengan beberapa indeks bursa diluar negeri dari 1 Januari 2008 sampai 1 Juli 2011 BAPEPAM-LK 10 PERFORMANCE SELECTED STOCK EXCHANGE INDICES Jan 4th , 2010 – July 1st , 2011 JCI Indonesia 52.48 Korea 25.33 Malaysia 24.08 DAX 22.21 Dow Jones 17.29 Singapore 8.45 FTSE100 8.50 Hong Kong 1.09 Shenzhen -3.06 Tokyo -7.38 Shanghai -14.93 -30 -20 -10 0 10 20 30 40 50 60 % Source: Bloomberg Perbandingan presentase perubahan (dari 4 Januari 2010 sampai 1 Juli 2011), antara IHSG (JCI), dengan beberapa indeks bursa diluar negeri. BAPEPAM-LK 11 SECURITIES OWNERSHIP December 2004 – June 2011 Equity Domestic Corporate Bonds Foreign Domestic Govt Bonds Foreign Domestic Foreign Periode 2004 22.73% 77.27% 97.06% 2.94% 97.31% 2.69% 2005 26.95% 73.05% 94.18% 5.82% 92.22% 7.78% 2006 26.60% 73.40% 94.72% 5.28% 86.88% 13.12% 2007 33.65% 66.35% 95.42% 4.58% 83.64% 16.36% 2008 32.16% 67.84% 96.13% 3.87% 83.33% 16.67% 2009 32.76% 67.24% 96.80% 3.20% 81.44% 18.56% 2010 37.20% 62.80% 95.61% 4.39% 69.47% 30.53% January 37.54% 62.46% 96.05% 3.95% 70.00% 30.00% February Maret April May June 37.82% 37.03% 36.63% 37.54% 36.58% 62.17% 62.97% 63.37% 62.46% 63.42% 95.87% 96.02% 96.07% 95.27% 95.30% 4.13% 4.98% 3.93% 4.73% 4.70% 69.65% 69.65% 67.39% 67.22% 65.99% 30.35% 31.35% 32.61% 32.78% 34.01% 2011 Source: KSEI, BAPEPAMLK, DMO Komposisi kepemilikan antara pemodal dalam negeri dan pemodal luar negeri untuk saham, obligasi korporasi dan Obligasi Pemerintah dari Desember 2004 sampai Juni 2011. BAPEPAM-LK 12 Regional Performance Indices Dec. 2008; Dec. 2009, Dec. 2010; July 1st ,2011 Regional Market Dec. 2009 Dec. 2010 1,355.41 2,534.36 3,703.51 3,927.10 6.04 876.75 1,272.78 1,518.91 1,582.94 4.22 Korea 1,124.47 1,682.77 2,051.00 2,125.74 3.64 Shanghai 1,820.81 3,277.14 2,808.08 2,762.08 -1.64 Hong Kong 14,387.48 21,872.50 23,035.45 22,398.10 -2.77 Singapore 1,761.56 2,897.62 3,190.04 3,139.01 -1.60 Tokyo 8,859.56 10,546.44 10,228.92 9,868.07 -3.53 553.30 1,201.34 1,290.87 1,162.07 -9.98 JCI Indonesia Malaysia Shenzhen 01.07.11 % Year to date Dec. 2008 Source: Bloomberg Perbandingan nilai IHSG (JCI Indonesia) dengan beberapa indeks bursa di luar negeri pada Desember 2008, Desember 2009, Desember 2010 dan 1 Juli 2011. BAPEPAM-LK 13 INDONESIA COMP. INDEX AND FOREIGN TRANSACTION January 2009 – July 1st ,2011 (Monthly) JCI Index : 3,927.10 Net Buy IDR : 760.00 (billion) Source: Bloomberg Perbandingan antara gerakan IHSG dengan nilai transaksi jual dan beli pemodal asing, di bursa efek Indonesia, dari Januari 2009 sampai 1 Juli 2011 (Bulanan). BAPEPAM-LK 14 INDONESIA COMPOSITE INDEX BY SECTOR December 31st 2010 – July 1th , 2011 (Year to date) JAKARTA MISC INDUSTRIES 21.72 JAKARTA TRADE & SERVICE 11.19 JAKARTA FINANCE INDEX 10.45 JAKARTA CONSUMER GOODS 9.22 JAKARTA BASIC IND & CHEM 5.27 JAKARTA CNSTR PRP RL EST 2.41 JAKARTA AGRICULTURAL IDX 1.54 JAKARTA MINING INDEX JAKARTA INFRA UTIL TRANS -10.00 0.32 -5.77 -5.00 0.00 5.00 10.00 15.00 20.00 25.00 30.00 Source: Bloomberg Komposisi dari IHSG per sektor dalam prosentase, dari Desember 2010 sampai 1 Juli 2011. BAPEPAM-LK 15 SECTORAL PRICE EARNING RATIO (Times) Dec. 31st 2008; July 1th 2011 PRICE EARNING RATIO SECTORAL Dec. 31st 2008 Dec. 31st 2009 Dec. 30th,2010 July 1st, 2011 JAKARTA AGRICULTURAL INDEX 4.64 37.10 25.28 14.10 JAKARTA MISCELLANEOUS INDUSTRIES INDEX 6.26 24.56 14.41* 16.05 JAKARTA MINING INDEX 5.18 21.88 42.17 22.56 JAKARTA BASIC IND & CHEMICAL INDEX 9.57 31.92 14.13 14.23 JAKARTA TRADE AND SERVICE INDEX 6.31 9.15 15.69 17.52 JAKARTA INFRA., UTIL., TRANSPORTATION 8.94 25.32 23.60 21.26 JAKARTA CONSUMER GOODS INDEX 11.87 19.00 23.02 22.23 JAKARTA CONSTRUCTION PROPERTY AND REAL ESTATE INDEX 12.74 21.66 22.16 17.51 JAKARTA FINANCE INDEX 10.86 20.36 17.69 16.30 Source: Bloomberg *) as of June 14th 2010 Rasio harga dan earning berdasarkan sektor, dari 31 Desember 2008 sampai 1 Juli 2011. BAPEPAM-LK 16 FUND RAISING FROM CAPITAL MARKET 2007 - 2011 Type of Offerings 2007 2008 2009 2011 2010 (as of July 1th ) Value (Rp Tril) Num. of Issuers Value (Rp Tril) Num. of Issuers Value (Rp Tril) Num. of Issuers Value (Rp Tril) Num. of Issuers Value (Rp Tril) Num. of Issuers Equity IPO 17.18 24 23.48 17 4.08 13 29.56 23 11.23 13 Right Offering 29.80 25 55.46 25 15.67 15 48.67 31 24.30 12 Corporate Bonds 31,28 39 14.10 20 31.09 29 36.60 26 27.01 24 Total Private 78.26 88 93.04 62 50.85 57 114.83 80 62.54 49 Gov’tBonds (Gross Domestic) 86.4 86.9 101.7 136.6 66.80 164.66 179.94 152.55 251.43 129.34 Total Private + Gov’t Bonds Source: Bapepam-LK and DMO • Perkembangan jumlah perusahaan serta nilai dana yang diperoleh, melalui penawaran umum saham, penawaran terbatas saham, obligasi korporat, dan obligasi pemerintah, pada 2007, 2008, 2009, 2010 dan 1 Juli 2011. (Lampiran Num. of Issuers, hal. 25 dan 26) BAPEPAM-LK 17 TOP 10 ISSUERS BY MARKET CAPITALIZATION July 1th,2011 No. Code Issuers Rp Trillion % 1 ASII Astra International Tbk PT 265.37 7.51 2 BBCA Bank Central Asia Tbk PT 190.39 5.39 3 BMRI Bank Mandiri Tbk PT 168.63 4.77 4 BBRI Bank Rakyat Indonesia Persero Tbk PT 163.63 4.63 5 TLKM Telekomunikasi Indonesia Tbk PT 145.15 4.11 6 HMSP Hanjaya Mandala Sampoerna Tbk 127.10 3.60 7 UNVR Unilever Indonesia Tbk PT 114.07 3.23 8 PGAS Perusahaan Gas Negara PT 98.18 2.78 9 GGRM Gudang Garam Tbk PT 96.20 2.72 United Tractors Tbk PT 91.39 2.59 Top 10 Market Capitalization 1,540.07 43.60 Total Market Capitalization 3,532.56 100.00 10 UNTR Source: Bloomberg Daftar 10 perusahaan terbesar di bursa efek Indonesia berdasarkan nilai kapitalisasi pasar (dalam triliun rupiah) pada 1 Juli 2011. BAPEPAM-LK 18 STATE OWNED ENTERPRISES MARKET CAPITALIZATION July 1th, 2011 No. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 Code BMRI BBRI TLKM PGAS BBNI SMGR PTBA JSMR ANTM KRAS BBTN TINS GIAA WIKA PTPP KAEF ADHI INAF Issuers Bank Mandiri Tbk PT Bank Rakyat Indonesia Persero Tbk PT Telekomunikasi Indonesia Tbk PT Perusahaan Gas Negara PT Bank Negara Indonesia Persero Tbk PT Semen Gresik Persero Tbk PT Tambang Batubara Bukit Asam Tbk PT Jasa Marga PT Aneka Tambang Tbk PT Krakatau Steel Tbk PT Bank Tabungan Negara Tbk PT Timah Tbk PT Garuda Indonesia Tbk PT Wijaya Karya PT Pembangunan Perumahan Persero PT Tbk Kimia Farma Tbk PT Adhi Karya Tbk PT Indofarma Tbk PT SOE's Market Capitalization Total Market Capitalization Rp Trillion % 168.63 163.63 145.15 98.18 72.00 58.43 48.85 24.99 20.03 16.56 15.17 12.58 11.77 3.97 3.24 1.53 1.48 0.28 4.77 4.63 4.11 2.78 2.04 1.65 1.38 0.71 0.57 0.47 0.43 0.36 0.33 0.11 0.09 0.04 0.04 0.01 866.48 3,532.56 24.53 100.00 Source: Bloomberg Daftar 18 BUMN berdasarkan nilai kapitalisasi pasar terbesar (dalam triliun rupiah) di Bursa Efek Indonesia pada 1 Juli 2011. BAPEPAM-LK 19 NAV OF MUTUAL FUND 2004 - June ,2011 180 160 149.10 145.42 150.78 153.70 155.93 157.06 142.45 140 NAV (Rp Trillion) 112.98 120 104.04 92.19 100 74.07 80 51.62 60 29.41 40 20 2004 2005 2006 2007 2008 2009 2010 June May Apr Mar Feb Jan 0 2011 Period Saham Pasar Uang Campuran Pend. Tetap Terproteksi Indeks ETF-Saham ETF-Pend. Tetap Syariah Source: E-monitoring Reksa Dana Perkembangan nilai aktiva bersih reksadana (dalam triliun rupiah) berdasarkan jenisnya, dari 2004 sampai Juni 2011. (data Kebijakan Investasi Reksa Dana terlampir di hal. 27) BAPEPAM-LK 20 NUMBER OF MUTUAL FUND UNIT HOLDER 2004 – 2011 Number of Mutual Fund Unit Holder 500,000 450,000 400,000 350,000 300,000 250,000 200,000 150,000 100,000 50,000 2004 2005 2006 2007 2008 2009 foreign 2010 May April March February January 0 2011 domestic Source: E-monitoring Reksa Dana Perkembangan jumlah pemegang unit reksadana berdasarkan kepemilikan dalam negeri dan kepemilikan luar negeri, dari 2004 sampai Mei 2011. BAPEPAM-LK 21 SUMMARY OF PENSION FUND NET ASSET (Trillion IDR) End of 2006 – 2nd Semester 2010 A Description Number of PF (Unit) Net Assets 2006 297 77,70 2007 288 91,17 2008 281 90,35 2009 Sem II. 2010* 276 272 112,53 130,00 74,97 22,06 0,25 7,43 19,49 17,32 2,36 2,77 0,45 2,81 0,01 87,90 20,26 0,74 13,99 22,64 19,20 4,94 2,83 0,27 3,00 0,03 86,55 20,33 0,60 8,47 21,90 25,15 3,35 3,04 0,27 3,36 0,08 108,06 23,03 0,66 16,00 25,99 29,74 5,41 3,51 0,11 3,48 0,14 125,43 27,29 0,39 21,80 29,24 30,42 7,39 3,74 0,14 3,80 1,22 B Investment 1. Deposito** 2. SBI 3. Equity 4. Corporate bond 5. Gov Sec 6. Mutual Fund 7. Shares Contribution 8. Promissory Notes 9. Land, Building, Land and Building 10. Others *** C Non Investment 3,23 3,88 4,48 5,16 5,36 D Operasional Asset 0,12 0,13 0,12 0,12 0,13 E Other Assets 0,42 0,46 0,55 0,58 0,55 F Short Term Liabilities (0,50) (0,61) (0,68) (0,69) (0,74) * ) Unaudited ** ) Deposito + Deposito on call + Sertifikat Deposito *** ) Sukuk + Tabungan Source: BapepamLK Perkembangan jumlah dana pensiun (unit); nilai aktiva bersih (triliun rupiah) dari 2006 sampai Semester II - 2010. BAPEPAM-LK 22 SUMMARY OF MULTIFINANCE BALANCE SHEET (Trillion IDR) Period 2006 – March 2011 Description A B C D E F G H I J K L M N O P Q R S T Number of Companies (Unit) Total Assets Cash and Cash Equivalent Short-term Investment Financing Activities Leasing Factoring Credit Card Consumer Finance Equity Investment Long-term Investment Leased Asset Fixed Asset Deferred Tax Asset Other Assets Total Liabilities and Equity Current Liabilities Tax Payable Borrowing Domestic Foreign Issues Bonds Deferred Tax Liabilities Sub Ordinaries Debts Other Liabilities Capital Reserves Retained Earnings Current Profit 2006 2007 2008 2009 2010 Apr 2011 214 108,90 3,47 0,58 93,13 32,64 1,30 1,48 57,70 0,10 0,01 0,62 1,62 0,89 8,47 217 127,26 6,77 0,70 107,69 36,48 2,20 1,44 67,56 0,14 0,02 0,75 1,83 1,20 8,17 212 168,45 12,74 0,35 137,24 50,68 2,22 1,15 83,19 0,17 0,01 0,81 2,16 1,17 13,80 198 174,44 11,28 0,38 142,54 46,53 2,03 0,93 93,05 0,18 0,00 0,59 2,27 0,89 16,31 192 230,30 10,14 0,55 186,35 53,17 2,30 0,88 130,02 0,27 0,01 1,12 20,01 0,85 10,99 193 250,77 12,67 0,51 203,39 55,23 2,71 0,90 144,56 0,30 0,01 1,35 20,24 0,85 11,45 108,90 1,99 0,44 65,20 33,21 31,99 10,09 0,20 0,23 11,82 13,82 0,57 1,40 3,13 127,26 2,35 0,70 76,86 40,54 36,32 12,84 0,20 0,61 9,15 15,78 0,49 3,89 4,38 168,45 2,89 1,26 108,93 55,39 53,55 11,49 0,23 0,92 10,33 18,71 0,55 6,76 6,37 174,44 4,07 1,34 101,28 56,92 44,36 13,60 0,23 0,68 13,15 21,03 0,67 10,56 7,83 230,30 3,97 1,14 144,80 84,91 59,89 18,39 0,37 0,52 13,29 22,31 0,74 15,85 8,93 250,77 4,32 0,61 156,72 92,60 64,12 24,83 0,44 0,26 16,39 22,34 0,87 20,75 3,25 Source: LBPP Perkembangan jumlah perusahaan pembiayaan (unit); Neraca bulanan Perusahaan Pembiayaan (triliun rupiah) dari 2006 sampai April 2011. BAPEPAM-LK 23 SUMMARY OF INSURANCE ASSET 2006 – 4th Quarter 2010 (Trillion IDR) Description Number of Insurance Comp (unit) 2006 157 2007 148 2008 144 2009 Q4 2010* 141 141 A Total Assets 174,93 228,83 243,23 321,09 399,69 B 1 2 3 4 5 6 7 8 9 10 11 12 13 Investment Time Deposit and Certificate of Dep Stocks Bonds and MTN Government Securities Bank Indonesia Promissory Notes Mutual Fund Direct Placement Property Mortgage Loans Policy Loans Murabahah Financing Mudharabah Financing Other Investments 152,94 49,18 14,78 18,53 41,93 1,70 14,23 8,08 2,54 0,27 1,16 0,01 0,53 202,23 46,79 31,55 24,14 52,71 1,94 26,71 5,84 7,48 2,18 1,92 0,01 0,00 0,96 211,18 52,05 22,95 21,03 60,90 4,57 32,94 10,39 2,74 0,19 2,56 0,01 0,00 0,86 283,22 65,06 43,82 31,04 72,28 1,51 49,91 13,20 2,84 0,15 2,64 0,01 0,01 0,74 356,32 79,23 70,26 45,36 76,18 0,56 67,95 11,06 2,89 0,16 2,38 0,01 0,00 0,28 C 1 2 3 4 5 6 7 8 Non Investment Cash and Bank Premium Receivable Reinsurance Receivable Investment Yield Receivable Property Computer Hardware Other Fixed Assets Other Assets 22,00 1,87 5,04 1,36 1,58 2,29 0,36 0,64 8,86 26,60 3,33 5,74 1,85 1,84 2,67 0,41 0,70 10,04 31,16 3,70 7,20 1,70 2,29 2,07 0,29 0,83 13,09 37,67 3,47 15,06 2,08 2,98 2,86 0,54 1,06 9,62 43,38 4,60 16,58 2,55 3,36 3,22 0,44 1,06 11,57 * Unaudited Perkembangan jumlah perusahaan asuransi (unit); nilai aset, investasi dan non investasi (triliun rupiah), dari 2006 sampai triwulan IV 2010. BAPEPAM-LK 24