LERA Burton PowerPoint

advertisement

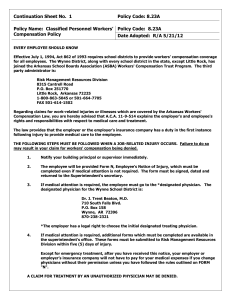

Labor and Employment Relations Association Annual Meeting St. Louis, Missouri June 7, 2013 John F. Burton, Jr. Professor Emeritus Rutgers University and Cornell University Workers and Employers Generally Dissatisfied with Tort Suits New Jersey and Wisconsin were the initial states to enact workers’ compensation statutes in 1911 U.S. Supreme Court interpretation of Commerce Clause precluded a federal law covering private sector and state and local government workers as of 1911 Although the constitutional limits on a federal program for private sector workers changed in the 1930, almost all private sector workers currently are covered by state workers’ compensation programs and there are no federal standards for these state programs Workers injured on the job do not need to prove that employer is negligent Workers’ compensation is exclusive remedy for workers for work-related injuries and diseases ◦ Workers can only receive benefits prescribed by workers’ compensation statute ◦ Workers cannot bring tort suits against employers (with very limited exceptions) Source: NASI (2012: Table 4) . $2.50 Benefits 2.18 2.16 2.13 2.17 Employer Costs 2.05 2.04 1.94 $2.00 1.86 1.83 1.79 1.76 1.67 1.71 1.70 1.71 1.66 1.64 1.58 1.57 1.50 1.49 $1.50 1.57 1.53 1.46 1.17 $1.00 1.04 1.05 1.23 1.29 1.56 1.49 1.65 1.65 1.38 1.35 1.34 1.45 1.43 1.33 1.47 1.29 1.23 1.35 1.34 1.26 1.17 1.09 1.13 1.12 1.06 1.16 1.13 1.10 1.13 1.09 0.99 0.96 0.97 0.95 0.97 1.02 0.99 $0.50 Source: National Academy of Social Insurance estimates. Benefits are payments in the calendar year to injured workers or to providers of their medical care. Costs are employer expenditures in the calendar year for workers' compensation benefits, administrative costs, or insurance premiums. Costs for self-insuring employers are benefits paid in the calendar year plus the administrative costs associated with providing those benefits. Costs for employers who purchase insurance include the insurance premiums paid during the calendar year plus the payments of benefits under large deductible plans during the year. The insurance premiums must pay for all of the compensable consequences of the injuries that occur during the year, including the benefits paid in the current as well as future years. 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1989 1988 1987 1986 1985 1984 1983 1982 1981 1980 $0.00 Source: National Academy of Social Insurance 2010 2008 2006 2004 2002 70 2000 1998 1996 1994 1992 1990 1988 1986 1984 1982 1980 1978 1976 1974 1972 1970 1968 1966 1964 1962 1960 Percentage share 80 Medical Benefits Cash Wage Replacement 60 50 40 30 20 10 0 35.0 32.1 30.0 25.0 20.0 17.7 18.2 17.9 15.0 10.7 10.0 5.3 5.0 1.9 1.8 0.0 0.0 -3.1 -5.0 -7.6 -10.0 1959-1965 1965-1970 1970-1975 1975-1980 1980-1985 1985-1990 1990-1995 1995-2000 2000-2005 2005-2010 Source: Burton and NCCI 2012. 2011 www.workerscompresources.com