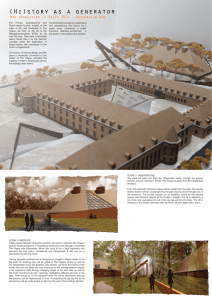

Optimal speed (knot)

advertisement

Speed optimisation Petter Haugen, Equity Research, Shipping, DNB Markets Bunker is now about 70% of the total cost Division between bunkers and hire Nicolay Dyvik +47 22 94 85 42 | nicolay.dyvik@dnbnor.no Øyvind Berle +47 22 94 94 55 | oyvind.berle@dnbnor.no Petter Haugen +47 22 94 89 15 | petter.haugen@dnbnor.no 40% 30% 20% 10% Assumptions/sources: VLCC, 92t/day at 15.9 knot (average in Clarksons World Fleet Register); 1 year TC-rates until year 2000 (Clarksons); Spot rates from 2001 until April 2012 (Poten&Partners) 2 2012 2010 2008 2004 0% 2002 2012 2010 2008 2006 2004 2002 2000 1998 1996 1994 1992 1990 0 50% 2000 20,000 60% 1998 40,000 70% 1996 60,000 80% 1994 80,000 90% 1992 100,000 1988 USD/day 120,000 90,897 108,357 140,000 1990 TC-hire TC-hire 100% 1988 Bunker Bunker Relative divition between vesel hire and bunkers 160,000 2006 140,199 Historic freight cost The basis for any speed optimisation model is the relationship between bunker consumption and vessel speed Theory (MAN) says that: 120 DNB new MAN 100 𝐶 = 𝑘𝑣 3.2 Consumption (tonne/day) 10% speed reduction = 30% consumption reduction Based on collected data we believe this is too generic and assume a higher fuel consumption for the same speed in our modelling 82 80 60 10% speed reduction = 20% consumption reduction 40 41 20 0 5 7 9 11 Speed (knot) Nicolay Dyvik +47 22 94 85 42 | nicolay.dyvik@dnbnor.no Øyvind Berle +47 22 94 94 55 | oyvind.berle@dnbnor.no Petter Haugen +47 22 94 89 15 | petter.haugen@dnbnor.no 13 15 17 Assumptions: VLCC consuming 92 tonne/day on 15.9 knot. 3 Speed optimisation = common sense Idea is simple: Reduce speed until the point of which the additional savings from bunker is equal to the additional cost of using extra days in sea 1.8 Bunker cost TC cost Optimal speed 1.4 10 knot Ballasting cost on TD3 (mUSD) 1.6 1.2 1.0 0.8 0.6 0.4 0.2 16 15 14 13 12 11 10 9 8 7 6 5 0.0 Vessel speed (knot) Nicolay Dyvik +47 22 94 85 42 | nicolay.dyvik@dnbnor.no Øyvind Berle +47 22 94 94 55 | oyvind.berle@dnbnor.no Petter Haugen +47 22 94 89 15 | petter.haugen@dnbnor.no Assumptions: Route is TD3, this is the ballast leg. VLCC consuming 92 tonne/day on 15.9 knot, TC-rate USD20,000/day, bunkers USD700/tonne 4 The third speed-dependent cost is cargo financing Nicolay Dyvik +47 22 94 85 42 | nicolay.dyvik@dnbnor.no Øyvind Berle +47 22 94 94 55 | oyvind.berle@dnbnor.no Petter Haugen +47 22 94 89 15 | petter.haugen@dnbnor.no 6.1 % 1.4 % Assumptions/sources: VLCC, 92t/day at 15.9 knot (average in Clarksons World Fleet Register); 1 year TC-rates until year 2000 (Clarksons); Spot rates from 2001 until April 2012 (Poten&Partners); LIBOR 3 month, Bloomberg 5 2012 0% 2010 0 2008 0% 1% 2006 1% 50 2004 2% 2% 2002 3% 3% 1996 100 1994 4% 4% 1992 150 % hire cost 5% 1990 5% 6% 1988 6% Transportation cost as % of total delivered cost 200 % bunker cost 7% Value of cargo (mUSD) 7% % financing cost 250 8% 8% Value of cargo (rhs) 1988 30 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 1% 2012 3 mth LIBOR (yearly average) 9% 2000 300 Interest rate (3 mth LIBOR, lhs) 240 10% Assuming no interest margin above LIBOR makes the financing cost go away 1998 The value of the cargo on a VLCC is record high, but interest rates are record low The charterer likes it fast, owner prefers it slow Neglecting the finance cost aligns charterer’s and owner’s incentives Charterer's optimal speed Owner's optimal speed 7.5 25 7.0 20 10 6.5 15 6.0 10 5.5 5 5.0 0 4.5 10 -5 4.0 3.5 -10 3.0 -15 Owner’s income (TCE, kUSD/day) Charterer's cost (USD/ton) Charterer's cost (USD/tonne) Owners income (TCE) The inclusion of finance cost, say 5%, results in different speed preferanses 5 6 7 8 9 10 11 12 13 14 15 16 17 18 Vessel speed (knot) Nicolay Dyvik +47 22 94 85 42 | nicolay.dyvik@dnbnor.no Øyvind Berle +47 22 94 94 55 | oyvind.berle@dnbnor.no Petter Haugen +47 22 94 89 15 | petter.haugen@dnbnor.no Assumptions: Route is TD3, this is the laden leg. VLCC consuming 92 tonne/day on 15.4 knot, TC-rate USD20,000/day, bunkers USD700/tonne. Idea is that the owners receive payment in USD/tonne equivalent of the charterer’s cost, hence owner use this USD/tonne in this maximisation of the TC-equivalent (which then will be above kUSD20/day). Note that the TC-eqv. is the same as assumed TC-rate on charterer’s optimal speed. 6 With a record high oil price, your interest rate is record important Interest rate: 5%, bunkerprice: USD700/tonne, oil price: USD117/bbl, TC-rate: kUSD20/day Financing cost Port cost 16 Bunker cost Optimal speed Interest rate: 10%, bunkerprice: USD700/tonne, oil price: USD117/bbl, TC-rate: kUSD20/day TC cost 12 knot Charterer’s cost (USD/tonne) 14 12 10 8 6 4 2 16.0 15.0 14.0 13.0 12.0 11.0 10.0 9.0 8.0 7.0 6.0 5.0 0 Vessel speed (knot) Nicolay Dyvik +47 22 94 85 42 | nicolay.dyvik@dnbnor.no Øyvind Berle +47 22 94 94 55 | oyvind.berle@dnbnor.no Petter Haugen +47 22 94 89 15 | petter.haugen@dnbnor.no Assumptions: Route is TD3, this is the laden leg. VLCC consuming 92 tonne/day on 15.4 knot, TC-rate USD20,000/day, bunkers USD700/tonne. 7 Optimal speed will depend on: 1) Interest rate, 2) TC rate and 3) bunker/oil price 1) Higher interest rate incentivise higher speed (bunker price: USD700/tonne) 2) Higher TC rate incentivise higher speed (interest rate: 5%) 16 16 15 15 Optimal speed (knot) Optimal speed (knot) 14 13 12 11 10 9 TC: USD5000/day 8 14 13 12 Bunker price USD100/tonne 11 Bunker price USD700/tonne TC: USD20000/day 7 10 6 0% 5% 10% 15% 20% Interest rates (%) Nicolay Dyvik +47 22 94 85 42 | nicolay.dyvik@dnbnor.no Øyvind Berle +47 22 94 94 55 | oyvind.berle@dnbnor.no Petter Haugen +47 22 94 89 15 | petter.haugen@dnbnor.no 25% 30% 0 10,000 20,000 30,000 40,000 50,000 TC rates (USD/day) Assumptions: VLCC consuming 92 tonne/day on 15.4 knot, oil price = bunker price/6 8 3) Bunker and oil prices correlate very well, but have opposite implications for speed optimisation. Bunker wins! Ballast, only impact from oil price is on bunker cost Laden; higher oil price incentivise higher speed, but higher bunker price incentivise lower speed 17 17 TC rate USD10,000/day 15 16 TC rate USD50,000/day 14 Optimal speed (knot) Optimal speed (knot) 16 13 12 11 15 14 13 12 11 10 10 9 9 8 8 0 250 500 750 Bunker price (USD/tonne) Nicolay Dyvik +47 22 94 85 42 | nicolay.dyvik@dnbnor.no Øyvind Berle +47 22 94 94 55 | oyvind.berle@dnbnor.no Petter Haugen +47 22 94 89 15 | petter.haugen@dnbnor.no 1,000 TC rate USD10,000/day TC rate USD50,000/day 0 250 500 750 Bunker price (USD/tonne) Assumptions: Route is TD3, this is the laden leg. VLCC consuming 92 tonne/day on 15.4 knot, interest rate 5%, oil price = bunker price/6 9 1,000 Bunker prices (USD/ton); Oil price (USD/bbl) How to operationalise the speed optimisation opportunity? Oil price 17 25 33 42 50 58 67 75 83 92 100 108 117 125 133 142 150 158 167 100 150 200 250 300 350 400 450 500 550 600 650 700 750 800 850 900 950 1,000 2,500 12.3 12.0 11.8 11.7 11.6 11.6 11.5 11.5 11.5 11.4 11.4 11.4 11.4 11.4 11.4 11.4 11.3 11.3 11.3 5,000 13.1 12.6 12.3 12.1 12.0 11.9 11.8 11.7 11.7 11.7 11.6 11.6 11.6 11.5 11.5 11.5 11.5 11.5 11.5 TC rates (USD/day) 7,500 10,000 12,500 15,000 17,500 20,000 22,500 25,000 27,500 30,000 32,500 35,000 37,500 40,000 42,500 45,000 47,500 50,000 13.8 14.4 14.9 15.3 15.7 15.9 15.9 15.9 15.9 15.9 15.9 15.9 15.9 15.9 15.9 15.9 15.9 15.9 13.1 13.6 14.0 14.4 14.7 15.0 15.3 15.6 15.8 15.9 15.9 15.9 15.9 15.9 15.9 15.9 15.9 15.9 12.8 13.1 13.5 13.8 14.1 14.4 14.6 14.9 15.1 15.3 15.5 15.7 15.9 15.9 15.9 15.9 15.9 15.9 12.5 12.8 13.1 13.4 13.7 13.9 14.2 14.4 14.6 14.8 15.0 15.1 15.3 15.5 15.6 15.8 15.9 15.9 12.3 12.6 12.9 13.1 13.4 13.6 13.8 14.0 14.2 14.4 14.5 14.7 14.9 15.0 15.2 15.3 15.4 15.6 12.2 12.5 12.7 12.9 13.1 13.3 13.5 13.7 13.9 14.1 14.2 14.4 14.5 14.7 14.8 14.9 15.1 15.2 12.1 12.3 12.5 12.8 13.0 13.1 13.3 13.5 13.7 13.8 14.0 14.1 14.2 14.4 14.5 14.6 14.7 14.9 12.0 12.2 12.4 12.6 12.8 13.0 13.1 13.3 13.5 13.6 13.7 13.9 14.0 14.1 14.3 14.4 14.5 14.6 11.9 12.1 12.3 12.5 12.7 12.8 13.0 13.1 13.3 13.4 13.6 13.7 13.8 13.9 14.0 14.2 14.3 14.4 11.9 12.1 12.2 12.4 12.6 12.7 12.9 13.0 13.1 13.3 13.4 13.5 13.6 13.8 13.9 14.0 14.1 14.2 11.8 12.0 12.2 12.3 12.5 12.6 12.8 12.9 13.0 13.1 13.3 13.4 13.5 13.6 13.7 13.8 13.9 14.0 11.8 11.9 12.1 12.2 12.4 12.5 12.7 12.8 12.9 13.0 13.1 13.3 13.4 13.5 13.6 13.7 13.8 13.9 11.7 11.9 12.0 12.2 12.3 12.5 12.6 12.7 12.8 12.9 13.0 13.1 13.2 13.3 13.4 13.5 13.6 13.7 11.7 11.8 12.0 12.1 12.3 12.4 12.5 12.6 12.7 12.8 12.9 13.0 13.1 13.2 13.3 13.4 13.5 13.6 11.7 11.8 11.9 12.1 12.2 12.3 12.4 12.5 12.7 12.8 12.9 13.0 13.1 13.1 13.2 13.3 13.4 13.5 11.6 11.8 11.9 12.0 12.1 12.3 12.4 12.5 12.6 12.7 12.8 12.9 13.0 13.1 13.1 13.2 13.3 13.4 11.6 11.7 11.9 12.0 12.1 12.2 12.3 12.4 12.5 12.6 12.7 12.8 12.9 13.0 13.1 13.1 13.2 13.3 11.6 11.7 11.8 12.0 12.1 12.2 12.3 12.4 12.5 12.6 12.6 12.7 12.8 12.9 13.0 13.1 13.1 13.2 11.6 11.7 11.8 11.9 12.0 12.1 12.2 12.3 12.4 12.5 12.6 12.7 12.8 12.8 12.9 13.0 13.1 13.1 Assumptions: Route is TD3, this is the laden leg. VLCC consuming 92 tonne/day on 15.4 knot, interest rate 5%, oil price = bunker price/6 Nicolay Dyvik +47 22 94 85 42 | nicolay.dyvik@dnbnor.no Øyvind Berle +47 22 94 94 55 | oyvind.berle@dnbnor.no Petter Haugen +47 22 94 89 15 | petter.haugen@dnbnor.no 10 Higher bunker prices is good for owners 275 100% m dwt 90% 225 85% 200 80% 175 Utilisation of fleet (%) 95% 250 Idea is simple: Higher bunker prices incentivise lower speed which reduces effective supply which should give higher rates 75% 2014e 2012e 2010 2008 2006 2004 2002 2000 1998 1996 1994 70% 1992 150 Effective fleet, mid year [m dwt] Total demand [m dwt] Utilisation with full speed [%] Utilisation [%] Nicolay Dyvik +47 22 94 85 42 | nicolay.dyvik@dnbnor.no Øyvind Berle +47 22 94 94 55 | oyvind.berle@dnbnor.no Petter Haugen +47 22 94 89 15 | petter.haugen@dnbnor.no Source: DNB Markets 11 DISCLAIMER AND STATEMENT THAT AFFECTS YOUR RIGHTS IMPORTANT/DISCLAIMER This report must be seen as marketing material unless the criteria for preparing investment research, according to the Norwegian Securities Trading Regulation 2007/06/29 no. 876, are met. This report has been prepared by DnB NOR Markets, a division of DnB NOR Bank ASA. The report is based on information obtained from public sources that DnB NOR Markets believes to be reliable but which DnB NOR Markets has not independently verified, and DnB NOR Markets makes no guarantee, representation or warranty as to its accuracy or completeness. Any opinions expressed herein reflect DnB NOR Markets’ judgment at the time the report was prepared and are subject to change without notice. Confidentiality rules and internal rules restrict the exchange of information between different parts of DnB NOR Markets/DnB NOR Bank ASA and this may prevent employees of DnB NOR Markets who are preparing this report from utilizing or being aware of information available in DnB NOR Markets/DnB NOR Bank ASA which may be relevant to the recipients’ decisions. This report is not an offer to buy or sell any security or other financial instrument or to participate in any investment strategy. No liability whatsoever is accepted for any direct or indirect (including consequential) loss or expense arising from the use of this report. Distribution of research reports is in certain jurisdictions restricted by law. Persons in possession of this report should seek further guidance regarding such restrictions before distributing this report. Please contact DnB NOR Markets at +47 22 94 82 72 for further information and inquiries regarding this report, such as ownership positions and publicly available/commonly known corporate advisory performed by DnB NOR Markets etc, in relation to the Norwegian Securities Trading Act 2007/06/29 no. 75 and the Norwegian Securities Trading Regulation 2007/06/29 no. 876. This report is for clients only, and not for publication, and has been prepared for information purposes only by DnB NOR Markets - a division of DnB NOR Bank ASA registered in Norway number NO 984 851 006 (the Register of Business Enterprises) under supervision of the Financial Supervisory Authority of Norway (Finanstilsynet), Monetary Authority of Singapore, and on a limited basis by the Financial Services Authority of UK. Information about DnB NOR Markets can be found at dnbnor.no. Additional information for clients in Singapore This report has been distributed by the Singapore branch of DnB NOR Bank ASA. It is intended for general circulation and does not take into account the specific investment objectives, financial situation or particular needs of any particular person. You should seek advice from a financial adviser regarding the suitability of any product referred to in this report, taking into account your specific financial objectives, financial situation or particular needs before making a commitment to purchase any such product. Recipients of this report should note that, by virtue of their status as “accredited investors” or “expert investors”, the Singapore branch of DnB NOR Bank ASA will be exempt from complying with certain compliance requirements under the Financial Advisers Act, Chapter 110 of Singapore (the “FAA”), the Financial Advisers Regulations and associated regulations there under. In particular, it will be exempt from: - Section 27 of the FAA (which requires that there must be a reasonable basis for recommendations when making recommendations on investments). Please contact the Singapore branch of DnB NOR Bank ASA at +65 6212 0753 in respect of any matters arising from, or in connection with, this report. We, the DnB NOR Group, our associates, officers and/or employees may have interests in any products referred to in this report by acting in various roles including as distributor, holder of principal positions, adviser or lender. We, the DnB NOR Group, our associates, officers and/or employees may receive fees, brokerage or commissions for acting in those capacities. In addition, we, the DnB NOR Group, our associates, officers and/or employees may buy or sell products as principal or agent and may effect transactions which are not consistent with the information set out in this report. In the United States Each research analyst named on the front page of this research report, or at the beginning of any subsection hereof, hereby certifies that (i) the views expressed in this report accurately reflect that research analyst’s personal views about the company and the securities that are the subject of this report; and (ii) no part of the research analyst’s compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed by that research analyst in this report. This report is being furnished upon request and is primarily intended for distribution to “Major U.S. Institutional Investors” within the meaning of Rule 15a-6 of the U.S. Securities and Exchange Commission under the Securities Exchange Act of 1934. To the extent that this report is being furnished, or will be disseminated, to non-Major U.S. Institutional Investors, such distribution is being made by DnB NOR Markets, Inc., a separately incorporated subsidiary of DnB NOR that is a U.S. broker-dealer and a member of the Financial Industry Regulatory Authority and the Securities Investor Protection Corporation. Any U.S. recipient of this report seeking to obtain additional information or to effect any transaction in any security discussed herein or any related instrument or investment should call or write DnB NOR Markets, Inc., 200 Park Avenue, New York, NY 10166-0396, telephone number 212-681-3800 or fax 212-681-4119. In Canada This email, and any materials attached with it, has been distributed in reliance on the International Dealer Exemption pursuant to NI 31-103 subsection 8.18(2) and subsection 8.18(4)(b). Please be advised that: 1. DnB Nor Bank ASA (DnB NOR Markets) and DnB NOR Markets, Inc. are not registered in Canada. 2. DnB Nor Bank ASA (DnB NOR Markets) and DnB NOR Markets, Inc's jurisdiction of residence is Norway and the United States, respectively. 3. The name and address of the agent for service of process for DnB Nor Bank ASA (DnB NOR Markets) and DnB NOR Markets, Inc. in the local jurisdiction is: Alberta: Blake, Cassels & Graydon LLP, Attention: Pat Finnerty/Ross Bentley, 855 – 2nd Street S.W., Suite 3500, Bankers Hall East Tower, Calgary, AB T2P 4J8. British Columbia: Blakes Vancouver Services, Inc., 595 Burrard Street, P.O. Box 49314, Suite 2600, Three Bentall Centre, Vancouver, BC V7X 1L3. Labrador: Stewart McKelvey, Cabot Place, 100 New Gower Street, Suite 1100, P.O. Box 5038, St. John’s, NL A1C 5V3. Manitoba: Aikins, MacAulay & Thorvaldson LLP, 30th Floor, Commodity Exchange Tower, 360 Main Street, Winnipeg, MB R3C 4G1. Newfoundland: Stewart McKelvey, Cabot Place, 100 New Gower Street, Suite 1100, P.O. Box 5038, St. John’s, NL A1C 5V3. New Brunswick: Stewart McKelvey, 10th Floor, Brunswick House, 44 Chipman Hill, Saint John, NB E2L 4S6. Nova Scotia: Stewart McKelvey, Purdy’s Wharf Tower One, 1959 Upper Water Street, Suite 900, P.O. Box 997, Halifax, NS B3J 2X2. Ontario: Blakes Extra-Provincial Services Inc., Suite 2800, 199 Bay Street, Toronto, Ontario M5L 1A9. Prince Edward Island: Stewart McKelvey, 65 Grafton Street, Box 2140, Charlottetown, PE C1A 8B9. Quebec: Services Blakes Quebec Inc., 600 de Maisonneuve Boulevard Ouest, Suite 2200, Tour KPMG, Montreal, QC H3A 3J2. Saskatchewan: MacPherson, Leslie & Tyerman LLP, 1500 Continental Bank Building, 1874 Scarth Street, Regina, SK S4P 4E9. Northwest Territories: Gerald Stang, Suite 201, 5120-49 Street, Yellowknife, NT X1A 1P8. Yukon: Grant Macdonald, Macdonald & Company, Suite 200, Financial Plaza, 204 Lambert Street, Whitehorse, YK Y1A 3T2. Nunavut: Terry Gray, P.O. Box 1779, Building 1088C, Iqaluit, NU X0A0H0. 4. There may be difficulty enforcing legal rights against DnB NOR Bank ASA (DnB NOR Markets) and DnB NOR Markets, Inc. because each is a resident outside of Canada and all or substantially all of their assets may be situated outside of Canada. Nicolay Dyvik +47 22 94 85 42 | nicolay.dyvik@dnbnor.no Øyvind Berle +47 22 94 94 55 | oyvind.berle@dnbnor.no Petter Haugen +47 22 94 89 15 | petter.haugen@dnbnor.no