Discount / Sales Tax Problems

advertisement

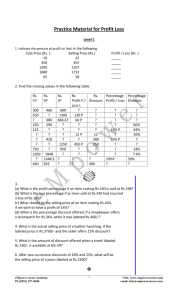

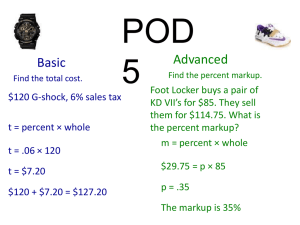

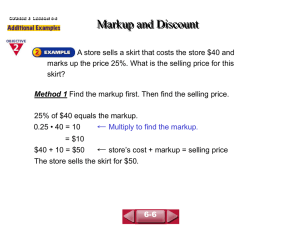

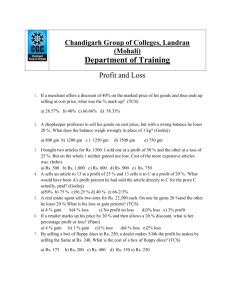

Discount, Sales Tax , Tipping , Commission • Discount is an amount subtracted from the original price. • Sales Tax is an amount added to the original price. • Tip is an amount added to the original price. • Commission is an amount earned based on the original price. 1) Change the percent to a decimal 2) Multiply by the original amount 3) Add or subtract, depending on what is asked Discount / Sales Tax Problems 1) A CD player that regularly sells for $79.00 is on sale at a 15% discount. a) What is the sale price? b) If the sales tax is 8%, what is the cost after tax? 2) A bike that regularly sells for $179 is on sale at a 25% discount. a) What is the sale price? b) If the sales tax is 6.5%, what is the cost after tax? 3) A computer normally sells for $1,299.00, but is discounted 10%. a) What is the discount amount? b) What is the sale price? c) If the sales tax is 7%, what is the price after tax? 4) Mary buys a dress and a pair of shoes. Before adding the tax, she pays $48 for the dress which normally sells for $62, and she pays $34 for the shoes which normally sell for $46. a) Before tax, how much does Mary save by buying at the sale price? b) What percent discount did Mary get on each item? c) Including a 6.5% sales tax, how much did Mary pay? 5) Nate buys 3 pencils for $1.50, an eraser for $1.25, a ruler for $0.75, and a notebook for $3.00. Each item is on sale for 50% off. Nate must pay 8% sales tax. How much does Nate pay for the school supplies? 6) Molly buys a skirt that originally costs $29.00. The skirt is on sale for 30% off. When she pays for it, the cashier tells her she can have an additional 25% discount. a) How much will Molly pay for the skirt? b) Is there a difference between: 1) taking off each discount separately or 2) adding the two discounts together before taking them off 7) Sammy buys his clothes at Super Discounts. On Saturday he bought shoes regularly priced at $40 for 25% off, and a jacket regularly priced at $100 for 30% off. a) Before the sales tax, what was the total price? b) What percent discount did Sammy get on his total purchase? 8) John earns a 5% commission for each car he sells. On Monday, he sells a car for $25,000. How much will John earn on this sale? 9) Martha sells real estate. She earns a 12% commission on each house she sells. In January, Martha sold a house for $275,000. How much will Martha earn on this sale?