Chapter 7: Balancing Supply and Use Table

advertisement

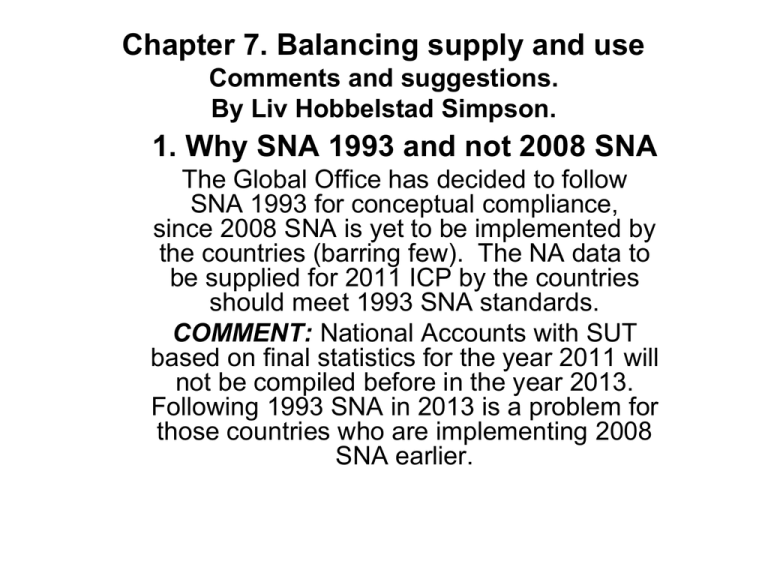

Chapter 7. Balancing supply and use Comments and suggestions. By Liv Hobbelstad Simpson. 1. Why SNA 1993 and not 2008 SNA The Global Office has decided to follow SNA 1993 for conceptual compliance, since 2008 SNA is yet to be implemented by the countries (barring few). The NA data to be supplied for 2011 ICP by the countries should meet 1993 SNA standards. COMMENT: National Accounts with SUT based on final statistics for the year 2011 will not be compiled before in the year 2013. Following 1993 SNA in 2013 is a problem for those countries who are implementing 2008 SNA earlier. 2. The ISWGNA prepared a table on 2008 SNA implementation milestones to the 42nd session of the UN Statistical Commission (UNSC), February 2011: Milestone 1 Basic indicators of GDP Complementary Data system: Supply and use table • The African Development Bank (AfDB), the African Union (AU) and UNECA has established an African Group on National Accounts (AGNA) to foster the implementation of 2008 SNA in Africa. The AGNA has prepared a ‘Draft African Strategy for Implementation of 2008 SNA, followed up by training workshops, seminars, regional meetings. 3. National Accounts with Supply and Use Tables • Several countries are using SUT as an integral part of the compilation of final annual National Accounts at current prices. • SUT are used as the framework for balancing National Accounts and compiling National Accounts aggregates. • The compiler(s) have to use judgement to reach a balance by adjusting the components as necessary. • Some countries also compiling SUT at previous year’s prices or at a fixed year constant prices. 4. Quality and balancing procedure of SUT depending of good statistics and other data • Agriculture statistics and agriculture census. Livestock censuses, Fisheries statistics • Annual Economic Survey for large enterprises or for a sample of enterprises. • Government Audited Accounts and Budget Documents, Finance statistics • External trade statistics, value and quantity data for imports and exports of goods, custom duty. • BOP for imports and exports of services • Integrated Household Survey, • Consumer price indices • Population Census, Housing Census 5. Classification important for balancing SUT. 5.1. Output should be classified into the following main types: 1. Market output - mainly goods sold at “economically significant” prices. 2. Production for own final use (non-market output) Important for Africa 3. Other-non-market production, General Government and NPISHs supplied to other units either free or at prices that are not economically significant.. 5.2. SUT classification for Industries and Products If ISIC Revision 4 is introduced for register and statistics, the industry classification used should be a NA-ISIC aggregation of ISIC Rev. 4, adapted for the economy of the country. The product classification for SUT should be a NA-CPC aggregation of CPC Version 2.0, Countries establishing SUT for the first time should start with the new classifications. 5.3. Classification of Final domestic expenditure The Use Table should have the following classification • COICOP classification for household consumption expenditure • COFOG classification for government final consumption expenditure • COPNI classification for final consumption expenditure of the non-profit institutions serving households (NPISHs) • Gross fixed capital formation by type and industry. 6. Balancing SUT at purchasers’ prices or at basic prices? 6.1. The methodology for balancing SUT is of particular important for the quality of the National Accounts.. Ref. SNA 1993, chapter C. Supply and use tables, paragraph 15.57 and 15.58.: In general, when preparing supply and use tables and making the balancing between the two sides, there is a choice between two lines of adjusting statistical data: Supply of each product at basic prices can be adjusted to a purchasers’ prices valuation to allow balancing with uses at purchasers’ prices. OR Each of the uses at purchasers’ prices could be adjusted to a basic prices’ valuation to match with supply at basic prices. 6.2. Balancing supply and use table at basic value SNA 93, paragraph 15.129 The supply and use table at basic prices are a step forward to the conversion towards input-output tables at basic prices. SNA 93, paragraph 15.161 The supply and use tables at basic prices are the most complete consistent framework for constant price estimation. 6.3. Balancing supply and use table at purchasers’ value Adjustment columns required to bring supply at basic prices up to purchasers’ prices. To compile the columns of VAT, other taxes and subsidies and trade margins by products in the Supply table, the distribution among uses should be known from the Use table Only non refundable VAT should be recorded, mainly for products to Household consumption. Subsidies as for fertilizer may be paid to all users, while product taxes may not be paid by some users as for products to export. Trade margin can be higher for a product to private consumption than for intermediate consumption 7. The compilation process for SUT at current prices • For estimating the Household consumption figures, the results from the Household Budget Surveys have to be evaluated and compared or balanced with other data sources used for the balancing of supply and use of goods and services. • Detailed data for imports and exports of goods and services are of great importance for the SUT compilation in developing countries. The detailed specification of import by products give information about the supply of many products not produced in the developing country. Eurostat has developed the EUROTRACE software package used by many countries in Africa to manage data for external trade statistics 8. The following example for balancing of GARMENTS is misleading and has to be corrected • Garments can not be supplied direct to Government or NPISHs final consumption expenditure, but as intermediate consumption. • Output for Government and for NPISHs is sum of: intermediate consumption, consumption of fixed capital and compensation of employees. Final consumption expenditures of Government and NPISHs are equal to output less sale (fees) • The government accounts do not normally provide a detailed breakdown of purchases of goods as garments. • Intermediate consumption specified by products for the government has to be estimated. • 8. Example with manual balancing of garments Supply/Use Unbalanced Balanced Domestic production at basic prices 48,920 83,287 Imports at c.i.f values 145,770 145,770 Transport cost 5,841 5,841 Trade margins 74,345 74,345 Product taxes 21,990 21,990 Total supply 296,776 331,233 Intermediate consumption 0 0 Government final consumption 570 570 NPISHs final consumption 4,230 4,230 Household final consumption 291,175 279,528 Change in inventories -75 -75 Exports at fob values 46,980 46,980 9. Comments to advertising services. It states in the Handbook: The only product taxes for advertising services are value added taxes. These must have been paid by households because enterprises do not pay VAT on intermediate consumption and NPISH do not pay VAT either Comment: The Government accounts will only give information about total value added tax received during a budget year, but not by type of products. In many countries the budget year is different from the calender year. The value of VAT, product taxes and subsidies have to be corrected to an estimated accrual value for the calender year 10. Comments to automatic balancing RAS The Supply table is shown as a matrix of domestic production with 3 products (commodities) and three industries (kinds of activity). Comment: RAS should be used at a final stage of the balancing of SUT when the remaining differences between supply and use of each products are small. The Supply table with figures for production and imports of products are more reliable than the Use table with distribution of products by users RAS should only be used at the final stage of balancing the SUT by correcting the Use Table.