Improving Pension Coverage of Informal Sector Workers

advertisement

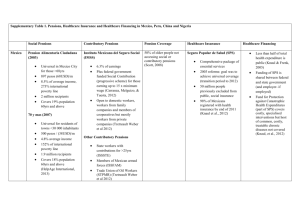

Fiona Stewart OECD/ IOPS MENA Workshop on Private Pension Supervision March 1-2 2011 Amman, Jordan 1 The Challenge of Coverage Developing Economies Social change means less ability to rely on family support – yet only a small % of the population have any formal retirement income Thailand 27% Bolivia China 25% Peru India 11% Colombia <20% More worryingly it is often the poorest sections of society most in need of pensions who are not covered Chile 23% independent workers contribute to retirement accounts vs. 57% of employees South Africa c1/3 total coverage – 80% formal sector workers (1/3 of workforce) but only around 10% of informal sector workers (2/3 of workforce) The Challenge of Coverage Developed Economies Basic social security may be in place, but as government provision declines, private pension participation rates remain low in many countries Germany 43% Italy 10% Spain 10% Portugal 7% More ‘vulnerable’ groups have consistently lower coverage rates – e.g. women, part-time or migrant workers, rural inhabitants+ agricultural workers, self-employed USA - around 60% full time workers have an occupational pension vs. only 20% of part-timers + in some age groups women are half as likely as men to belong to a pension scheme Ireland - coverage rates for men 55% vs. women 44% Coverage is challenge in OECD and non-OECD countries What can be done? Wide range of policy responses to raise pension coverage have been tried - Labour Market reforms and Economic growth (China) Comprehensive pension reform (Chile, Mexico) Linking 1st and 2nd tier pensions (Sweden) Making occupation pensions compulsory (HK, Australia) Tax incentives (USA) Improving portability / vesting rights (Korea) Ensure equal access (Korea - smaller firms / more sectors) Encouraging collective schemes (Netherlands) Automatic enrolment (New Zealand, UK) Control charges (UK) Adjusting size of contribution rate (Japan) Building trust in the pension system as a whole (UK) Using financial education and awareness (Ireland) Research suggests that government policies do influence coverage Which are appropriate will differ according to the situation in each country Informal Sector Workers Pension reform has been widely observed around the globe However, focus has been given to formal sector workers; thus the informal sector left out Definition of informal sector employees: low income, self- employee, small firm, farmer, part-time/seasonal, etc Higher income owners (e.g. lawyer, consultant) excluded Despite the importance of the informal sector (number of people and contribution to GDP), pension coverage is very low No reliable/official statistics found, however it is estimated to be very low, i.e. well below 5-10%. Experiences from both OECD & non-OECD countries presented Some policy suggestions proposed 5 Background: some statistics (ILO 2002) Table 1. Informal employment as % of non-agricultural employment, 2000 North Africa Algeria Morocco Tunisia Egypt Sub-Saharan Africa Benin Chad Guinea Kenya South Africa Asia India Indonesia Philippines Thailand Syria Memo Developing world (non-agriculture) Developing world (all) European countries (15) 48 43 45 50 55 72 93 74 72 72 51 65 83 78 72 51 42 Latin America Bolivia Brazil Chile Colombia Costa Rica El Salvador Guatemala Honduras Mexico Rep Dominicana Venezuela 51 63 60 36 38 44 57 56 58 55 48 47 60-70 (approx) 80-90 (approx) 15-25 6 Table 2. Contribution of informal sector to GDP in %, 1990-2000 North Africa 27 Sub-Saharan Africa 41 Algeria 26 Benin 43 Morocco 31 Burkina Faso 36 Tunisia 23 Burundi 44 Latin America 29 Cameroon 42 Colombia 25 Chad 45 Mexico 13 Cote d'lvoire 30 Peru 49 Ghana 58 Asia 31 Guinea Bissau 30 India 45 Kenya 25 Indonesia 31 Mali 42 Philippines 32 Mozambique 39 Republic of Korea 17 Niger 54 Senegal 41 Tanzania 43 Togo 55 Zambia 24 7 Countries taking actions to address this issue Non-contributory arrangements Contributory arrangements Others 8 I. Non-contributory arrangements Broaden access to social assistance program (old-age) No contribution necessary Means-tested or universal Particularly relevant to the poor who are too poor to save It operates in some African countries, e.g. Botswana, Mauritius, South Africa, and Kenya is considering a “zero pillar” pension 9 I. Non-contributory arrangements Broaden access to social assistance program (old-age) No contribution necessary Means-tested or universal Particularly relevant to the poor who are too poor to save It operates in some African countries, e.g. Botswana, Mauritius, South Africa, and Kenya is considering a “zero pillar” pension 10 Examples of universal and means tested schemes Age limit Bangladesh 57 Bolivia 65 Botswana 65 Brazil (Rural) 60 (M) 55 (W) Chile 65 Costa Rica 65 India 65 Mauritius 60 Moldova 62 (M) 57 (W) Namibia 60 Nepal 75 South Africa 65 (M) 60 (W) Thailand 60 Vietnam 60 US$ 2 18 27 140 75 26 4 60 5 28 2 109 8 6 % of GDP 0.03 means tested 1.3 universal 0.4 universal 0.7 means tested 0.38 means tested 0.18 means tested 0.01 means tested 2 universal 0.08 means tested 0.8 universal universal 1.4 means tested 0.005 means tested 0.5 means tested Source: Willmore (2006). Universal pensions for low income countries 11 II. Contributory arrangements: Encourage voluntary contribution Flexible terms: contribution requirements (reduced contribution, periodic contribution) vesting policies (earlier withdrawal, e.g. due to emergency, housing, foods) Financial incentives: tax credit, tax reduction, and matching contributions Financial education: enhance financial/pension awareness. ADB project in India (2006); similar schemes in the UK 12 13 II. Contributory arrangements: compulsory contribution The main logic: individuals have reluctance, inertia in making complex financial decisions Semi-compulsory (or auto enrolment), e.g. the NEST in the UK, KiwiSaver in NZ, and similar schemes in Italy Compulsory, e.g. Chile, Hong Kong, Kenya (under consideration) 14 III. Other routes Utilization of existing (non-pension) infrastructure: banks, post offices, depository agencies Utilization of existing (non-pension) financial intuitions - micro- finance Creation of new institutions to reduce transaction costs, e.g. central clearing house (India, Sweden and UK) 15 Some policy suggestions Old-age pension guarantee Flexible terms Target those capable of extra saving Utilize existing infrastructure Centralised admin. agency 16 However… Any reform options (in developing countries) MUST be considered in line with country-specific conditions, which are a function of various parameters economic growth income level consumption preference financial markets governance, etc 17