Chapter 8

advertisement

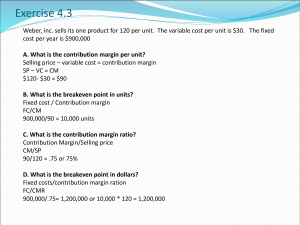

Chapter 8 Breakeven Analysis for Profit Planning Breakeven Analysis • Breakeven analysis (cost-volume-profit analysis): approach to profit planning that requires derivation of various relationships among revenue, fixed costs, and variable costs in order to determine units of production or volume of sales dollars at which firm “breaks even” (where total revenues equal total of fixed and variable costs) Assumptions of Breakeven Analysis 1. Costs can be reasonably subdivided into fixed and variable components. 2. All cost-volume-profit relationships are linear. 3. Sales prices will not change with changes in volume. Assumptions of Breakeven Anaylsis 1. Costs can be reasonably subdivided into fixed and variable components. – Fixed costs (i.e. depreciation expenses, salaries, rental expenses, etc.) and variable costs (i.e. cost of direct labor and materials used) can be easily identified in most cases. – Semivariable expenses can be problematic, but can nonetheless be separated into fixed and variable components for analysis purposes. Assumptions of Breakeven Analysis 2. All cost-volume-profit relationships are linear. – Assumption holds so long as analysis is confined to reasonable range of operations. – If level of operations are doubled, relationship may be different. Assumptions of Breakeven Analysis 3. Sales prices will not change with changes in volume. – Economic theory states that one would normally expect price increase to be accompanied by decrease in sales volume and vice versa. – Assumption holds so long as analysis is confined to reasonable range of prices. Breakeven Applications • Four major applications: 1. 2. 3. 4. New product decisions Pricing decisions Modernization or automation decisions. Expansion decisions. Breakeven Applications 1. New product decisions – Determine sales volume required for firm (or individual product) to break even, given expected sales and expected costs 2. Pricing decisions – Study the effect of changing price and volume relationships on total profits Breakeven Analysis 3. Modernization or automation decisions – Analyze profit implications of a modernization or automation program – In this case, firm substitutes fixed costs (i.e. capital equipment costs) for variable costs (i.e. direct labor) 4. Expansion decisions – Study aggregate effect of general expansion in production and sales – In this case, relationships between total dollar dales for all products and total dollar costs for all products are examined in order to indentify potential changes in these relationships The Breakeven Technique • Simplified example – Peter Porter’s Porsche Plant is a small business that assembles and markets improved racing suspension for Porsches • Fixed costs estimate: $1,650 • Variable costs estimate: $350 • Selling price per package:$500 The Breakeven Technique • At what point will new product break even? Revenue = Fixed costs + Variable costs – Requires determining quantity of items to be produced and sold – Let X be equal to unknown breakeven quantity $500X = $1,650 + $350X – $500X = total revenue produced by selling X items – $1,650 = total fixed costs – $350X = total variable costs incurred by producing X items The Breakeven Technique • Solve the equation $500X = $1,650 + $350X $150X = $1,650 X = 11 units • Thus, 11 units is the breakeven point for this product. • As a computational check, simply substitute X=11 into the breakeven equation. The Breakeven Technique Operating Leverage • Contribution margin: difference between selling price and variable cost; represents contribution made by each unit sold toward covering fixed costs and making profit – For Peter, contribution margin is $150. – This is key to breakeven problem. • Once enough units sold to cover fixed costs (11 units), each unit then makes direct contribution to profits. • Once above breakeven point, relatively small percentage increase in number of units sold will produce relatively large percentage increase in profit. The Breakeven Technique • Operating Leverage – If firm produces 12 units, it will then earn $150 in profit. $500[12] - $350[12] - $1,650 = $150 – Increase in production of 1 unit, or 8.3% (1/12=8.3%), will result in profit of $300 (100% increase). – Additional increase of 1 unit will increase profits to $450 (50% increase). – As production moves further and further above breakeven point, operating leverage effect becomes less dramatic in terms of percentage increase in profits generated. The Breakeven Technique • Operating Leverage – Implications of operating leverage concept: • As firm incurs higher levels of fixed costs due to use of more capital equipment (becomes more capital intensive), it normally incurs lower levels of variable costs (becomes less labor intensive). • Once fixed costs are covered, any available contribution margin will make direct contribution to profit. • If firm falls short of covering its fixed costs, loss will be incurred. • The higher the degree of operating leverage, the higher probability that loss may be incurred, and the higher the risk. The Breakeven Technique • Additional Breakeven Applications 1. Determine breakeven point in terms of aggregate sales dollars for a multiproduct operation. – Set up breakeven equation in terms of percentage relationships. – Porter wants to expand his operation to full-time business carrying full line of specialized racing equipment. • Variable cost estimate: 70% of sales ($350/$500 = 70%) • Contribution margin per unit: 30% ($150/$500 = 30%) • Fixed costs estimate: $30,000 The Breakeven Technique • Additional Breakeven Applications 1. (continued) – Solve new equation: Revenue (R) = Fixed costs + Variable costs R = $30,000 +0.7R 0.3R = $30,000 R = $100,000 – Thus, new operation will break even at sales level of $100,000. The Breakeven Technique • Additional Breakeven Applications 2. Determine sales dollars (or units) required to earn given level of profit – Porter is concerned with sales volume required to earn $3,000 in profit • • Add required profit to right-hand side of original equation X now equals number of units required to earn $3,000 profit The Breakeven Technique • Additional Breakeven Applications 2. (continued) Revenue = Fixed costs + Variable costs + Required profit $500X = $1,650 + $350X + $3,000 $150X = $4,650 X = 31 units – Porter must sell 31 units, or $15,500 worth of suspensions ($500 x 31 = $15,500). The Breakeven Technique • Additional Breakeven Applications 3. Determine pricing decisions. – Porter wants to know what price he will have to charge for given number of orders and predetermined level of profit. – If Porter sells 20 units, what price should he charge to earn $3,000 in profit? The Breakeven Technique • Additional Breakeven Applications 3. (continued) – Solve in terms of selling price (X = sales price): Revenue = Fixed costs + Variable costs + Required profit 20X = $1,650 + $350 (20) + $3,000 20X = $1.650 + $7,000 + $3,000 20X = $11,650 X = $582.50 – Selling price of $582.50 will yield required profit. Breakeven Charts • See exhibit 8.1 for graphic representation of breakeven problem posed by Peter Porter’s Porsche Plant 1. Illustrates key assumptions of breakeven analysis – Revenue and total cost are treated as simple linear functions of number of units produced and sold. – Profit or loss is difference between revenue and total cost. – Breakeven point occurs where revenue equals total cost. Breakeven Charts • Exhibit 8.1 (continued) 2. Provides simple visual interpretation of effect of changing cost-volume-profit relationships – – Incurring additional fixed costs shifts horizontal fixed-cost line upward, thus raising total-cost line parallel to itself and causing breakeven point to rise. “Substitute” additional fixed costs (i.e. additional depreciation for improved capital equipment) for low levels of variable cost (i.e. less direct labor and material waste): – – – Horizontal fixed-cost line moves upward, but total-cost line becomes less steep due to lower levels of variable cost Higher breakeven level and higher contribution margin (revenue per unit less variable cost per unit) At levels of operation sufficiently above breakeven point, profits are much higher, while near or below breakeven, profits are less or losses are greater. Breakeven Charts • Exhibit 8.1 (continued) 2. (continued) – – – – Porter buys additional capital equipment to produce racing suspensions, causing annual fixed costs to rise to $1,920. Variable costs per unit decline to $340. New contribution margin is $160 per unit New breakeven point: Revenue = Fixed costs + Variable costs $500X = $1,920 + $340X $160X = $1,920 X = 12 units Breakeven Charts • See exhibit 8.2 • At new level of operation, breakeven point is one unit higher than old level. – At high levels of operation (30 units), profits under new cost-volume-profit relationships are $2,880 (compared to $2,850 under old relationships) – At lower levels, (20 units), profits for new system are $1,280 (compared to $1,350 for old system) – At loss levels (5 units), new relationships produce loss of $1,120 (compared to $900 under old relationships) – An increase in level of fixed costs must be justified by expectation of level of operations substantially in excess of breakeven level. Breakeven Charts • Determine point at which new relationships produce same profit as old relationships. R – FC – VC = R – FC – VC $500X - $1,650 - $350X = $500X - $1,920 - $340X $270 = $10X X = 27 units – At 27 units of production, profits are same under either alternative. • Under first alternative: Profit = ($500) (27) - $1,650 – ($350) (27) = $2,400 • Under revised alternative: Profit = ($500) (27) - $1,920 - ($340) (27) = $2,400 Breakeven Charts • See exhibit 8.3: profit as function of units produced and sold is graphed for each alternative – Above 27 units, second alternative will produce larger profits than first alternative. – Below 27 units, first alternative will produce higher profits (in profit zone) or lower losses (in loss zone) than second alternative. Nonlinear Breakeven Analysis • Empirical studies of cost behavior over wide ranges of output suggest that average variable cost per unit declines over some range and then begins to increase. • See exhibit 8.4 – Total cost function for wide ranges of output looks like a curve • Total cost curve increases at decreasing rate over some range and then begins to increase at increasing rate. – Revenue function more nearly resembles a curve than a straight line over wide ranges of output. • If sales volume continues to expand over very wide range, sales price per unit must eventually decline in order to achieve everincreasing sales. Nonlinear Breakeven Analysis • Two key factors of exhibit 8.4 1. Two breakeven points in nonlinear case. – – Lower breakeven point occurs at point where rising revenue curve crosses rising total cost curve. Upper breakeven point occurs at very high output level where declining revenue curve crosses now rapidly increasing total cost curve 2. Planning plant capacity – – • Maximum profit point represents point of maximum separation of revenue and cost curves. This is optimal production level: production at either higher or lower levels of output will result in lower profits Developing equation for curves is almost impossible, but can be ignored for practical purposes.