ppt - Environmental Science and Policy

advertisement

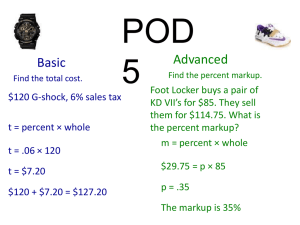

Discounting Discounting is a method for placing weights on future values to convert them into present values so that they can be combined to a single number in common units, the “present value”. 0 (present) t1 t2 time The discount factor: determined by the discount rate and t. • discount rate, r: o a parameter that determines the discounting factor or weight, dt o typically: zero to 10% • discounting factor, dt: o the weight placed on a value accrued in year t to convert it to a present value in the present (year 0). o typically <1 discount rate, r Discounting example: r=0.05 and an arbitrary stream of net benefits 0.05 0 0 5 10 15 discount factor, d t 1 25 t 0 5 10 15 20 25 30 40 20 dt*NBt 0 0 5 10 15 20 25 30 40 PVNB t = dt * NBt 20 0 0 5 10 15 20 25 200 PVNB 30 d = 1/(1+r)t 0.5 0 Yearly pres. val. Yearly net of NB, PVNBt benefits, NBt 20 100 0 <--PVNB = the sum of the PVNBt terms across the horizon 0 time, t 30 Rationale 1: We should discount to account for the opportunity cost of investment. • Public (environmental) sector investments should generate returns at or above the level available in the private sector. – E.g. business loan interest rate, rate of return in the stock market • “Time value of money”, “opportunity cost of capital” Rationale 1: We should discount because it is consistent with how individuals make decisions in the face of tradeoffs over time. • Individuals are “impatient”. • Individuals are typically indifferent between payoff X at time t and payoff Y<X at time t’ < t. – E.g., I will give you $100 in 1 year: What would you be willing to accept today in lieu of this promise? • Jargon: “pure rate of time preference” A common approach to choosing a social discount rate is to estimate the observed return to investment (long-run, after-tax, risk-free) • 7%: approx. the real return to investment in large companies (1926– 1990) (Newell and Pizer, 2004) • But personal taxes (up to 50%) mean that return to investors, the consumption rate of interest, is closer to 4%. – And this 4% return includes a premium for risk (firms may fail). – To separate the issue of risk from this analysis, consider relatively safe government bonds: 4% nominal return2% after taxes. • “The appropriate rate …. in the United States is generally taken to be around a 3% real, riskless rate.” (Kopp et. al, 1997) Federal guidelines prescribe assessing results over a range of discount rates • U.S. OMB 2003 : – provide estimates of PVNB using discount rates of 3% and 7% – 3%: consumption rate of interest (i.e. after tax return on investments) – 7%: OMB estimate of the opportunity cost of capital • see: http://www.whitehouse.gov/omb/circulars_a004_a-4/ • “Many economists believe that this…range…is too high” (Fraas and Lutter, 2011) Specifying a social discount rate for long-run climate policy analysis often employs the Ramsey framework Ramsey (1928) optimal growth model: Economy operates as if a “representative agent” selects consumption and savings to max PV of the stream of utility from consumption over time. One implication of the Ramsey model is the following equation: • r = ρ + ƞg • r: return to capital (real, long-run) • ρ: pure rate of time preference “time discount rate”, due to “impatience” • ƞ: elasticity of marginal utility w.r.t. consumption • g: average growth in consumption per capita Two different perspectives on parameterizing the Ramsey discounting equation lead to very different results. ρ: pure rate of time preference; ƞ: elasticity of marginal utility w.r.t. consumption; g: average growth in consumption per capita 1. Descriptive approach/Nordhaus & the DICE model • Use economic data to estimate parameters: • Nordhaus (2008): • r = ρ + ƞg = 0.04 (average over the next century (Nordhaus, 2008, 10)) – 5.5% over first 50 years (61). • Economic growth and population growth will slow, rate will fall over time. 2. Prescriptive approach/Stern & the Stern Review (2006) • Argument: No ethical reason to discount future generations due to a pure rate of time preference except for the possibility that we might not be here at all (ρ reflects only ann. prob. of extinction). 1.3% growth assumed. • r = ρ + ƞg = 0.001 + 1*0.013 = 0.014 There is no consensus on a single value for the social discount rate Q: What discount rate do you favor for discounting long-term environmental projects? Respondents-over 2,000 Ph.D. level economists Weitzman, M. L. (2001). “Gamma discounting.” American Economic Review 91, 260-271. Image: http://www.dbj.jp/ricf/en/research/symposium199511.html There is no consensus on a single value for the social discount rate Weitzman (2001): “The most critical single problem with discounting future benefits and costs is that no consensus now exists, or for that matter has ever existed, about what actual rate of interest to use.” The considerations on which a discount rates are based “are fundamentally matters of judgment or opinion, on which fully informed and fully rational individuals might be expected to differ.” The lack of discount rate consensus means that sensitivity analysis is critical • “We should have less confidence in a project for which – the sign of the PVNB is highly sensitive to • the discount rate or to • small changes in projected future benefits and costs, compared with a project with a PVNB that is not very sensitive to these elements.” (Goulder and Stavins 2002, p. 674) There is a potential problem with preference-driven parameterization when the problem spans generations • The justification for a pure rate of time preference is based on the choices individuals make about payoffs in their own lifetime. • Some economists argue that at the societal level there is no good ethical argument for using a pure rate of time preference other than zero. – Especially, across generations. Note: Real versus nominal • Discount rates are NOT meant to address inflation (before discounting all values should be in real terms). • Nominal value: expressed in the money of the day • Real value: adjusted for inflation Nominal ($ of the day) Buying power in 1982 $ 10 Buying power in 2012 $ 10 Real ($ of 2012) Buying $ 20.38 power in 2012 $ 10 • In a BCA analysis, benefits and costs from each year are stated in the same real units, e.g. in 2005 dollars.