II.2.1 - Cowen Securities LLC: Adam Graf

advertisement

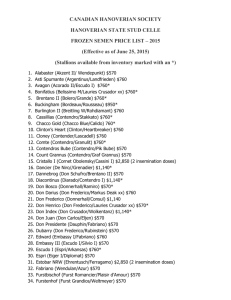

VALUATION TRENDS IN PRECIOUS METALS & EMERGING MINERS APRIL 30, 2013 Adam P. Graf, CFA, Managing Director 646.562.1344 Adam.Graf@cowensecurities.com Misha Levental, Associate 646.562.1410 Misha.Levental@cowensecurities.com www.cowensecurities.com | Member: FINRA/SIPC CONFIDENTIAL 1 www.cowensecurities.com Valuation – Who’s Looking? Mining Company / Private Equity Concerned with returns and ability to weather the cycle Use conservative price assumptions, downside potential is key concern. Finance with cash or debt Equity Investors Looking to determine value today and value change with commodity price Debt Investors / Banks Most concerned with downside potential and ability to service debt (interest and repayment) May require hedging to insure debt service, thus eliminating upside potential that likely are the concern of equity investors. adam.graf@cowensecurities.com CONFIDENTIAL 2 www.cowensecurities.com Determining Value and Leverage By separating value and leverage, investors have a more complete method for choosing stocks that offer one, the other, or both. Additionally, investors can evaluate the cost of each. Value – The difference (or discount) between the market price and the ultimate intrinsic value of an asset at current commodity prices. Leverage – The change in intrinsic value directly associated with the price movement of an underlying commodity. NAV Methodology – Discounted cash flow method used to determine the intrinsic value of a company from the valuation of its assets at current commodity prices. By constructing commodity price matrices, leverage to underlying commodities can quickly be determined and compared. NAV can accommodate all significant variables and thus offers a more complete analysis than simple ratios (e.g. ounces of gold per share). adam.graf@cowensecurities.com CONFIDENTIAL 3 www.cowensecurities.com Leverage to Commodity Price LEVERAGE PER SHARE VS. UNDERLYING COMMODITY GOLD SILVER COPPER SA 2.37x 0.32x 0.96x ZINC 0.05x NAK 0.46x 0.00x 1.55x 0.49x TRQ 0.29x NG 2.25x SSRI 0.22x 2.18x 1.39x 4.00x AGI 1.58x 0.04x KGC 2.12x 0.08x 0.00x NEM 2.63x 0.12x 0.29x ABX 2.46x 0.14x 0.78x 0.01x GG 1.30x 0.19x 0.14x 0.10x AEM 2.68x 0.15x 0.03x 0.02x AUY 1.05x 0.19x 0.37x UXG 0.45x 0.59x 3.82x VTR 3.42x 0.82x AR 0.80x FCX CDE 0.11x 1.52x AG 0.78x ATM TRQ 0.46x 4.03x SSRI 4.50x MAY NAK GCU UXG 1.79x AR 1.72x PAAS 2.83x IMZ AUMN GSV 0.06x TKO 1.84x TGD 1.96x 0.12x GG 0.66x AG AUY PAAS 0.00x ANV 0.19x AUQ 2.44x AGI GBU TGD 0.24x GUY 0.04x IMZ 2.29x KGC 2.58x NG PVG GGA 0.50x CKG 1.08x 3.20x GGA 2.14x SGR 0.00x SA CKG 1.00x 0.00x VGZ 3.27x GBU 1.78x 0.81x ABX 3.99x AUMN MDW 2.31x PZG PVG VGZ 1.50x 2.36x NEM 3.67x GSV 1.05x THM AEM 1.50x TKO VIT GUY 2.00x 0.08x SGR 2.44x 2.50x VTR 3.32x 3.00x THM VIT MDW 3.50x PZG 0.07x ATM 0.95x 1.33x MAY 1.35x GCU ANV 5.00x 4.50x 1.35x AUQ Equity to Gold Leverage MOLYBDENUM 0.13x Company Ticker 0.94x 0.09x 2.57x adam.graf@cowensecurities.com CONFIDENTIAL 4 www.cowensecurities.com The Value Proposition “Major” and “Mid-Tier” miners trade at a higher P/NAV than single asset plays (“Juniors”) or development plays (“Emerging Miners”) 1.5x SWC AEM NAV( EoY 2013) 1.4x “Seniors” or “Majors”, & “Mid-Tier” producers 1.3x III 1.2x CDE BTO/CGA 1.1x 1.0x FVI “Junior” producers 0.9x MND LGC TMM P/NAV multiple 0.8x KRM 0.7x SSL RBY MAG THO AR P AZK AUN BVN EDR ABG SVM LODE KDX NG AZC SMF KOR RR CEE CUM NSU SMT/DIB LYD ASR ANV TRY PZG R BSX CS CG SRCH GUY PG SWD MAX SSRI GBU CSI MUX PVG MDW WS LSG LCC AUMN TGB SUE GSV .HDA SA ATM EOM/GSL SGR SSP VGZ CKG ATN THM CUV GCU ORANCQ NAK NKL QMM XRA VTR VIT GGA NUS JAG SFEG ANTO NCM PCU/SCCO NGD SLW AUY AG IVP HOC AUQ AGI HL FRES FNV GOLD OSK PMTL/POLY DGC RGLD PAAS NEM ABX GG EGO KGC FCX IMZ 0.6x 0.5x 0.4x 0.3x 0.2x MAY 0.1x 0.0x 10 KBX 100 1,000 IMG TRQ/IVN Explorers & Emerging Miners 10,000 100,000 Market Cap ($MM) Single/Duel Asset Producer Pre-Producer Multi-Asset Producer adam.graf@cowensecurities.com CONFIDENTIAL 5 www.cowensecurities.com Life Cycle of a Mining Share CONFIDENTIAL 6 www.cowensecurities.com The NAV Argument: Company vs. Asset Level Analysis • The finite resource and uniqueness of every ore body favors an asset-by-asset approach. • Mining companies and regulatory requirement often (but not always) provide the transparency needed. • The consolidated company approach loses data • The NAV is a collection of the value of each asset combined with the corporate balance sheet to indicate value to equity holders. adam.graf@cowensecurities.com CONFIDENTIAL 7 www.cowensecurities.com Market Based/M&A Based Valuation System $25 $20 $15 $10 $5 FRG Fundmental Value FRG Projected Market Value 2017 E 2016 E 2015 E 2014 E 2013 E 2012 E 2011 E 2010 2009 2008 $0 FRG Avg Annual Stock Price FRG provides a convenient case study. Applying a simple multiple set to project in various states of development, FRG followed “fair-market value” from 2008-2010. In late 2010, FRG was acquired by NEM for near “fundamental value”. adam.graf@cowensecurities.com CONFIDENTIAL 8 www.cowensecurities.com Market Based/M&A Based Valuation System 17% 16% 15% 14% 13% 12% 11% 10% 9% 8% 7% 6% 5% Gold & Silver Discount Rate Dec-12 Oct-12 Aug-12 Jun-12 Apr-12 Feb-12 Dec-11 Oct-11 Aug-11 Jun-11 Apr-11 Feb-11 Dec-10 Oct-10 Aug-10 Jun-10 Apr-10 Feb-10 Dec-09 Oct-09 Aug-09 Jun-09 Apr-09 Feb-09 Dec-08 4% Copper Discount Rate As equities underperform the commodities, the implied discount rate rises. A rising discount rate reduces NAVs, especially for long-lived projects. adam.graf@cowensecurities.com CONFIDENTIAL 9 www.cowensecurities.com Forward Looking Trends In Valuation Source: Mike Samis, Ernst & Young adam.graf@cowensecurities.com CONFIDENTIAL 10 www.cowensecurities.com Valuation Trends Dynamic NAV methodology, with market based inputs allows for asset and equity valuation in the context of the current market. Only by using this method can value be separated from leverage, allow both to be quantified and ranked. By determining fundamental (or intrinsic) value for each asset, can fairmarket value be projected over time using a schedule of catalysts. Advanced computing power allows for the use of increasingly sophisticated dynamic NAV models – which replace the need to use arbitrary conservative inputs (non-market derived) for prices or discount rates to evaluate risk. adam.graf@cowensecurities.com CONFIDENTIAL 11 www.cowensecurities.com Current Investment Trends Risk-Off in Gold Equities – Producers vs. Pre-Producers Investors shunning any hint of risk. Major Risks Concerning Investors & Acquirers Political Risk Permitting Risk Financing/Dilution Risk Execution Risk Large Producers have been punished for making acquisitions or aggressively executing project pipelines, then falling pray to these risks. adam.graf@cowensecurities.com CONFIDENTIAL 12 www.cowensecurities.com