8.1 Interest Rate Swap

advertisement

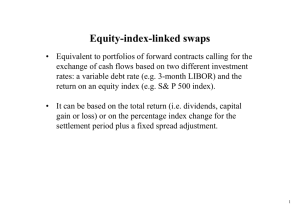

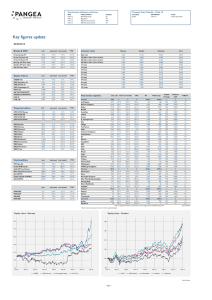

Topic 8. Swaps 8.1 Over-the-counter (OTC) Derivatives 8.2 Interest Rate Swap 8.3 Zero Curve 8.4 Forward Curve 8.5 Zero Delta 8.6 Forward Delta 8.7 DV01 1 8.1 OTC Derivatives 2012 Global OTC Derivative Gross Market Value: -- 25,392 Billion USD 30000 HK GDP: -- 263 Billion; -- 96 times of Hong Kong! 25000 20000 15000 10000 5000 0 US GDP: Hong Kong United States GDP GDP -- 15,684 Billion; -- 60% larger than the world largest economy ! Global OTC Derivatives 2 8.1 OTC Derivatives http://www.bis.org/statistics/otcder/dt1920a.pdf 3 8.1 OTC Derivatives The market for swaps has grown enormously, which has raised serious regulatory concerns regarding credit risk exposures. Such concerns motivated reforms from global regulators, e.g., the Dodd Frank Wall Street Reform Act, central clearing & collateralizations 18000 16000 OTC swaps in order of mkt value : -- interest rate: 17,265 billion usd -- currency: 1,955 -- credit: 1,187 -- commodity: 328 -- equity: 147 14000 12000 10000 8000 6000 4000 2000 0 Rates FX Credit Comm Equity 4 8.1 Interest Rate Swap Swaps are different from most other derivatives Portfolio of forward contracts Marked to market at coupon payment dates Intermediary should reduce counterparty risk Interest rate swap as succession of forwards: For example, a long position in “payer” means: -- Swap buyer agrees to pay fixed-rate, -- Swap seller agrees to pay floating-rate Purpose of interest rate swap: Allows swapping variable-rate income into fixed-rate (or vice versa) Better match the duration of assets and liabilities -- hedging 5 8.1 Interest Rate Swap Agreement to exchange fixed for floating interest cash flows A interest rate swap is quoted by the swap rate Example: $100m 3.1% 1x10 LIBOR swap Swap rate 3.1%, every 6m Bank A Bank B 3m Libor rate, every 3m 6 8.1 Interest Rate Swap Ex: $100m 3.1% 1x10 LIBOR swap Trade level specs: Notional: 100 million us dollars Trade date: 2012-Apr-9, today, the date the trade is transacted Settlement date: 2012-Apr-11, 2bd after the trade date, trade is “live” Swap effective date: 2013-Apr-11, after 1y, interests start to accrue Swap expiry date: 2023-Apr-9, after 11y, interests end accruing 7 8.1 Interest Rate Swap Ex: $100m 3.1% 1x10 LIBOR swap Floating Leg: Fixing: 3m USD LIBOR Pay Freq: quarterly Reset date: 2 bds before interest accrual period starts DCT(Day count conventions) : Act/360 BDC(Business day conventions): LON holiday, modified following 8 8.1 Interest Rate Swap Ex: $100m 3.1% 1x10 LIBOR swap Fixed leg: Fixed rate: 3.1% annualized Pay freq: semiannually DCT/BDC: 30/360, NY holidays, modified following 9 8.1 Interest Rate Swap Ex: $100m 3.1% 1x10 LIBOR swap 10 8.1 Interest Rate Swap Ex: $100m 3.1% 1x10 LIBOR swap 11 8.1 Interest Rate Swap 12 8.1 Interest Rate Swap Swap Rate – cout. Discount factor is from the zero curve – RED Forward LIBOR rate is from the forward curve – Blue 13 8.1 Zero Curve 14 8.1 Zero Curve 15 8.1 Zero Curve 16 8.1 Forward Curve 17 8.1 Forward Curve 18 8.1 Swap Sensitivity – Zero Delta 19 8.1 Swap Sensitivity – Forward Delta 20 8.1 Swap Sensitivity – DV01 21