FAS Bogota presentation

advertisement

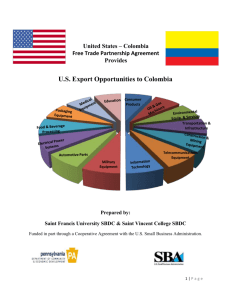

Colombian – U.S. Trade in Agriculture Elizabeth Mello Agricultural Attaché American Embassy Bogotá, Colombia Basic Facts Population: 44.9 million 50.6% women 49.4% men Bogota 7.7 million Medellin 2.1 million Area: Size of Texas and California combined Major Ag Exports: Coffee, cut flowers, and bananas Major Imports: Corn, soybeans and soybean meal, wheat, cotton GDP per capita (PPP): $4.964 (2009e) GDP growth (2009): 0.5 % Agricultural Land Use • 51 million hectares - 45% total Colombian area. • 77 % Livestock (39.2 mil) • 81 % Pastures (31.8 mil) • 14 % Forests • 95% Natural • 5% Commercial • 7% Cropland - 3.6 million hectares (Red) • Permanent crops • 2.1 million ha • Transitory crops • 1.4 million ha •Available land for Agriculture: 4.5 million ha could be converted to agricultural use without the need for deforestation. Livestock Forests Agriculture Let us know if you may have further questions. Colombia’s Agricultural Trade Colombia has exhibited dynamic economic growth but was halted by the recent world crisis which negatively affected total agricultural trade in 2009. Exports Imports Trade Surplus Two-Way Agricultural Trade The United States was Colombia’s #1 trading partner. In 2010, Colombian exports to the US valued $2 billion and Imports from the US fell to $846 million. Exports Imports Trade Surplus Two-Way Trade: Agricultural Market Share Imports of US products gained market share between 2001 and 2008 as Colombia increased Imports of corn, wheat, cotton, soybeans, and soybean meal. But in 2009-2010, US products, mainly corn and soybeans, lost market against Mercosur countries. Exports Imports In 2009-2010 U.S. Ag Export Values to Colombia Fell after Reaching Record Levels in 2008 Total Ag Export Value to Colombia Export Value, CY 2008 – 2010 CY 2001-10 ($ Millions) ($ Millions) Value added products In 2009-2010 U.S. Ag Export Values to Colombia Fell after Reaching Record Levels in 2008 Colombian Agricultural Imports from United States Changes Value (Millions $) Volume (Tons.) 2005-2008 2008-2010 2005-2008 2008-2010 Corn +453.6 -606.5 +479,836 -1,941,516 Wheat +222.5 -221.9 +172,263 -382,192 Soybeans +58.0 -41.0 +29,820 -51,762 Soybean Meal +85.7 -127.1 +103,654 -291,558 Cotton +23.0 +34.8 +5,232 +5,502 Food Ingredients (ch 21) +40.6 +6.9 +1,155 +1,374 Flour, starch, pasta (ch 19) +60.6 +0.6 +22,314 -74 Mechanically Deboned Chicken Meat (MDC) +16.5 +4.2 +24,949 +1,082 Trade Developments Ag Imports from the US lost market share Against Mercosur Countries and this trend may continue in 2010. Colombia expanded preferences to Mercosur countries. Colombia Signed and Agreement with Canada and is under negotiation with the European Union. Colombia continues to pursue free trade agreements with different countries. The implementation of the CTPA will level the playing field for US products. Most value-added food products and ingredients will enter duty-free immediately. In spite of an expected recovery for US Ag Exports to Colombia in 2010, the US will continue to lose market share due to the preferential import duties for competing countries if the CTPA is not signed. Colombia - U.S. Trade Promotion Agreemet (CTPA) Main Ag Products Yellow Corn Poultry meat - leg quarters Dry beans Beef Standard Quality Basic Duty U.S. 15 1/ 70 1/ 60 Current Duty 5% 1/ 3/ 70 60 Under Trade Promotion Agreement Out-of-TRQ TRQ - Duty Phase out Duty period 15 1/ 2.1 Mil. MT 12 years 127 27,040 MT 18 years 60 15,750 MT 10 years 80 80 2,100 MT 10 years Variety Meats 70 - 80 70 - 80 4,664 MT 10 years Powdered Milk Cheese Whey Eggs Pork Meat 98 1/ 20 1/ 94 20 20 /1 33 20 - 33 94 20 30 5,500 MT 2,310 MT 14 years 15 years Value Added food Products 15-20 15-20 Note: The CTPA remove the Price Band variable duty for imports from the United States. 1/ Under the Andean Community Price Band System variable duty 2/ Under CAN-Mercosur Free Trade Agreement 3/ Subject to a TRQ into a special Importing Mechanism Administration MAC 5 years 5 years Immediate Colombians Household Expenditures Colombians Hypermarkets - Supermarkets Name of Retailer Ownership # of Outlets Carrefour 100 % France 60 Alkosto 100% Local Makro of Colombia 100% SHVHolding (Dutch Holding) Almacenes Éxito Pomona, CarullaVivero, Surtimax Supertiendas Olimpica 62% Casino – France 38% Others 100% Local Cacharreria La 14 100% Local 19 Colsubsidio * 100% Local 20 Cafam* 100% Local 42 9 14 261 153 Location Type of Purchasing Agent(s) Bogota, Cali, Pereira, Importer, direct, Medellín, Ibague, local Barranquilla Bogota, Villavicencio, Importer, direct, Pasto, Ipiales, local, producers, Tuquerres distributors Bogota, Cali Importer, direct, Pereira,MedellinBarra local, producers, nquilla, Ibague, distributors Cartagena Medellin, Bogota, Importer, direct, Cali, local, producers, Other Main Cities distributors Main/Middle Cities Importer, local, producers, distributors Cali, Pereira. Importer, direct, Manizales, Local, producers, Buenaventura distributors Regional Bogota Local producers, distributors Regional Bogota Local producers, distributors * Entities funded by the employers as a way to provide workers with fringe benefits. They are mandated by the Colombian Labor legislation. Market Developments Colombia is a growing market for value-added food products. Economic recovery will be a driving force that will foster demand for new products at reasonable prices. Healthy and ethnic food categories are a new trend in the market and their acceptance and preference are growing fast. Gourmet products are penetrating the market with excellent results. Consumption of international wines has been increasing. Hypermarkets and supermarkets are actively working to promote wines from different sources as well as to educate Colombian consumers. Surveyed retailers and producers feel there is significant potential for new products in almost all food product categories.