A372ch6

advertisement

Chapter 6 Time Value of

Money and Accounting

In

theory, the fair value or market price of

assets and liabilities should equal the

present value (PV) of future cash inflows or

outflows

Examples:

– the fair value of long-term Notes (or Bond)

Receivables (or Payables) equals the PV of the

principal plus the PV of future interests

Single Sum Problem

Future

Valuet: PV=$1, n=5,i=10%; Table 1

0

1

2

3

4

5

I

I

I

I

I

I

$1

FV= $1.61051

Present Value: fv=$1, n=5, i=10%; Table 2

0

1

2

3

4

5

I

I

I

I

I

I

PV=0.62092

$1

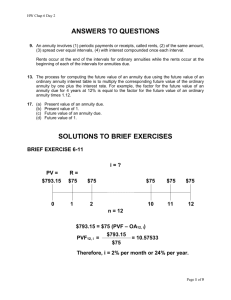

Ordinary Annuity

Future

Value: R=$1, n=5,i=10%; Table 3

0

1

2

3

4

5

I

I

I

I

I

I

$1 $1

$1 $1 $1 FV-OA=$6.1051

Present Value: R=$1, n=5, i=10%; Table 4

0

1

2

3

4

5

I

I

I

I

I

I

PV-OA=$3.79079 $1

$1 $1 $1 $1

Annuity Due

Future

Value:R=$1;n=5;i=10%; No Table

0

1

2

3

4

5

I

I

I

I

I

I

$1 $1 $1 $1 $1 FV-AD=$6.71569

Present Value: R=$1;n=5;i=10%; Table 5

0

1

2

3

4

5

I

I

I

I

I

I

PV-AD=$4.16986 $1

$1 $1 $1 $1

Deferred Annuity--first rent

occurs (y+1) periods from now

Future Value

R x (FVF-OA;n,i)

Present Value

R x [(PVF-OA;n+y,i) - (PVF-OA;y,i)]

or R x [(PVF-OA;n,i) x (PVF;y,i)]

FV= 9.48717

PV=3.6577

e.g.., y=3; n=7; i=10%; R=$1

0 1 2 3 4 5 6 7 8 9 10

I I I I I I I I I I I

$1 $1 $1 $1 $1 $1 $1

Deferred Annuity Due--first rent

occurs y periods from now

Future Value

Present Value

R x (FVF-AD;n,i)

R x [(PVF-AD;n+y,i) - (PVF-AD;y,i)]

or R x [(PVF-AD;n,i) x (PVF;y,i)]

FV = 10.4359

PV= 4.0235

e.g., y=3; n=7; i=10%; R=$1

0 1 2 3 4 5 6 7 8 9 10

I I I I I I I I I I I

$1 $1 $1 $1 $1 $1 $1

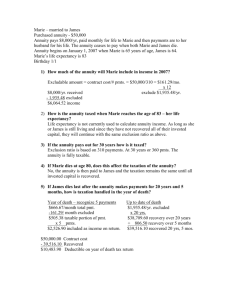

Deferred Annuity Exercise

What

amount must be deposited at 10% on

Jan.1 1995 to permit annual withdrawals of

$500 each beginning on Jan. 1, 1999 and

ending on Jan, 1 2002?

Time Diagram:

95 96 97 98 99 00 01 02

P=?

$500 $500 $500 $500

Solution to the Deferred

Annuity Problem

An

ordinary annuity of 4 rents deferred for 3

periods: PV=R x {(PVF-OA;7,10%) - (PVF-OA;3,10%)}

=$500 x {4.86842 - 2.48685} = $1,190.79

or PV= R x (PVF-OA; 4,10%) x (PVF; 3,10%)

=$500 x 3.16986 x 0.75131 = $1,190.79

An annuity due of 4 rents deferred for 4

periods: PV=R x {(PVF-AD;8,10%) - (PVF-AD;4,10%)}

=$500 x {5.86842 -3.48685} = $1,190.79

Bond Valuation

On

1/1/95, X Co. issued $1,000, 8%, 3-year

bonds with semiannual interest (market rate

is 10%), what is the sale price of the bond?

Answer:

PV of $1,000= $1,000 x (PVF;6,5%)=$747

PV of interest= $40 x (PVF-OA;6,5%)=$203

PV of bonds= $747 + $203 = $950