chapter 5

advertisement

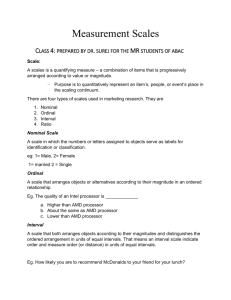

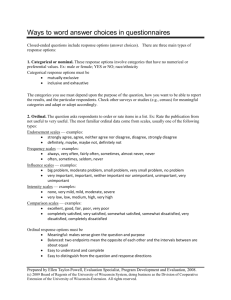

GODFREY HODGSON HOLMES TARCA CHAPTER 5 MEASUREMENT THEORY Importance of measurement Campbell: The assignment of numerals to represent properties of material systems other than numbers Assignment of numerals to objects or events according to rules. (Stevens) 2 Importance of measurement • Involves linking the formal number system to some property of objects or events by means of semantic rules – e.g. semantic rules in accounting are represented by transactions • In accounting we measure profit by: – first assigning a value to capital – then calculating profit as the change in capital over the period 3 Scales • Every measurement is made on a scale • Created when a semantic rule is used to relate the mathematical statement to objects or events • The scale shows what information the numbers represent 4 Nominal scale • • • • In this scale, numbers used only as labels Numbers represent classification e.g. numbering footballers e.g. the classification of assets and liabilities into different classes 5 Ordinal scale • In this scale, rank orders objects with respect to a given property – e.g. tallest to shortest person – e.g. investment alternatives that are ranked 1, 2, 3 according to the size of their net present values • Intervals between the numbers are not necessarily equal 6 Interval scale • In this scale, rank orders objects with respect to a given property • The distance between each interval is equal and known • An arbitrarily selected zero point exists on the scale – e.g. celsius temperature scale – e.g. standard cost accounting 7 Ratio scale • In this scale, rank orders objects with respect to a given property • Intervals between objects are known and equal • A unique origin exists – e.g. measurement of length – e.g. use of dollars to measure assets and liabilities 8 Permissible operations of scales • Invariance of a scale means that the measurement system will provide the same general form of the variables, and the decision maker will make the same decisions • This is not the case in accounting – there is more than one accounting system • The information they provide will differ and different decisions will be made 9 Permissible operations of scales • Nominal and ordinal scales – no arithmetic operations • Interval scale – addition and subtraction • Ratio scale – all arithmetic operations 10 Types of measurement • There must be a rule to assign numbers before there can be measurement • The formulation of the rules gives rise to a scale • Measurement can be made only on a scale 11 Fundamental measurements • Numbers are assigned by reference to natural laws • Fundamental properties are additive – e.g. length, number and volume • In accounting there is considerable debate over the nature of fundamental value 12 Derived measurements • Is one that depends on the measurement of two or more other quantities • Depends on known relationships to fundamental properties – e.g. the measurement of density depends on the measurement of both mass and volume – e.g. the measurement of profit depends on the measurement of both income and expenses 13 Fiat measurements • Typical in social sciences including accounting • Based on arbitrary definitions - e.g. of profit • Numerous ways in which scales can be constructed • May lead to poor levels of confidence in the scale – e.g. there are hundreds of ways to measure profit 14 Reliability and accuracy • No measurement is free of error except counting – e.g. we can count the chairs in a room and be exactly correct 15 Sources of error The sources of error include the following: • Measurement operations stated imprecisely • Measurer • Instrument • Environment • Attribute unclear • Risk and uncertainty We need to establish limits of acceptable error 16 Reliable measurement • What is reliable measurement? – proven consistency – repeatable or reproducible – precision • Reliability incorporates two aspects – accuracy and certainty of measurement – representative faithfulness 17 Accurate measurement • Consistency of results, precision and reliability do not necessarily lead to accuracy • Accuracy has to do with how close the measurement is to the ‘true value’ of the attribute measure - representation • ‘True value’ may not be known – e.g. in accounting accuracy relates to the pragmatic notion of usefulness 18 Accurate measurement • Many accounting measurements are on a ratio scale • This is the most informative scale • Weakest theoretical foundation as they are fiat measurements 19 Measurement in accounting • Two fundamental measures – capital & profit • Capital and profit can be defined & derived in various ways • Concepts of capital & profit have changed over time – number of concepts of fundamental measurement 20 Measurement in accounting • Two notable developments in international standards (2005, IASB) – profit measurement and revenue recognition should be linked to timely recognition – the fair value approach should be adopted as the working measurement principle At no stage has the principle of capital maintenance been explicitly discussed 21 Measurement issues for auditors • The focus of profit measurement has shifted from matching revenues and expenses to assessing the changes in the fair value of net assets – e.g. immediate recognition of impairment losses 22 Measurement issues for auditors • Auditors must determine whether management has made appropriate and reasonable valuations – e.g. at least 12 methods of valuing intangibles 23 Measurement issues for auditors • It is possible for several different but reasonable measurements and impairment losses to be recognised by management • These would all be acceptable to an auditor if management have – applied the valuation models correctly – used appropriate data – made appropriate assumptions – acted in a consistent manner 24 Summary • Measurement involves the formal linking of numbers to some property or event via semantic rules • Rules used to assign numbers are determined according to four scales • Invariance of a scale means the measurement system will provide the same general form of the variables and the decision maker will make the same decisions • There are three different types of measurement • Reliability refers to consistency, and accuracy refers to the representation of a fundamental value • The two fundamental measures in accounting are capital and profit and they are both derived measures • The existence of alternative valuation methods creates auditing issues 25 Key terms and concepts • • • • • • • • • • • • • Measurement Nominal scale Ordinal scale Interval scale Ratio scale Invariance of a scale Fundamental measurements Derived measurements Fiat measurements Reliability in measurement Accuracy in measurement Capital and profit as derived measurements Appropriate measurement in an auditing context 26 27