“Unlawful” vs. Lawful Expropriation: Date of Valuation

advertisement

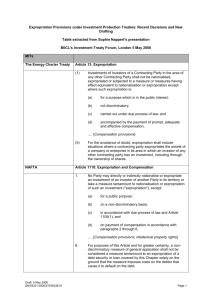

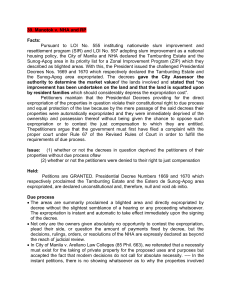

Foro de Arbitraje 2011 Unique Considerations regarding Damages in Investment and Commercial Arbitration Craig S. Miles King & Spalding, Houston, EUA Mexico City 2 September 2011 Topics • Lawful vs. “unlawful” expropriation in investment arbitration and date of valuation Issues in both investment and commercial arbitration • Standard of compensation for non-expropriation violations in investment arbitration • Appropriate pre-/post-award interest rates for awards against sovereigns • Measuring damages to shareholders in investment arbitrations (puede ser muy complicado) • Effect of local company settlements on shareholder claims in investment arbitrations “Unlawful” vs. Lawful Expropriation • Typical expropriation provision: “Investments shall not be expropriated or nationalized except under due process of law, in a non-discriminatory manner, and upon payment of prompt, adequate and effective compensation payable in freely transferable currency” • Suppose State acknowledges obligation to compensate but parties disagree on amount; or State pays in bonds that are not “freely transferable” • Does this make the State’s expropriation “unlawful”? Does it matter? Should it matter? “Unlawful” vs. Lawful Expropriation: Date of Valuation • Where it could matter (also true in commercial cases): date of valuation (or “date of expectations”) • Suppose in 2008 State expropriates (or commercial party breaches obligation related to) barrel of oil due to be produced in 2011 • In 2008, oil trading at $35/bl • In 2011, oil trading at $85/bl • Should Tribunal in assessing damages in 2011 use price of $35/bl at date of expro/breach in 2008, or current price of $85/bl? Why or why not? Standard of Compensation for Non-Expropriation Treaty Violations (e.g., F&ET) • Treaties say to use fair market value (“FMV”) for lawful expropriation • Treaties generally silent on standard of compensation for “unlawful” expropriation or other, non-expropriation Treaty violations • Customary international law standard = “full compensation” • Some tribunals use FMV for non-expropriation violations; States don’t like it • Does it matter? Should it matter? Appropriate Interest Rate to Use for Awards Against Sovereigns • Can the whole “lawful” vs. “unlawful” problem be solved by interest rate? • Example of Venezuela: expropriated oilfield service companies in May/June 2009; has not paid • Assume expropriated oilfield services company was worth $100 MM in May 2009 • In August 2011, compensation would be: – $107.5 MM at risk-free rate (~ 3.5%) – $134.4 MM at risk-free + EMBI (~ 14.3%) – $130 MM at VZ 10-year bond rate (~ 12.5%) – $123 MM at VZ 7-year bond rate (~ 10%) Quantifying Damages to Shareholder in Presence of HoldCo Debt $50 or $100? Claimant 100% Third-Party Debts of $50 Hold Co. 50% 50% $100 Op. Co. $200 7 Situation A: Investor Bears 100% of Damages Investor $60 100% $30 Hold Co. $90 $60 100% 100% Op. Co. $100 Lenders $30 Lenders $10 $40 Situation B: HoldCo’s Lenders Also Get Hit Investor $50 100% $20 Hold Co. $80 100% $10 $60 100% Op. Co. $100 Lenders $30 Lenders $20 $40 Situation C: Both HoldCo and OpCo’s Lenders Get Hit Investor $20 100% $0 Hold Co. $50 100% $30 Lenders $30 $60 100% Op. Co. $100 $10 Lenders $50 $40 Local Company Settlements -- Effect on Shareholder’s Treaty Arbitration • BITs protect shareholders in local companies • When local company settles (e.g., Argentina), what is effect on BIT claim? • More often than not shareholder’s interests aligned with local company and BIT claim will disappear with settlement • But what if shareholder is minority shareholder and votes against settlement? • Sempra Award: Tribunal took settlement into account in assessing damages but not did not bar claim; other Tribunals have suggested claim should be barred