Five Forces Industry Analysis

1

Five Forces Industry Analysis

Nicole Fiamingo

Five Forces Industry Analysis

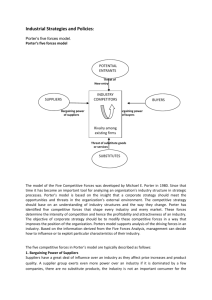

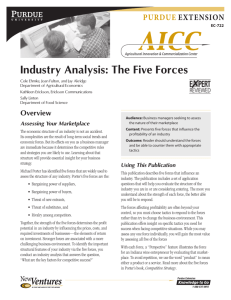

Description & Purpose

Developed by Michael Porter

Provides an understanding of an industry and its participants

Used as a means to decrease the gap between a firm’s external environment and its internal resources

2

Five Forces Industry Analysis

Objective of the Five Forces

Identify the profit potential of an industry

Identify the forces that would harm your company’s profitability in that industry

Protect and extend your competitive advantage

Anticipate changes in industry structure

3

Five Forces Industry Analysis

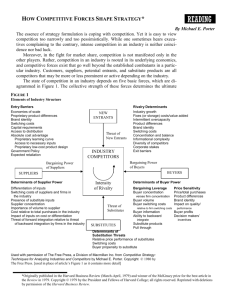

Porter’s Five Forces

3.

4.

1.

2.

5.

Threat of new entrants

Bargaining power of suppliers

Bargaining power of buyers

Threat of substitute products or services

Degree of rivalry among existing competitors

4

5

Five Forces Industry Analysis

1. Threat of New Entrants

1.

2.

3.

4.

5.

6.

7.

8.

9.

New entrants usually face several barriers to entry, including:

Entry-deterring price

Incumbent retaliation

High entry costs

Experience effects

Other cost advantages

Product differentiation

Distribution access

Government restrictions

Switching costs

6

Easy to Enter if there is:

• Common technology

• Little brand franchise

• Access to distribution channels

• Low scale threshold

Difficult to Enter if there is:

• Patented or proprietary know-how

• Difficulty in brand switching

• Restricted distribution channels

• High scale threshold

Easy to Exit if there are:

• Salable assets

• Low exit costs

• Independent businesses

7

Difficult to Exit if there are:

• Specialized assets

• High exit costs

• Interrelated businesses

Five Forces Industry Analysis

2. Bargaining Power of Suppliers

Suppliers bargaining power may be influenced by:

3.

4.

1.

2.

5.

Concentration

Diversification

Switching costs

Organization

Government

8

Suppliers are Powerful if:

Credible forward integration threat by suppliers

Suppliers concentrated

Significant cost to switch suppliers

Customers Powerful

Suppliers are Weak if:

Purchase commodity products

Concentrated purchasers

Customers Weak

Example

Baxter International, manufacturer of hospital supplies, acquired American

Hospital Supply, a distributor

Drug industry's relationship to hospitals

Microsoft's relationship with PC manufacturers

Boycott of grocery stores selling nonunion picked grapes

Example

Grocery store brand label products

Garment industry relationship to major department stores

Travel agents' relationship to airlines http://www.quickmba.com/strategy/porter.shtml

9

Five Forces Industry Analysis

3. Bargaining Power of Buyers

Buyer’s Bargaining power my be influenced by:

3.

4.

1.

2.

Differentiation

Concentration

Profitability

Quality

10

Buyers are Powerful if: Example

Buyers are concentrated - there are a few buyers with significant market share

Buyers purchase a significant proportion of output - distribution of purchases or if the product is standardized

Buyers possess a credible backward integration threat - can threaten to buy producing firm or rival

Buyers are Weak if:

Producers threaten forward integration producer can take over own distribution/retailing

Buyers are fragmented (many, different) no buyer has any particular influence on product or price

Producers supply critical portions of buyers' input - distribution of purchases

DOD purchases from defense contractors

Best Buy and Sears' large retail market provides power over appliance manufacturers

Large auto manufacturers' purchases of tires

Example

Movie-producing companies have integrated forward to acquire theaters

Most consumer products

Intel's relationship with PC manufacturers http://www.quickmba.com/strategy/porter.shtml

11

Five Forces Industry Analysis

4. Threat of Substitute Products or Services

Market displacement by existing/potential substitutes can be influenced by:

1.

2.

3.

Relative price/performance trade off

Switching costs

Profitability

12

The Threat of Substitutes is High Risk: The Threat of Substitutes Low Risk:

Consumer switching costs are low

Substitute product is cheaper than industry product

Consumer switching costs are high

Substitute product is more expensive than industry product

Substitute product quality is equal or superior to industry product quality

Substitute product quality is inferior to industry product quality

Substitute performance is equal or superior to industry product performance

Substitute performance is inferior to industry product performance

No substitute product is available http://www.wikicfo.com/Wiki/default.aspx?Page=Threat+of+Substitutes+-

+one+of+Porters+Five+Forces&AspxAutoDetectCookieSupport=1

13

Five Forces Industry Analysis

5. The Degree of Rivalry Among Existing Players

The intensity of competition within an industry is determined by:

3.

4.

5.

1.

2.

Market Growth

Cost Structure

Barriers to exit

Product switching

Diversity

14

Rivalry will be high:

There are a large number of similar sized firms (rather than a few dominant firms) all competing with each other for customers

The costs of leaving the industry are high e.g. because of high levels of investment. This means that existing firms will fight hard to survive because they cannot easily transfer their resources elsewhere

The level of capacity utilization. If there are high levels of capacity being under-utilized the existing firms will be very competitive to try and win sales to boost their own demand

The market is shrinking so firms are fighting for their share of falling sales

There is little brand loyalty so customer are likely to switch easily between products http://www.oup.com/uk/orc/bin/9780199296378/01student/additional/page_11.htm

15

Five Forces Industry Analysis

Strengths

Forecast future changes in each of the five forces

Discover how these changes will affect the other forces

Discover how the interrelated changes will affect the future profitability of the industry

Discover how you might change the strategy to exploit the changing industry structure

16

Five Forces Industry Analysis

Weaknesses

Underestimates the capabilities that may serve as the company’s competitive advantage in the long-term

Does not take into account the synergies and interdependence within a corporation’s overall portfolio

Strict interpretations ignore social & political factors

Does not address why or how companies are able to get advantageous positions

17

Five Forces Industry Analysis

How to Do It

Step 1: Collect Information

Identify your industry

Look at existing demand & supply patterns

Identify the characteristics of each of the five forces

Examine & assess their impact on the industry

18

Five Forces Industry Analysis

How to Do It

Main Sources of Competitive Pressures

1.

Rivalry among competitors

2.

3.

Threat of substitute products

Threat of potential entry

4.

5.

Bargaining power of suppliers

Bargaining power of buyers

19

Five Forces Industry Analysis

How to Do It

Step 2: Assess & Evaluate

Determine the direction of the force

Give each force a value indicating if it is strong, moderate, or weak.

Scale of 1 – 5, with 1 being the weakest

The ultimate goal:

To identify the ability of your company to successfully compete within its industry, of the five forces given the collective strength

20

Five Forces Industry Analysis

How to Do It

Step 3: Develop Strategy

Repeat the first two steps in light of industry change and evolution

Long-term industry trends should be analyzed to determine whether the profitability of the industry is sustainable and how this will affect your company’s competitive position.

21

Five Forces Industry Analysis

Conclusion

Understanding how an industry will evolve provides important direction for selecting and managing strategy around these five criteria

Not all industries are alike-for companies with product portfolios across numerous industries, this technique should be repeated for each industry

22