Slides

A First Look at Everything

Interest Rates and the Time Value of Money

• Time Value of Money

▫ Imagine a simple investment opportunity with the following cash flows (which are certain to occur).

Cost: $1,000 today

Benefit: $1,030 in one year

Can we judge the opportunity as valuable by noting that

$1,o3o > $1,000?

Money has two “units”

▫ The difference in value between money today and money in the future is “the time value of money.”

The Interest Rate:

An Exchange Rate Across Time

• The rate at which we can exchange money today for money in the future via the financial markets is determined by the current interest rate.

▫ Suppose the current annual risk free interest rate is

5%. By investing or borrowing at this rate, we can exchange (trade) $1.05 in one year for $1 today.

Risk Free Interest Rate (Discount Rate), r f

: The interest rate at which money can be borrowed or lent without risk.

Interest Rate Factor = 1 + r f

= 1.05 ($s tomorrow/$ today)

Discount Factor = 1 / (1 + r f

($s today/$ tomorrow)

) = 1/1.05 = $0.9524

▫ Investors are compensated for surrendering capital.

Previous Example

• Real investment opportunity

Cost: $1,000 today

Benefit: $1,030 in one year

$1,000 today becomes $1,030 in one year.

• Financial market, with an interest rate of 5%:

$1,000×(1+r f

) = $1,000×(1.05) = $1,050

$1,000 today becomes $1,050 in one year.

• What do we think of the investment opportunity?

Problem

• The cost of replacing a fleet of company trucks with more energy efficient vehicles is $100 million now.

• The cost is estimated to rise by $8.5 million next year.

• If the interest rate is 4%, what is the cost of a delay in terms of dollars next year?

Solution

• If the project were delayed, it’s cost next year will be:

▫ $100 million +$8.5 million = $108.5 million next year

• Compare this amount to the cost of replacing nowstated in dollars next year using the interest rate of

4%:

▫ $100 million × ($1.04 next year/$1 now) = $104 million next year

• The cost of a one year delay would be:

▫ $108.5 million – $104 million = $4.5 million next year

(future value)

Problem

• The cost of replacing a fleet of company trucks with more energy efficient vehicles is $100 million now.

• The cost is estimated to rise by $8.5 million next year.

• If the interest rate is 4%, what is the cost of a delay in terms of dollars now?

Solution

• We know if we delay, the project costs $108.5 million next year.

• Compare this amount to the cost of $100 million now using the interest rate of 4%:

▫ $108.5 million ÷ ($1.04 next year/$1 now) =

$104.33 million now

• The cost of a one year delay would be:

▫ $104.33 million – $100 million = $4.33 million now (present value). Why is the value different?

Discussion

• This example is the same as the example of trading gold for silver presented in the text.

• The price today of receiving $1.04 in one year is $1.

• The price today of receiving $1 today is of course $1.

• After we convert the values using these prices we do not ask whether to trade $X today for $Y in one year but rather should we trade $X today for $W today.

▫ Importantly: $Y in one year and $W today are equivalent.

• In these terms the choice is clear: is X W or X W?

• We will discuss and extend this idea as we go forward.

Present Value and the NPV Rule

• The net present value (NPV) of a project or investment is the difference between the present value of its benefits and the present value of its costs.

▫ Net Present Value

NPV

PV (Benefits)

PV (Costs)

PV (Benefits

Costs)

NPV

PV (incremental project cash flows)

The NPV Decision Rule

• When making an investment decision, take the alternative with the highest NPV. Choosing this alternative is equivalent to receiving its NPV in cash today.

▫ Accept all projects with a positive NPV. Accepting them is equivalent to receiving their NPV in cash today (firm value changes by the NPV of the project).

▫ Reject projects with a negative NPV. Accepting these projects is equivalent to reducing current wealth by their NPV.

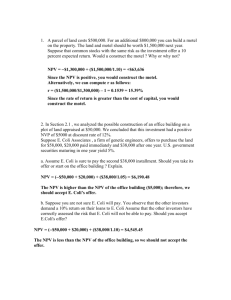

Consider Three Projects (r

f

= 20%)

B

C

Project

A

Cash Today ($)

42

-20

-100

Cash in one year ($)

42

144

225

PV of Cash in one year

NPV ($ today) Project

A

B

C

Cash Today

42

-20

-100

NPV

• Although Project B has the highest NPV, what if we do not want to (can’t) spend the $20 for the cash outlay?

Would Project A be a better choice? Should this affect our choice of projects?

• What if you will need more than $144 next year, is

Project C then a good choice?

• As long as we are able to borrow and lend at today’s interest rate, Project B is superior whatever our preferences regarding the timing of the cash flows.

• Again, this follows from the same logic as the gold for silver trade in your text. Let’s see…

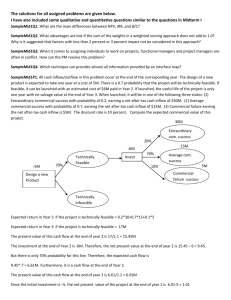

NPV and Individual Preferences

Project B and borrowing

Project B

Borrow

Total

Cash today

-20

62

42 (compare A: 42)

Cash in one year

144

-62 × 1.20 = -74.4

69.6 (compare A: 42)

Project B and saving Cash today

Project B

Save

Total

-20

-80

Cash in one year

144

80 × 1.20 = 96

-100 (compare C: -100) 240 (compare C: 225)

NPV and Individual Preferences

Project B and borrowing

Project B

Borrow

Total

Cash today

-20

120

100

Cash in one year

144

-144

0

• As we said, accepting a positive NPV project is equivalent to receiving that much cash today.

• This arrangement is equivalent to selling the right to project B and extracting all the value in the sale.

Separation Principle

• The only arbitrage free price for a financial security is for price to equal the present value of the cash flows

(expected to be) paid by that security.

• This means that in an arbitrage free market the NPV of buying or selling financial securities is zero.

▫ Every trade has a buyer and a seller, if the price is such that the NPV is not zero one party will object.

• Therefore, a real investment project can be evaluated independently of the financing necessary to pursue it.