closing entries. - Mrs. Radlick`s Website

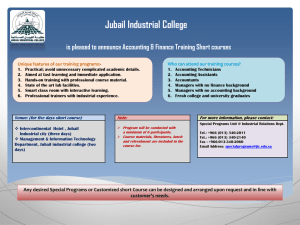

advertisement

Chapter 10 Adjusting and Closing Entries Recording Adjusting Entries In Chapter 8, we learned about adjustments. We analyzed how adjustments affect assets and expenses on the Worksheet, but we did not make the adjusting entries. Recording Adjusting Entries Adjustments must be journalized so they can be posted to the general ledger accounts. Journal entries recorded to reflect adjustments to the general ledger accounts at the end of a fiscal period are called “adjusting entries.” Where do you make adjusting journal entries? Adjusting entries are made in the general journal (general debit and general credit columns of a journal with special columns), on the next journal page following the page on which the last daily transactions for the month are recorded. Recording adjusting entries Worksheet: Account Title Supplies Trial Balance Debit $1,000 Adjustments Credit Debit Credit (a)$400 ***(omitted) Supplies Expense (a)$400 Recording Adjusting Entries Journal Date Account Title Dec. 31 Adjusting Entries Supplies Expense Supplies Page 3 Doc Post No. Ref. General Debit Credt $400 $400 Recording Adjusting Entries There is no Document No., so you write the heading “Adjusting Entries” in the Journal, one time, before all of the adjusting entries that follow. Recording Adjusting Entries Write the date in the left hand column. Debits go first – debit “Supplies Expense,” Credit “Supplies” Post to the General Ledger Post each Journal entry to the General Ledger accounts (Supplies and Supplies Expense). Put the No. of the General Ledger account in the Posting Ref. column of the Journal Posting to the General Ledger Posting the adjusting entries to the General Ledger accounts will adjust these account balances to the correct amount, as reflected on the Worksheet / financial statements. Effect of Posting (using T-accounts) Supplies $1,000 (a)$400 $600 (End. Bal.) Supplies Expense (a)$400 Recording adjusting entries – Prepaid Insurance Worksheet: Account Title Prepaid Insurance Trial Balance Adjustments Debit Credit Debit $1,200.00 (b)$500. 00 ***(omitted) Insurance Expense Credit (b)$500 .00 Recording Adjusting Entries Journal Page 3 Date Account Title Dec. 31 Adjusting Entries Supplies Expense Doc Post No. Ref. General Debit Credt $400 Supplies 31 Insurance Expense Prepaid Insurance $400 $500 $500 Recording Adjusting Entries Write the date in the left hand column. Debits go first – debit “Insurance Expense,” Credit “Prepaid Insurance” Effect of Posting (using T-accounts) Prepaid Insurance $1,200 (b)$500 $700 (End. Bal.) Insurance Expense (b)$500 Recording Closing Entries What is an Odometer? How many does a car have? Why? Apply the Trip Odometer Concept to Accounting: What would happen if you kept adding to the existing accounts in the new fiscal period? Closing Entries (continued) For some accounts – it is necessary to carry forward the balance from the previous period These are permanent accounts. Exs: Cash, Accounts Receivable, Accounts Payable – Assets, Liabilities, and Owner’s Capital are Permanent Accounts Closing Entries (continued) Other accounts must be re-set to zero at the start of the new fiscal period (just like the trip odometer) – temporary accounts Temporary Accounts: Revenue and Expense Accounts, Income Summary, Drawing Account – “REID” Temporary Accounts Temporary accounts track changes in the owner’s capital during the fiscal period. Easier to harvest information about activity during a fiscal period if you use temporary accounts (just like a trip odometer.) They must be reset to zero at the end of the fiscal period (just like a trip odometer.) Closing Entries Journal entries made to close out temporary accounts at the end of a fiscal period and prepare them for a new fiscal period are called “closing entries.” Closing Entries The closing entry re-sets the account to zero, so each fiscal period’s amounts are kept separate. To close an account, make an entry on the opposite side, equal to the amount of the balance in the account. Closing Entries (continued) When you make the closing entries, the entry must have equal debits and credits. If you credit an account to close it (e.g., expenses have a debit balance), then you must enter an equal amount of debits. Use a temporary account called “Income Summary” to summarize the closing entries for revenue and expense accounts. Income Summary Account The Income Summary account: A temporary account Does not have a normal balance side The balance (debit or credit) is determined by the amounts posted at the end of a fiscal period Income Summary Account When revenue > expenses, there is net income, and the Income Summary account has a _________ balance (CLOR) When revenue < expenses, there is a net loss, and the Income Summary has a __________ balance (DEAD) Income Summary So, if Income Summary has a credit balance, then the amount of the credit balance is the net income. If Income Summary has a debit balance, then the amount of the debit balance is the net loss. Income Summary – Credit Balance Income Summary DEBIT CREDIT Total Expenses Total Revenue (Greater than Expenses – Credit Balance is Net Income) Income Summary – Debit Balance Income Summary DEBIT CREDIT Total Expenses Total Revenue (Greater than Revenue – Debit Balance is a Net Loss) 4 Closing Entries: 1. 2. 3. 4. Entries to close Income Statement accounts that have credit balances (Revenue / Sales); Entries to close Income Statement accounts that have debit balances (Expenses); An entry to record Net Income (Loss) and close the Income Summary account; An entry to close the Drawing account Example of Closing Entry – Credit Balance (Revenue / Sales) Before closing entry: Sales /Fees / Income 4,000 (cr) Closing entry: Sales/ Fees/ Income 4,000 (dr) 4,000 0 Income Summary 4,000 (cr) Debit Sales/Fees/Income, and credit Income Summary. Example of Closing Entry – Debit Balance (Expenses) After adjusting entry, before closing entry: Supplies Expense 1,000 (dr) Closing entry: Supplies Expense 1,000 1,000 (cr) 0 Income Summary 1,000 (dr) Credit the Expense, and debit Income Summary. Closing entry to close Income Summary (record net income / loss) The Income Summary account balance must be reduced to zero at the end of the fiscal period (reset the trip odometer.) What is the balance in the Income Summary account? (see slide #26) Credit balance = Net Income Debit balance = Net Loss Closing entry to close Income Summary (record net income / loss) We learned in Chapter 9 that Net Income increases the Owner’s Capital account, while a Net Loss decreases the Owner’s Capital account. Closing entry to close Income Summary (record net income / loss) If you have Net Income (credit balance in Income Summary), then you debit Income Summary and credit Owner’s Capital (CLOR). This will INCREASE Owner’s Capital. If you have a Net Loss (debit balance in Income Summary), then you crebit Income Summary and debit Owner’s Capital (CLOR). This will DECREASE Owner’s Capital. Closing entry to close Income Summary (record net income) Income Summary 2,500(dr) 4,000(cr) 1,500(bal) Ben Radlick, Capital 3,000(cr) Income Summary 1,500 (dr) 1,500 0 Ben Radlick, Capital 3,000 1,500(cr) 4,500(bal) Closing entry to close Income Summary (record net loss) Income Summary 4,500(dr) 4,000(cr) 500(bal) Ben Radlick, Capital 3,000(cr) Income Summary 500 500 (cr) 0 Ben Radlick, Capital 500(dr) 3,000 2,500(bal) Closing entry for Drawing Account You must reduce the Owner’s Drawing account (debit balance) to zero, so you credit it, but you must balance the credit with a debit entry -where do you think the entry to balance it goes? Hint: it does not affect Income. Closing entry for Drawing Account Remember that Withdrawals are amounts that the Owner takes out of the business – they reduce the Owner’s investment in the business, so they reduce the Owner’s Capital account. The drawing account is closed directly to the Owner’s Capital account. Closing entry for Drawing account Ben Radlick, Drawing 400 (dr) Ben Radlick, Capital 4,500(cr) Ben Radlick, Drawing 400 400 (cr) 0 Ben Radlick, Capital 400(dr) 4,500 4,100(bal) Closing entry for Drawing Account