4.1 - bcarroll01

advertisement

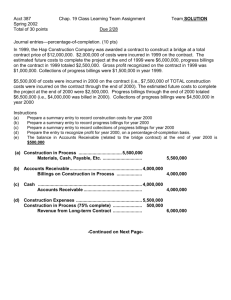

Consumer Credit Chapter 4 Live within your income, even if you have to borrow money to do so. - Josh Billings The use of credit cards: • There are almost a billion MasterCard and Visa credit and debit cards in the United States. • In 2006, Visa cardholders made more than $1,000,000,000,000 in purchases • Today’s consumer owes money, on average, to 13 different lending institutions. • More than half of the United States population has at least 2 credit cards. What do you need to know before using credit? 2 ways to make a purchase: 1) Buy now, pay now 2) Buy now, pay later Anytime you purhcase something that you do not pay for immediately, you are using credit. How is using electricity a form of credit? What other daily activities can be considered credit? Buy now, pay later Any time you purchase something that you do not pay for immediately - Credit People who use credit - Debtors Organizations or people that extend credit to consumers - Creditors What are the advantages and disadvantages of using credit? Why does using credit tempt overspending? Installment Plans • The customer pays for the merchandise over a period of time. • The customer pays part of the selling price at the time of purchase (down payment) • The rest of the selling price is paid in monthly installments. • Customers are also charged interest, also known as a finance charge Heather wants to purchase an electric guitar. The price of the guitar with tax is $2,240. If she can save $90 per month, how long will it take her to save up for the guitar? Is Heather using credit? Divide selling price by monthly savings 2,240 90 24.9 → 25 months Heather speaks to a salesperson who suggests she buy the guitar on an installment plan. It requires a 15% down payment. The remainder, plus an additional finance charge, is paid back on a monthly basis for the next two years. The monthly payment is $88.75. What is the finance charge? Down payment of 15% of selling price How do you find 15% of $2,240 = (0.15) x (2,240) = $336 Price = $2,240; Down payment = $336 • Makes a monthly payment of $88.75 for 2 years – (24 months) x (88.75) = $2,130 • How much did she pay for the guitar? $2,130 + $336 = $2,466 • What was the finance charge? $2,466 - $2,240 = $226 Class Work • Page 178, 2-6 Consumer Credit Chapter 4 He that goes a borrowing goes a sorrowing. Benjamin Franklin What is: • Credit? • Finance Charge? • Creditor? • Debtor? Carpet King is trying to increase sales, and it has instituted an installment plan with no interest, as long as the total is paid in full within six months. There is a $20 minimum monthly payment required. If you buy a carpet for $2,134 and make only the minimum payments for five months, how much will you have to pay in the sixth month? → $20 a month for 5 months = $100 → You will need to pay $2,034 in the sixth month 2. Monique buys a $4,700 air conditioning system using an installment plan that requires 15% down. How much is the down payment? → What is 15% of $4,700? = (0.15) x (4,700) = $705 How much will Monique have left to pay? = 4,700 - 705 = $3,995 3. Craig wants to purchase a boat that costs $1,420. He signs an installment agreement requiring a 20% down payment. He currently has $250 saved. Does he have enough? → What is 20% of $1,420? = (0.20) x (1,420) = $284 Does he have enough? Nope 4. Jean bought a $1,980 snow thrower on the installment plan. The agreement included a 10% down payment and 18 monthly payments of $116 each. a) How much is the down payment? = (0.10) x (1,980) = $198 b) What is the total amount of the monthly payments? = ($116) x (18 months) = $2,088 c) How much did Jean pay for the snow thrower? = $198 + $2,088 = $2,286 5. Linda bought a washer and dryer for y dollars. She signed an installment agreement requiring a 15% down payment and monthly payment of x dollars for one year. a) How much is the down payment? = (0.15) (y) = 0.15y b) How many monthly payments? 12 c) What is the total amount of monthly payments? = (12) (x) = 12x c) How much did Linda pay for the washer & dryer? = 0.15y + 12x 5. How much is the finance charge? = Amount paid – price of purchase = 0.15y + 12x - y 6. Zeke bought a $2,300 bobsled on the installment plan. He made a $450 down payment, and he has to make monthly payments of $93.50 for the next two years. How much interest will he pay? Down Payment: $450 Monthly payment amount:(93.50) (24) = $2,244 Total amount paid: $450 + $2,244 = $2,694 Interest: $2,694 - $2,300 = $394 The Whittendale family purchases a new refrigerator on a no-interest-for-one-year plan. The cost is $1,385. There is no down payment. If they make a monthly payment of x dollars until the last month, express their last month’s payment algebraically. Down Payment: $0 Monthly payment amount:(11) (x) = 11x Total amount paid: 11x Last Payment: $1,385 – 11x Try this: You purchase a guitar that costs “p” dollars. You make a 20% down payment for a oneyear installment plan and pay “w” dollars per month. Express your finance charge algebraically. Down Payment: 0.2p Monthly payment amount:(12) (w) = 12w Total amount paid: 0.2p + 12w Finance Charge: 0.2p + 12w - p Class Work • Page 178, 7 – 11, skip part e in number 11 7. Gary is buying a $1,250 computer on the installment plan. He makes a down payment of $150. He has to make monthly payments of $48.25 for 2 ½ years. What is the finance charge? Down Payment: $150 Monthly payment amount:(48.25) (30) = $1,447.50 Total amount paid: $1,597.50 Last Payment: $1,597.50 - $1,250 = $347.50 8. Mazzeo’s Appliance Store requires a down payment of 1/3 on all installment purchases. Norton’s Depot requires a 30% down payment on installment purchases. Which store’s down payment rate is lower? Mazzeo’s 1/3 down payment = 33.33% Norton’s Depot = 30% Norton’s Depot is lower 9. Ari purchased a microwave oven on the installment plan for m dollars. He made a 20% down payment and agreed to pay x dollars per month for the two years. Find the finance charge down payment = 20% of m = 0.2m Monthly payments: x dollars for 2 years = 24x Finance Charge: Paying Prince – Selling price = 24x + 0.2m - m 10. Adam bought a $1,670 video game system for no-interest. He made $100 down payment and agreed to pay off the entire purchase in 1 ½ years. The minimum payment is $10. If he pays the minimum up until the last month, what will his last payment be? down payment = $100 Monthly payments: ($10) (17) = $170 Total Paid: $100 + $170 = $270 Last Payment: $1,670 - $270 = $1,400 11.Open the following spreadsheet: 4.1 homework problem 11 Consumer Credit Credit Rating Credit Rating: • Remember that credit is a promise to repay all the borrowed money • This means that credit is based on honesty • Your honesty is determined by your credit rating •Better rating → Lower finance charges Credit Rating: • Your credit rating is based on 3 things: 1) Total Assets Everything you own 2) Earning Power Your ability to make money now and in the future 3) Credit History Your previous credit record Credit Score: • Most popular score is the FICO Score - Credit score ranges from 300 to 850 - Higher the score, better the credit rating - Better the credit rating, less risky it is to lend you money - Less risk → Lower interest rate FICO Score: • checked when you apply for: •Mortgage •Car Loan •Credit Card •Rental Apartment •Even Prospective Employer • 3 Major Credit Bureaus: •Experian, Transunion, and Equifax FICO History: • Originally only contained negative information •Fair Credit Act of 1971 •Positive information is added •You gain the right to see your credit score •1989 – FICO score is adapted FICO Significance: • You are judged by a number •300 – extremely risky borrower •850 – Perfect borrower •Low rating can determine whether you get a loan, apartment, or even job •Nobody can check your credit report without your permission FICO Effects: • Credit rating of 650 and lower, you may still get a loan, but much higher interest rate - Can mean hundreds of dollars more - May also need larger down payment •Landlords also check credit rating before renting •Employers also check credit rating - Want to know how disciplined you are FICO Prevention/Solutions: • To keep your credit rating high: - Pay all your bills on time - If you pay a bill late, pay it before it reaches the 30 day mark. - Limit the number of times you apply for credit and credit cards - Never let any bills go to collections You can check your credit report for free once a year from each of the 3 bureaus Your grandfather is debt-free – he bought his car and his house without taking out a loan. He saved and paid cash. He wanted to take out a loan to buy you a car for college graduation. The bank turned him down when he applied for credit. Why would this happen? The following inequalities give information on your credit score, with x being your score: • If x > 700, your credit score is excellent •If 680 < x < 700, your credit score is good •If 620 < x < 680, your credit score should be watched carefully •If 580 < x < 620, your credit score is low •If x < 580, your credit score is poor If you have a low credit score, but receive 40 points for paying off some debt, is it possible your credit moves to good? Class Work • Page 178, 12 - 16