Equal and Uniform Taxation * Not in Texas!

advertisement

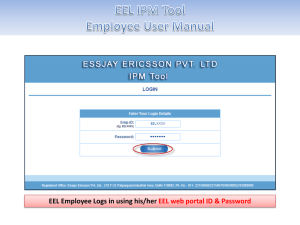

Equal and Uniform Taxation – Not in Texas! Presented By: Alvin Lankford Chief Appraiser Williamson CAD Appraisal District 101 Texas State Law provides for the establishment of appraisal districts within each county. The appraisal district is responsible for appraising property in the district for each taxing unit that imposes ad valorem (property) taxes on property within the district. The appraisal district is a political subdivision of the State of Texas. • ALL appraisals are done at 100% of Market Value as of January 1 of the tax year • Texas Property Tax Law’s 2 Basic Principles Article 8, Section 1, Texas Constitution ◦ All taxable property should be taxed in proportion to its market value. ◦ All taxable property should be taxed in an equal and uniform manner. Market Value per Texas Property Tax Code Market Value – The price at which a property would transfer for cash or its equivalent under prevailing market conditions if: ◦ Exposed for sale in the open market with a reasonable time for the seller to find a purchaser. ◦ Both the seller and the purchaser know of all the uses and purposes to which the property is adapted and for which it is capable of being used and of the enforceable restrictions on its use ◦ Both the seller and purchaser seek to maximize their gains and neither is in a position to take advantage of the exigencies of the other. Market Value per Common Sense What is the property worth? What would the property sell for? How is market value obtained by the Appraisal Districts? Sales! Seems simple but it is not simple in Texas! Texas is one of only 5 states that do not require sales disclosure when buying or selling real estate. ◦ Texas is the only one of the 5 that local governments are funded primarily using property taxes. Non – Sales Disclosure States Why would anyone want to tell the government about the price they paid? “It’s a privacy issue” ◦ That would make sense but…. ◦ Websites now display home sales How do Appraisal Districts Obtain Residential Home Sales? No MLS Access Utilizing websites Sending Sales Questionnaires Realtors and Brokers Property owner provided Appraisal Districts obtain 80-90% of ALL residential sales This large sample of sales creates a fairly accurate appraisal of most homes ◦ The average appraisal is typically 98-100% of the sale price or actual market value in most metropolitan counties However, Million Dollar plus homes do not report on MLS or any other source ◦ The owners of these high value homes typically pay less in proportion to their market value because of the lack of information Pays Property Taxes on 70% - 80% of Market Value Pays Property Taxes on 98% 100% of Market Value How do Appraisal Districts Obtain Commercial Property Sales? Paid Services such a Co-Star and Loop Net Sales Questionnaires Realtors and Brokers Appraisal Districts only obtain 20-30% of ALL Commercial Sales. ◦ Because of the lack of information large Commercial Properties see appraisals at 50-70% of their actual market value. Pays Property Taxes on 50% - 70% of Market Value Lack of Sales Disclosure Creates Unequal Appraisal Remember the first basic principle in the Tax Code? ◦ All taxable property should be taxed in proportion to its market value. ◦ Large Commercial property is NOT taxed in proportion to its market value Residential pays taxes at 98-100% of their market value (with the exception of high value homes) Large Commercial pays taxes at 50-70% of their market value How do we correct this? Full Sales Disclosure ◦ Allows for sales information to be shared with the Appraisal District on large commercial properties and high value homes (ex: $1MM+ homes) ◦ Creating a fair playing field for values Real Property Values for Texas https://www.youteube.com/watch?v=TTQ -ksLrdPo It Gets Worse…. Large Commercial starts out with a lower value in relation to their market value Yet, Legislation written in 1997 (by a property tax attorney who works for large commercial property owners: Jim Popp www.property-tax.com ) created a loophole that allows for continued reductions in appraisals of large commercial properties. Remember the 2nd Basic Principle? “All taxable property should be taxed in an equal and uniform manner.” The 1997 legislation added language to section 41.43 and 42.26 of the tax code dealing with equal and uniform. ◦ This language though innocuous at first glance has changed the manner in which equal and uniform appraisal is protested. The Text of The Equal and Uniform Law being taken advantage of ARB Protest Section ◦ 41.43 (b) (3) – the appraised value of the property is equal to or less than the median appraised value of a reasonable number of comparable properties appropriately adjusted. Lawsuit Section ◦ 42.26 (a) (3) – the appraised value of the property exceeds the median appraised value of a reasonable number of comparable properties appropriately adjusted. Let’s Break It Down….. “Median Value” – The value of the middle property when values are arrayed from smallest to largest. ◦ Properties must be “equal to or less than” the median per the law. ◦ Example: Adjusted Comparable Values Median $ 40,000,000 $ 37,500,000 $ 35,000,000 $ 30,000,000 $ 27,500,000 $ 25,000,000 $ 20,000,000 Let’s Break It Down….. “Reasonable Number of Comparable Properties” - Who defines what a reasonable number is? What does “comparable” mean? – There is no guidance given on either. “Appropriately Adjusted” – Who decides what is “appropriate” The Deterrence of Litigation You may ask yourself…”Why don’t Appraisal District’s fight these values at court?” CAD is liable for attorney’s fees for the other side if the property is reduced at all in court Commercial Property Owner is NOT liable for CAD attorney’s fees at all These fees penalize appraisal districts for trying to hold a fair value. The Deterrence of Litigation Attorney’s Fees Sec. 42.29. . (a) A property owner who prevails in an appeal to the court under Section 42.25 or 42.26, in an appeal to the court of a determination of an appraisal review board on a motion filed under Section 25.25, or in an appeal to the court of a determination of an appraisal review board of a protest of the denial in whole or in part of an exemption under Section 11.17, 11.22, 11.23, 11.231, or 11.24 may be awarded reasonable attorney’s fees. The amount of the award may not exceed the greater of: (1) $15,000; or (2) 20 percent of the total amount by which the property owner’s tax liability is reduced as a result of the appeal. (b) Notwithstanding Subsection (a), the amount of an award of attorney’s fees may not exceed the lesser of: (1) $100,000; or (2) the total amount by which the property owner’s tax liability is reduced as a result of the appeal. The Shrinking Value of Large Commercial Examples of Equal and Uniform Abuse •Cost = $200 Million •Travis CAD Appraised Value = $111 Million •Equal and Uniform Lawsuit Adjusted Value = $98 Million •Paying Property Taxes on 48% of original cost Examples of Equal and Uniform Abuse JW Marriott Hill Country Resort and Spa & San Antonio •Cost = $600 Million •2011 Appraisal = $150 Million •Under Equal and Uniform Lawsuit Every Year…. •Paying taxes on 25% of their cost to construct Examples of Equal and Uniform Abuse Towers at Williams Square in Las Colinas (Dallas Area) •Sold in 2012 for $226 Million •Equal and Uniform Litigate Value = $147 Million •Paying Property Taxes on 65% of Sale Price Link to E&U Articles Here is a link to articles that have been written in local newspapers throughout the State http://bit.do/WCAD Texas Association of Appraisal Districts Focus Minimize the impact of this law and increase the FAIRNESS! Point One: For the median calculation of adjusted comparables use: ◦ Use Value at time of Appraisal Notice for all comparables during ARB (Appraisal Review Board) hearings ◦ Use ARB Determined Value during Litigation Texas Association of Appraisal Districts Focus Point Two: Go back to the Texas Constitution and use “All taxable property should be taxed in proportion to its market value.” ◦ Never more than 10% below the Market Value Stated another way: The greater of (1) median or (2) value that is equal to market less 10% Other Needed Legislative Changes No attorney’s fees unless more than 10% over median value Or, attorney fees calculate from the last official offer from the appraisal district instead of the ARB determined value What Can You Do? Talk to your Legislators! This is a FAIRNESS issue it is not about taxes Contact Information Alvin Lankford ◦ 512-931-7811 ◦ AlvinL@WCAD.org