Duration

advertisement

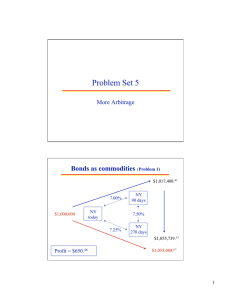

V: Bonds 15: Duration Duration Concept Calculation Duration and Price Volatility Chapter 15: Duration © Oltheten & Waspi 2012 Fundamental Risk Reinvestment Risk: The risk that coupons, paid out of the bond, cannot be reinvested at the same YTM. Price Risk: The risk that the price of the bond will fall Note that this is a risk only if we sell the bond before it matures. There is no price risk if we hold the bond to maturity. Chapter 15: Duration © Oltheten & Waspi 2012 Duration Duration: Weighted by Net Present Value average term to maturity. Duration can be calculated on any cash flow structure. Chapter 15: Duration © Oltheten & Waspi 2012 A Tale of Two Bonds $1000 5% Annual Coupon $1000 9% Annual Coupon $50 $50 $50 $50 $50 $90 $90 $90 $90 $90 Price: $918.00 Price: $1,082.00 Chapter 15: Duration © Oltheten & Waspi 2012 A Tale of Two Bonds Capital Gain -1.56% Capital Gain 1.73% 5 $1082.00 Income Yield: 5.45% 5 $918.00 t 1 t 1 $50 .07 1 1 t $1000 .07 1 1 5 year capital gain = 8.93% Annual capital gain = 1.73% Yield to Maturity: 7.00% Chapter 15: Duration Income Yield: 8.32% 5 $90 .07 1 1 t $1000 .07 1 1 5 year capital gain = - 7.58% Annual capital gain = - 1.56% Yield to Maturity: 7.00% © Oltheten & Waspi 2012 5 A Tale of Two Bonds How much of my investment faces a reinvestment risk every year? $50 $50 $50 $50 $1050 $90 $90 $90 $90 $1090 Chapter 15: Duration © Oltheten & Waspi 2012 Calculating Duration I T 1 year 2 years 3 years 4 years 5 years Chapter 15: Duration 5 year 5% Annual Coupon Bond at 7% Cash NPV NPV/P Flow $50 $46.73 5.09% $50 $43.67 4.76% $50 $40.81 4.45% $50 $38.14 4.16% $1050 $748.64 81.55% Total NPV =$918.00 100.00% © Oltheten & Waspi 2012 A Tale of Two Bonds How much of each bond must be reinvested after 1,2,3,4 and 5 years? 5.1% 5% Bond 4.8% 4.4% 9% Bond 4.2% 7.8% 7.3% 6.8% 6.3% 81.6% Chapter 15: Duration 71.8% ©& Oltheten & Waspi 2012 © Oltheten Waspi 2012 Calculation 5 year 5% Annual Coupon Bond at 7% T 1 year 2 years 3 years 4 years 5 years Chapter 15: Duration Cash Flow $50 $50 $50 NPV $46.73 $43.67 $40.81 NPV/P Duration Convexity T*NPV/P D*(T+1) 5.09% .050903 .101806 4.76% .095146 .285439 4.45% .133383 .533530 $50 $38.14 4.16% .166209 .831044 $1050 $748.64 81.55% 4.077553 24.465317 Total NPV =$918.00 100.00% 4.523 yrs 26.217 yrs2 © Oltheten & Waspi 2012 A Tale of Two Bonds Chapter 15: Duration © Oltheten & Waspi 2012 Duration & Price Risk Volatility: Change in the price of the bond due to a change in market yield. Δ Price Duration Volatility * Δ Yd 1 Yd Price Chapter 15: Duration © Oltheten & Waspi 2012 Duration & Volatility 5% annual bond: 4.523 yrs * 1% = 4.227% 1.07 Modified Duration is 4.227 years If Yd1% then P4.227% If Yd 1% then P4.227% Chapter 15: Duration 9% annual bond: 4.272 yrs * 1% = 3.993% 1.07 Modified Duration is 3.993 years If Yd1% then P3.993% If Yd 1% then P3.993% © Oltheten & Waspi 2012 Price Yield Curve 150 140 130 120 110 100 90 80 70 60 1% Chapter 15: Duration 3% 5% 7% 9% 11% 13% © Oltheten & Waspi 2012 Price Yield Curve 5 year 5% annual coupon 7% yield 120 110 100 90 80 70 1% Chapter 15: Duration 3% 5% 7% 9% 11% 13% © Oltheten & Waspi 2012 Price Yield Curve 20 year 6% semi-annual coupon 8% yield 200 175 150 125 100 75 50 25 0 1% Chapter 15: Duration 3% 5% 7% 9% 11% 13% 15% © Oltheten & Waspi 2012 Calculating Duration II Calculate the duration and convexity of a semi-annual bond $10,000 6% coupon December 31, 2017 Settles March 2, 2014 102.000 Chapter 15: Duration © Oltheten & Waspi 2012 Calculating Duration II Base Price: 62/180 days Accrued Interest: Invoice Price: $10,200.00 $103.33 $10,303.33 YTM: 5.41186% Chapter 15: Duration © Oltheten & Waspi 2012 Calculating Duration II Chapter 15: Duration © Oltheten & Waspi 2012 Exercise Calculate the duration and convexity of a semi-annual bond $1000 6% coupon 2.5 years to maturity Priced to yield 8% Chapter 15: Duration © Oltheten & Waspi 2012 Semi-Annual Bonds 1 1/2 year 6% Semi-Annual Coupon Bond at 8% T Cash Flow NPV NPV/P Duration T*NPV/P Convexity D*(T+1) 1 2 3 4 5 Chapter 15: Duration © Oltheten & Waspi 2012 Volatility Duration: First derivative of the Price Yield Curve .D = dP/dY Slope of the Yield Curve Convexity: Second derivative of the Price Yield Curve .C = dP2/d2Y Curvature of the Yield Curve Chapter 15: Duration © Oltheten & Waspi 2012 Volatility Taylor Expansion: ΔP Duration 1 Convexity 2 Δy Δy 2 y P 2 y 1 1 2 2 Modified Duration Modified Convexity Yield at which duration was calculated Chapter 15: Duration © Oltheten & Waspi 2012 Volatility $1000 6% semi-annual coupon 2 ½ years to maturity Duration: Modified D: Convexity: Modified C: 2.355 yrs 2.355 =2.264 (1.04) 6.922 yrs2 6.922 = 6.400 (1.04)2 Priced to Yield 8% Chapter 15: Duration © Oltheten & Waspi 2012 Δ Yield +200 basis points Duration only -2.355 (+.02) (1.04) Chapter 15: Duration Convexity Correction + 1 2 Total 6.922 (+.02)2 = (1.04)2 © Oltheten & Waspi 2012 Δ Yield -200 basis points Duration only -2.355 (-.02) (1.04) Chapter 15: Duration Convexity Correction + 1 2 6.922 (-.02)2 (1.04)2 Total = © Oltheten & Waspi 2012 Price Yield Curve 200 Convexity corrections are always positive 175 150 125 100 Price effect is asymmetric 75 50 25 0 1% Chapter 15: Duration 3% 5% 7% 9% 11% 13% © Oltheten & Waspi 2012 15% Volatility Yields increase by 2% - 4.5288% + 0.128% = - 4.4009% Yields decrease by 2% + 4.5288% + 0.128% = + 4.46568% Convexity corrections are always positive Chapter 15: Duration Price effect is asymmetric © Oltheten & Waspi 2012 Spreadsheet Exercise 15-1 15-2 Chapter 15: Duration © Oltheten & Waspi 2012 Bonds IV