Insuring Terrorism Risk - 2015 and Beyond

TERRORISM RISK 2015

AND BEYOND

Wendy Peters

Senior Vice President

Terrorism Practice Group Willis North America

TERRORISM RISK TODAY

The Terrorism Risk:

Is terrorism risk still an issue?

How is terrorism currently insured?

New market dynamics & capacity.

The Terrorism Risk Insurance

Program Reauthorization Act of 2014:

News from Capitol Hill. Support or inaction? The latest proposals.

The consequences of indecision

– options available to ensure optimal coverage.

Action Items for 2015

TERRORISM TODAY – THE NEW THREATS

ISIS

ISIS and ISIL:Islamic State of Iraq and Syria

(ISIS / or Islamic State of Iraq and the

Levant

Estimated 50,000 in Syria / 30,000 in Iraq

Estimated $2 billion in net assets by mid

2014 private donors, robbing banks, etc.

Produces raw crude and sells electric power in Syria

Sophisticated in use of social media; cunning, brutal, well-funded.

ISIS is believe to have established foothold in Mexico in cooperation with drug cartels.

Is it still a threat in the US?

Over 50 potentially significant attacks have been identified & prevented in the US since 9/11

TERRORISM IN THE US

• At least 19 publically known terrorist attacks against the US have been foiled since 9/11.

• While not of the scale of 9/11, the fear of home grown terrorists increases

• Motives can vary from revenge for war on Islam, to poverty, to animal rights, or governmental policy.

• Over 100 US citizens have been identified as ISIS recruits.

• New tactics: Cyber terrorism, electro- magnetic pulse, biological agents ( e.g. ebola) .

• Attacks on the power grid in 2014 in

California.

INSURING TERRORISM RISK: MARKET DYNAMICS

Terrorism was not a defined peril until 9/11. Now considered an

“unmodelable” risk.

TRIA is due to expire in December of 2014 without Congressional action.

The stand alone property and casualty terrorism insurance market has an estimated capacity at $3.0 billion per risk written by over 30 US and UK markets.

Captives have provided broadened access to otherwise uninsurable perils and limits

Percentage of companies purchasing terrorism insurance for either property or casualty exposures – either embedded or stand alone insurance: 60 -70%.

Major Metro area insureds face greatest challenges in obtaining sufficient coverage, but all insureds will be impacted by TRIPRA changes.

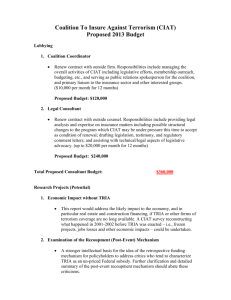

TRIA 2014: THE WORD FROM CAPITOL HILL:

July 17 th , U.S. Senate passed by a vote of 93 - 4 extension of TRIA

Changes Proposed in the Senate Legislation:

•

Incrementally raises the coinsurance contribution of insurers from the current 15% of loss to 20% by 2019

• Changes recoupment from $27.5 billion to $37.5 billion.

• Extends the program for a further 7 years

•

No change to program trigger of $100 million

•

No change to NBCR coverage

THE WORD FROM CAPITOL HILL:

Changes to TRIA in the House Proposal:

• Incrementally raises the coinsurance contribution of insurers from the current 15% of loss to 20% by 2019

•

Changes recoupment from 133% to 150% of losses paid.

•

Extends the program for a further 5 years only

• Raises trigger incrementally to $500 million. Maintains

$100 million trigger for NBCR.

• Allows for “smaller companies” to opt out less than $300 million surplus?

( less

DAYS LEFT IN CURRENT

CONGRESSIONAL CALENDAR

:

6

CURRENT STATE OF TRIA REAUTHORIZATION

Congress

House of

Representatives

Senate

H.R. 4871 TRIA

Reform Act of 2014

Sponsor Randy

Neugebauer (R-TX)

Bill introduced into

House of

Representatives

A House-Senate conference committee writes a compromise bill that goes back to both houses

Bill introduced into

Senate

S.2244 Terrorism

Risk Insurance

Program

Reauthorization

Act of 2014

Sponsor Charles

"Chuck"

Schumer(D-NY)

House Committee on

Financial Services

Chairman Jeb

Hensarling (R-Texas

Referred to House committee and subcommittee

Referred to Senate committee and subcommittee

Senate

Committee on

Banking, Housing and Urban Affairs

Chairman Tim

Johnson (D-SD)

House and Senate vote on final passage;approved bill is sent to the President

Voted on by full committee

Reported by

Committee on

June 3, 2014

Reported by

Committee on

June 20, 2014

Voted on by full committee

Chairman Hensarling will not move the bill past committee stage as he does not believe there are enough votes for House passage

House debates and votes on passage

Senate debates and votes on passage

Passed on

July 17, 2014

President can sign bill into law or veto it

TRIA reauthorization bill(s)

THE POSSIBLE CONSEQUENCES OF NON RENEWAL

If TRIA is allowed to expire, insurers are no longer mandated to offer terrorism insurance. Losing that “subsidy”, insurers will be inclined to raise rates.

Mortgage lender requirements may not be met

Captives will be defunded.

Stand alone terrorism market may offer only secure capacity for the medium term risk. May be insufficient in Tier One areas.

No exclusion permitted for fire following terrorism in 14 states. Will impact availability of property insurance.

No exclusion permitted for workers compensation – will force carriers out of the market.

ACTION PLAN FOR 2015

Confirm with existing insurers position regardless of TRIA extension.

Evaluate placing stand alone capacity to fill gaps or drop down where carriers cannot confirm extension post 12/2014.

Consider Risk Modeling – Do I understand the impact of attack to my portfolio?

Not only a property issue. Casualty, Comp,

Environmental.. all could have sunset clauses.

Secure sufficient capacity to reinsure captives, if currently deployed, in the event

TRIA backstop eliminated.