File

advertisement

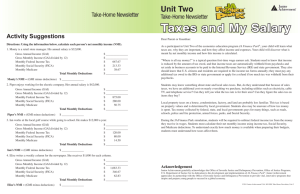

Unit 2: Lesson 2 Nearly everyone who holds a job has taxes automatically taken out of, or withheld, from their paychecks. No matter what kind of job you have, your take-home pay will be reduced by the amount of tax owed to the Internal Revenue Service (IRS) and, in most cases, state government. As participants in the Finance Park program, students will gain an understanding of taxes and how taxes will affect their income and expenses. Students will determine their net monthly income (NMI) using income tax, Social Security, and Medicare deductions. Students will learn about different kinds of taxes and will understand how these taxes may affect how much money they have available when preparing their budgets. FICA Federal Insurance Contributions Act, also known as Social Security. Medicare A social insurance program that extends health coverage to almost all Americans aged 65 and over. Social Security A federal retirement program in which the working generation contributes to support retired workers, survivors, and the disabled. Separate into groups. Each group will receive a set of Tax Cards. Without reviewing any resource information, groups need to separate the cards into two piles. One pile should contain all federally supported programs, and the other pile should contain state-supported programs. Federally Supported Programs State-Supported Programs Social Security Public Schools Medicare Local Libraries Retirement Programs Streetlights Community Development Programs (job, training, education) Social Programs Garbage Collection Law Enforcement (CIA, FBI) Police, Jails, Courts Government Administration (IRS) Local Parks & Recreation Social Services Firefighters Elections Mass Transportation It has been said that taxes are what we pay to have a civilized society. Taxes are needed to pay for the services we have come to expect from government. Many of these services are for things most people could not afford individually, such as an army or highway system. A tax is required payment of money to local, state, or federal government. Income tax, sales tax, and property tax are the three main sources of tax income. An income tax is a tax on an individual’s earnings from wages, salary, tips, interest, rents, capital gains, and dividends. It is the largest sources of tax revenue for the federal government. Federal income tax usually is the largest single amount withheld from workers’ paychecks. Each year on and before April 15, American citizens calculate what they owe in taxes and pay any amount due (beyond what was withheld from their pay) or refund (if they overpaid). The following are some characteristics of the American income tax system: Federal income tax is based on one’s ability to pay. This is called progressive taxation: The higher a person’s income, the greater the percentage he or she pays. The IRS relies on individual honesty and responsibility for citizens to pay their income taxes. This is called voluntary compliance. Income taxes are figured on a pay-as-you-earn basis. As you receive income, you pay the estimated tax owed. It is an employer’s responsibility to withhold tax from your paycheck and deposit it with the IRS. You, rather than the government, prepare and file (send) your tax forms (tax return) each year, determine your own tax liability, and pay any tax due or request a refund. This is called selfassessment. The federal government uses tax money to pay for different programs to help the country and its citizens. Examples of these programs are: Social Security, Medicare, and other retirement programs National defense, veterans, and foreign affairs Interest payments on the national debt Physical, human, and community development programs (natural resource, environmental, transportation, job training, and education programs) Social programs (Medicaid, food stamps, health programs, unemployment compensation, assisted housing) Law enforcement and government administration (prisons, FBI, CIA, and the general costs of federal government, including the collection of taxes) Complete page 49, Income Tax, in the JA Finance Park book What is it? A proportion of one’s personal income paid to the government. The largest source of revenue for state and federal governments. Where does it come from? Individual workers and corporations Uses National Debt National Defense Social Programs Law Enforcement Veterans Affairs Government Administration How is it determined? A percentage of income or revenue Sales taxes, those pennies or dollars added to purchases, are a source of income for most state governments. Each state decides its own sales tax. Countries and cities also may charge a sales tax. Some items are taxed, and some are not. Items not taxed are taxexempt. Examples of taxed items may be: Household Items Restaurant Food Furniture Gasoline Utilities Shoes and Clothing Motel and Hotel Bills Liquor Tobacco Products Examples of nontaxable items may be: Groceries Medicine Medical Services Insurance Sales taxes provide income to state and local governments, but they are criticized by some for being regressive, meaning individuals or families with low incomes may pay a greater percentage or proportion of their incomes in sales taxes than do families with higher incomes. Complete page 48, Income Tax, in the JA Finance Park book What is it? A percentage tax imposed on the retail price of most items. A source of income for governments. Where does it come from? (Who pays it?) Consumers, both individuals and businesses Uses Human Services, Health Care State and/or Local Government Police, Jails, and Courts Transportation College, Schools, and Libraries Parks and Recreation Taxable Items Household items, restaurant food, furniture, gasoline Non-Taxable Items Groceries, Medicine, Services, Insurance Property Taxes are paid based on the value of property – anything from private homes and cars to commercial buildings and factories. This property value is determined by local governments. Property taxes often are the primary source of local government income. Local and state governments use sales and property tax revenues to pay for services and facilities, such as the following: Public schools and local libraries Local roads and streets Streetlights Garbage collection, recycling Police, jails, and courts Local parks and recreation State employment services Social services Firefighters Elections Mass Transportation Complete page 50, Income Tax, in the JA Finance Park book What is it? A tax paid to local government based on the value of one’s property. Where does it come from? (Who pays it?) Owners of homes, property, commercial buildings, and factories Uses Human Services, Health Care State and/or Local Government Police, Jails, and Courts Transportation College, Schools, and Libraries Parks and Recreation How is it determined? Based on the value of the property Bob Randall and Margaret Bratter have been working parttime at Handy Corner Convenience Store for more than a year and are earning a good salary. They receive a paycheck each week. One day, during an afternoon break, they discussed the amount of their paychecks after taxes were deducted. Both were surprised at the amount of money they actually had left over to take home. They thought they would bring home more than they did. Where did it all go? Complete the pay stubs. Use the information on each stub to calculate the amount of the employee’s total check. Complete the checks for the correct amount and answer the questions. Employee Name: Bob Randall Pay Period: April 22-29, 2009 Weekly Salary: $187.50 Federal tax withheld (one exemption):$18.08 Social Security tax withheld: $16.36 Medicare tax: $3.06 Total Deductions: $37.50 Net Pay (weekly salary minus total deductions): $150.00 What is the name of Bob’s Employer? Handy’s Corner Concenience Store How much did Bob earn before taxes? $187.50 How much is Bob’s net (take home) pay? $150.00 Why was his net (take home) pay so much less than he earned? Taxes were deducted. List Bob’s deductions. Federal tax $18.08 Social Security tax $16.36 Medicare tax $3.06 Employee Name: Margaret Bratter Pay Period: April 22-29, 2009 Weekly Salary: $193.66 Federal tax withheld (one exemption):$18.87 Social Security tax withheld: $16.58 Medicare tax: $3.18 Total Deductions: $38.63 Net Pay (weekly salary minus total deductions): $155.03 How much did Margaret earn before taxes? $193.66 How much is Margaret’s net (take-home) pay? $155.03 List Margaret’s deductions. Federal tax $18.87 Social Security tax $16.58 Medicare tax $3.18 All but a handful of states have a sales tax. Each state determines its own tax rate, which can run from 0 to 9.25%. The following receipts are from a state where the sales tax is 6%, and there is an additional county tax of 1%. In this county, consumers pay a total of 7% in sales tax. As in many states, nonfood items are taxable, but food and drugs are not taxable (tax exempt). Sales tax is charged only on taxable items. Examine the two sample sales receipts. Compute the sales tax and final cost for the items found at the bottom of the page. Taxable Items Nontaxable (exempt) Items Diapers $7.99 Bread $1.09 Toothpaste $1.99 Can tomato soup $0.69 Deodorant $2.29 1 gal. ice cream $2.50 Beach ball $4.39 Oranges $5.29 Camera film $2.75 Ground beef $6.39 Window cleaner $2.19 Frozen pizza $3.99 Spiral notebook $1.99 Apple juice $0.99 Subtotal $23.59 Subtotal Sales Tax Total $1.65 $25.24 Sales Tax Total $20.94 $0.00 $20.94 To compute sales tax: Convert the percent (%) to a decimal. ▪ Example: 7% = .07 Multiply the subtotal by .07. ▪ Example: $23.59 x .07 = $1.65 Add the computed sales tax to the subtotal for the total that the consumer pays. ▪ Example: $23.59 + $1.65 = $25.24 Deodorant Price = $2.29 7% sales tax = $0.16 Final Price = $2.45 Window Cleaner Price = $2.19 7% sales tax = $0.15 Final Price = $2.34 Camera Film Price = $2.75 7% sales tax = $0.19 Final Price = $2.94 Diapers Price = $7.99 7% sales tax = $0.56 Final Price = $8.55 Spiral notebook Price = $2.75 7% sales tax = $0.14 Final Price = $2.13 What is 7% sales tax on a car that costs $8,099.00? $566.93 What is the total cost of this car (including sales tax)? $8,665.93 Using the information provided, calculate each person’s net monthly income (NMI). Remember, GAI is gross annual income, and GMI is gross monthly income. 1. )Stephanie graduated from college and on her first job earned an annual salary of $25,000. GAI GMI (GAI divided by 12) $25,000.00 $2,083.33 Monthly Federal Income Tax $259.00 Monthly Social Security Tax $132.00 Monthly Medicare TOTAL MONTHLY DEDUCTIONS Stephanie's NMI = (GMI minus deductions) $26.00 $417.00 $1,666.33 2. ) Darren was able to land a job at the town recreation center after school and on weekends. He will make $2,700 if he works the entire year. GAI GMI (GAI divided by 12) $2,700.00 $225.00 Monthly Federal Income Tax $23.00 Monthly Social Security Tax $18.00 Monthly Medicare TOTAL MONTHLY DEDUCTIONS Darren's NMI = (GMI minus deductions) $4.00 $45.00 $180.00 3. ) Jeremy is working his way through college with two jobs. He will earn $13,000 a year if he continues to work both jobs. GAI GMI (GAI divided by 12) $13,000.00 $1,083.33 Monthly Federal Income Tax $129.00 Monthly Social Security Tax $67.00 Monthly Medicare $16.00 TOTAL MONTHLY DEDUCTIONS $212.00 Jeremy's NMI = (GMI minus deductions) $871.33 Complete the rest of the NMI Calculation Practice page. There is a total of eight. Social Security is a social insurance system created to provide economic security for Americans who are retired, sick, or too disabled to work, as well as for the families of workers who have died. Workers are required to participate. Benefits are based on past work. The Social Security Administration, which runs the program, is a branch of the federal government with an office in nearly every community. Benefits: People are entitled to Social Security payments or benefits if they or someone in their family contributed part of their earnings as workers. The benefits have expanded over the years to include unemployment insurance, oldage assistance, aid to dependent children, and grants to the states to provide various medical care and assistance. Benefits are weighted in favor of low-income workers and families. About one of every six Americans receives Social Security benefits. Medicare: Since the Medicare bill was signed in 1965, the Social Security Administration became responsible for this social insurance program. Medicare covers health expenses for almost all Americans age 65 and older. Social Security is funded primarily through a payroll tax on workers and their employers. This tax appears as FICA (Federal Insurance Contributions Act) on a paycheck. Social Security taxes paid by today’s workers are used to pay benefits to tomorrow’s beneficiaries. Social Security funds are invested in special trust funds, and the earnings on the investments are used to pay benefits. Over the years, more than $4.5 trillion has been paid into trust funds, and more than $4.1 trillion has been paid out in benefits. The remainder is currently on reserve in the trust funds and will be used to pay future benefits. A Social Security number is used by the government to keep track of you and your earnings throughout your lifetime. When someone applies for Social Security benefits, the Social Security Administration assigns a number – which never changes throughout an individual’s lifetime – and uses this number to tell if an individual is eligible for benefits and how much he or she is entitled to. Your parents need your Social Security number when they claim you as one of their dependents on their income tax return. Today, most parents apply for a child’s Social Security number at the hospital when that child is born. This Social Security number, which every worker must have, is printed on a Social Security card. Do you have a Social Security card? If you do not have a card, you can call your Social Security office to request an application. You also can complete the application process via the Internet at www.ssa.gov/kids/card.htm Keep your Social Security number and card in a safe place to prevent theft. It is not necessary to carry your Social Security card with you. In fact, it is recommended that you don’t carry it with you. You will need to show your card to your employer when you start a job, or give your Social Security number to the bank to apply for a loan. When you show somebody your card or give out your Social Security number, make sure you know why your number is needed and how your number will be used. It’s important to be careful with your Social Security number to prevent their misuse. What is Social Security? Social Security is a social insurance system operated by the federal government to pay people who are retired, sick, or too disabled to work, as well as the families of workers who have died. What is the primary goal of Social Security? The goal of Social Security is to provide economic security for Americans when they are not able to work. Who pays for Social Security? Workers and their employers pay for Social Security through payroll tax. What is another name for Social Security? The Federal Insurance Contributions Act, or FCIA, is another name for Social Security. What happens to the money between the time a worker pays into a trust fund and the time when he or she collects benefits from that fund? The money is invested, and the earnings on the investments are used to help pay benefits. What is the purpose of a Social Security number? A Social Security number is used by the government to keep track of people and their earning throughout their lifetime. It is also used by the government to identify people for tax purposes. When and how do you expect Social Security to be beneficial to you? Social Security may be beneficial to me as a source of regular income after retirement. The benefits also might be used of I become disabled or too sick to work prior to retirement age. What is Medicare? Medicare is a social insurance program operated by the Social Security Administration that extends health coverage to almost all Americans age 65 or older. Complete the rest of the Word Map on page 59 by writing a brief sentence or drawing a picture showing your understanding of the terms.