Sales and Use Taxes for the Construction Industry

advertisement

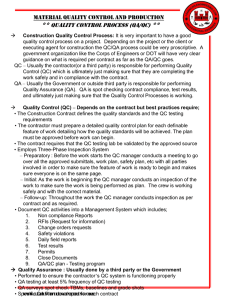

Connecticut Sales and Use Taxes for Construction Contractors presented by Felicia Hoeniger and Scott Sebastian Robinson & Cole LLP Paul Greenfield Department of Revenue Services CBIA Connecticut Business Tax Conference – June 1, 2012 Structure of Connecticut Sales and Use Taxes • The Sales Tax – Imposed on sales of tangible personal property and enumerated services – Retailer liable • The Use Tax – Imposed on use in CT of purchased tangible personal property or enumerated services – Purchaser liable • Nontaxable and exempt sales – Certificates • Removal from Inventory – nonexempt use • Credit for taxes paid Structure of Connecticut Sales and Use Taxes • All gross receipts presumed taxable • Services taxable only if enumerated • Accrual method of accounting – Exceptions • Situs of Taxation – Property Transactions – Temporary Storage Exception – Buy Connecticut Refund – Enumerated services – Environmental Exclusion Contractor as Purchaser of Tangible Personal Property • Contractor is Consumer of Materials and Supplies, not a Retailer • Who is a contractor? – Types of contract • Contractor’s Exempt Purchases – Governments and Exempt Organizations – Manufacturing Machinery and Equipment – Other Exemptions – Use of Certificates Contractor as Purchaser of Tangible Personal Property • Contractor’s Use of Tools and Equipment – Contractor as Independent Contractor – Contractor as Agent • Trade-ins • Safety Apparel • Particular Types of Equipment Contractor as Retailer • Contractor may Qualify as Retailer • Purchases for Resale – Manufacturing and Fabricating – Machinery Purchases • Installation Services • Repair or Maintenance Services • Warranty Contracts • Equipment Rental or Service Contract? • Out-of-state Contracts • Nonresident Contractors Contractor as Service Provider • Taxable Service Categories • New Construction – Renovation vs. new construction – Site improvements – When does Construction Begin and End? • Other Exceptions – Low and Moderate Income Housing – Residential Exception Contractor as Service Provider • Construction Managers • Accounting for Purchases of Services from Subcontractors • Exemptions and Exempt Persons • Specific Services Billing • Tax Base ‾ Materials ‾ Services • General Contractor Purchases Services of Contractor – General contractor issues a resale certificate to subcontractor – General contractor does not issue a resale certificate • Tax held in trust • “Pay When Paid” method for materialmen Audit Considerations • If under audit, documentation may be required to support amount of tax paid by subcontractors (i.e., invoices) • May still incur additional tax due on materials if subcontractor is located out of state • Results in extra – Time spent – Money in wages and taxes Record Keeping • A taxpayer shall maintain all records that are necessary to a determination of correct tax liability under the affected tax law provisions. • Each exemption certificate, whether resale or otherwise, should indicate the time period the acceptor must keep such certificate in his or her records. • A safe practice is to retain all certificates and records until the taxpayer is next audited by the State. • IP 2009(15) states that resale certificates should be kept at leat 6 years.