CA Rajesh Mehta 30-08-14 - Indore

advertisement

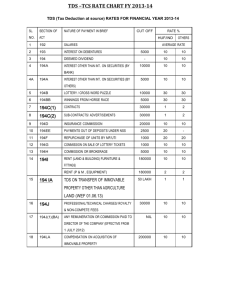

DISCUSSION ON RECENT CHANGES IN TAX AUDIT REPORT & TDS ISSUES Speaker: CA. Rajesh Mehta CBDT via Notification No. 33/2014; Dated 25th July 2014, had made changes in Form 3CA, 3CB and 3CD. ~via these changes, the compliances and disclosures which a CA is required to ensure have been increased. FORM 3CA In point 1(a) “date of beginning and ending” :- “the audited *profit and loss account/income and expenditure account for the period beginning from …………………..to ending on …………………..” In point 1(b) “the audited balance sheet as at …………..” In Point 3 “information and according to examination of books of account including other relevant documents and explanations given to me/us” and also inserted phrase “subject to the following observations/ qualifications, if any :(a).…., (b).…, (c).... Name and seal of signatory AUDITOR’S INFORMATION FORM NO. 3CB In point 1 “…..balance sheet as on, ____, and the *profit and loss account / income and expenditure account for the period beginning from ---------------------to ending on -----------------.” Point No. “3(C) (i)/(ii)” of 3CB Qualifications: In point 5; In *my/our opinion………… subject to following observations/qualifications, if any: a. b. c. 5. Suggested Qualification Type FORM NO. 3CD 41 clauses as against 32 clauses in the old form. PART A : It includes Clauses from 1 to 8. PART B : It includes Clauses from 9 to 41. FORM NO. 3CD PART – A Clauses 1. Name of the asseessee 2. Address 3. Permanent Account Number PART – A Clauses 4. Registration/Identification Number for payment of Indirect Taxes 5. Status 6. Previous Year 7. Assessment Year 8.Relevant Clause of Sec. 44AB; under which audit has been conducted. PART - B Clauses 9. If Firm or AOP, indicate name of partners/members and their profit sharing ratios 10. Nature of business or profession 11. (a)Whether books of account are prescribed under section44 AA, if yes list of books so prescribed. (b) List of books of account maintained and the address of each location at which books of accounts are kept. (c) List of books of accounts & nature of relevant documents examined. 12. Whether the profit and loss account includes profits and gains U/s 44AD, 44AE, 44AF, 44B, 44BB, 44BBA, 44BBB, Chapter XII-G, First Schedule or any other relevant section 13. Change in method of accounting and its effect on profit or loss. [Section 145] 14. Change in Method of valuation of closing stock and the effect thereof on the profit or loss. [Section 145A] Serial number Particulars Increase in profit (Rs.) Decrease in profit (Rs.) 15. Details of capital asset converted into stock-in-trade. 17. Transfer of land/building for less than stamp duty value. Details of property Consideration received or accrued Value adopted or assessed or assessable 19. Amounts admissible under sections: Section Amount Amounts admissible as per the provisions of the Income Tax debited to Act, 1961 and also fulfils the conditions, if any specified under the profit and the conditions, if any specified under the relevant 14 provisions loss account of Income Tax Act, 1961 or Income Tax Rules,1962 or any other guidelines, circular, etc., issued in this behalf. Amounts are admissible under following Sections: 32AC 33AB 33ABA 35(1)(i) 35(1)(ii) 35(1)(iia) 35(1)(iii) 35(1)(iv) 35(2AA) 35(2AB) 35ABB 35AC 35AD 35CCA 35CCB 35CCC 35CCD 35D 35DD 35DDA 35E 20.(a) Any sum paid to an employee as bonus or commission for services rendered [Section 36(1)(ii)] (b) Details of contributions received from employees for various funds as referred to in section 36(1)(va) Serial Nature of Sum number fund received from employees Due date for payment The actual The actual date amount of payment to paid the concerned authorities 21. (a) Amounts debited to the profit and loss account, being in the nature of capital, personal, advertisement expenditure, etc……. Etc. covers following Expenditure incurred at clubs being cost for club services and facilities used. Expenditure by way of penalty or fine for violation of any law for the time being force Expenditure by way of any other penalty or fine not covered above Expenditure incurred for any purpose which is an offence or which is prohibited by law 21.(b) Amounts inadmissible under section 40 (a) 21. (d) Disallowance/deemed income under section 40A(3): Serial number Date of payment Nature of Amount payment Name and Permanent Account Number of the payee, if available 22. Amount of interest inadmissible under section 23 of the Micro Small and Medium Enterprises Development Act, 2006. 23. Particulars of payments made to persons specified under section 40 A(2)(b) 24. Deemed income under Section 32AC or 33AB or 33ABA or 33AC. 25. Any amount of profit chargeable to tax under section 41 and computation thereof. 26. In respect of any sum referred to in section 43B, the liability for which; (A) pre-existed on the first day of the previous year (B) incurred in the previous year and was paid/not paid on or before the aforesaid date 27. (a) Amount of Central Value Added Tax credits availed or utilized. (b) Income or Exp. of prior period credited or debited to P. & L. A/c 28. If a firm or a company received shares without consideration or for inadequate consideration. Section 56(2)(viia) 29. If an assessee received any consideration for issue of shares above fair market value. 30. Details of amount borrowed on hundi or any amount due (including interest) repaid, through an account payee cheque . [Section 69D] 31. Particulars of each loan or deposit section 269SS & 269T by an account payee cheque or an account payee bank draft based on examination of books of account and other relevant documents. 32. Losses from speculation business (Section 73) & details of brought forward loss or depreciation allowance. Serial Number Nature of loss / Assessment Year allowance (in rupees) Amount as returned (in rupees) Amounts as assessed (give Remarks reference to relevant order) 33. Reporting of deductions claimed under Chapter III (Section 10A, Section 10AA) or admissible under Chapter VI A . Section under which deduction is claimed Amounts admissible as per the provision of the Income Tax Act, 1961 and fulfils the conditions, if any, specified under the relevant provisions of Income Tax Act, 1961 or Income Tax Rules,1962 or any other guidelines, circular, etc, issued in this behalf. 34. (a) Compliance with TDS/TCS provisions: Whether the assessee has complied with the provisions of Chapter XVII-B and Chapter XVII-BB regarding TDS & furnishing of TDS / TCS statement within prescribed time limit. Tax Section deduction and collection Account Number (TAN) Nature of payment Total amount of payment or receipt of the nature specified in column (3) Total amount on which tax was required to be deducted or collected out of (4) Total amount on which tax was deducted or collected at specified rate out of (5) Amount of tax deducte d or collected out of (6) Total amou nt on which tax was deduc ted or collec ted at less than specif ied rate out of (7) Amount of tax deducted or collected on (8) Amount of tax deducted or collected not deposited to the credit of the Central Governm ent out of (6) and (8) (1) (3) (4) (5) (6) (7) (8) (9) (10) (2) Details of TDS/TCS statement filed:-Clause 34 (b) • TDS on payment to transporter • TCS on Bullion & Jewellery • TCS on Scrap • Due date of depositing TCS • Interest in case of Deemed date of payment of Tax • Due date of deposit of TDS U/s 194IA 35. (a) In case of a trading concern, give quantitative details of principal items of goods traded. (b) In the case of a manufacturing concern, give quantitative details of the principal items of raw materials, finished products and by-products A. Raw Materials B. Finished products/by- products 36. Tax on distributed profits under section 115-O, in case of a domestic company. 40. Details of principal items of goods traded/manufactured or services rendered; as follows :Serial number Particulars 1. Total turnover of the assessee 2. Gross profit/turnover 3. Net profit/turnover 4. Stock-intrade/turnover 5. Material consumed/finished goods produced Previous year Preceding previous year